General Electric’s 50% dividend cut is the latest evidence of the importance diversification. Because of the decrease, the ninth largest in the history of the S&P 500, owners of GE stock will lose $4.16 billion in payments annually.

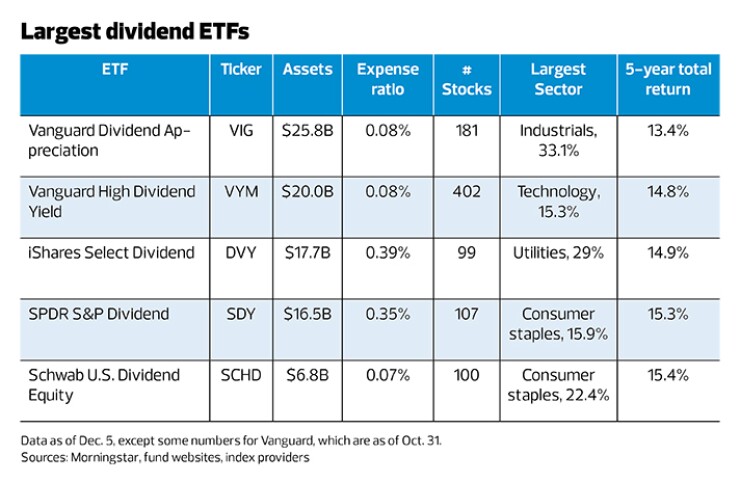

Diversified dividend-oriented ETFs will likely see little damage from the cut. But it raises the concern of how diversified these ETFs are, both in the number of positions and in the sector composition of the portfolios. Here’s a look at the five largest dividend-focused ETFs:

Vanguard Dividend Appreciation (VIG, assets: $25.8B, expense ratio: 0.08%), which tracks the Nasdaq U.S Dividend Achievers Select Index, held 181 stocks as of Oct. 31. Because Vanguard ETFs are classes of their mutual funds, the company delays release of holdings. The underlying index requires a company to have at least seven consecutive years of dividend increases and caps individual stocks at a 4% weighting. There is no cap on sector weighting. In VIG’s case, industrials were 33.1% of holdings, the largest sector concentration.

Vanguard High Dividend Yield (VYM, $20B, 0.08%) is based on the FTSE High Dividend Yield Index, a subset of the FTSE USA Index. All the dividend payers in that index are ranked by their indicated 12-month consensus dividend yield and roughly the top half of that universe constitutes the benchmark. At the end of October, the fund held 402 stocks and technology was the largest sector at 15.3% of the portfolio. There are no weighting caps.

iShares Select Dividend (DVY, $17.7B, 0.39%) follows the Dow Jones U.S. Select Dividend Index, which does not mandate annual growth of shareholder payments. Instead the index requires stocks to have a five-year, non-negative dividend growth rate and to have paid shareholders in each of the preceding five years. The highest yielding 100 issues to qualify are in the index. DVY holds 99 stocks with utilities accounting for 29% of the fund’s market value. Individual stocks are limited to 10% of the index; there is no sector-weighting cap.

SPDR S&P Dividend (SDY, $16.5B, 0.35%) tracks the S&P High Yield Dividend Aristocrats Index, which requires at least 20 years of consecutive dividend increases. Stocks are drawn from the S&P Composite 1500. SDY owns 107 stocks and the largest sector concentration is consumer staples at 15.9%. Individual stocks are capped at a 4% weighting; there is no sector-weighting cap.

Schwab U.S. Dividend Equity (SCHD, 0.07%) holds the 100 stocks of the Dow Jones U.S. Dividend 100 Index, which requires member companies to have paid dividends for at least 10 years and have a minimum market cap of $500 million. Potential index components are ranked on four factors: cash flow to total debt, return on equity, dividend yield and five-year dividend growth. No company can be more than 4.5% and no industry more than 25% of the index. Consumer staples is 22.4% of SCHD.

Of these ETFs, only DVY held GE (0.28% weighting) at the time of its dividend cut. Longer annual dividend increase requirements kept the stock out of many dividend growth ETFs. But dividend increase requirements didn’t help when GE cut its dividend by $8.9 billion in February 2009. Prior to that cut, GE had grown its annual payments to shareholders for more than 25 years.

A larger number of holdings in the ETF will help mitigate the effect of any single dividend cut. That makes VYM the most attractive in this regard. But six of the 10 largest dividend cuts in the history of the S&P 500 were by financial stocks during the 2008-2009 crisis. That argues for advisors to look for ETFs where no sector is more than 20% of the portfolio.