This was a tough year to launch any new product, and exchange-traded funds were no exception.While ETFs were anticipated by many to overtake mutual funds due to their ability to trade like stocks, the crippling global economic crisis of 2008 put a halt to that growth for now, forcing dozens of new ETFs to close and hundreds more to delay launching until conditions improve.Approximately 70% of the 730 U.S.-based ETFs opened in the last three years, but that pace has slowed significantly this past fall. Many ETFs based on the healthcare industry are liquidating, such as those of New York ETF firm XShares Advisors, and many exchange-traded products based on commodities like oil have been hammered by extremely volatile price swings.Actively managed ETFs also failed to garner widespread support in 2008.

-

Lisa Golia, now chief operating officer of the firm's U.S. wealth business, will be in charge of hiring, retaining and paying advisors.

7h ago -

New research shows visuals and gamified tools can dramatically boost client understanding and engagement around complex retirement rules.

8h ago -

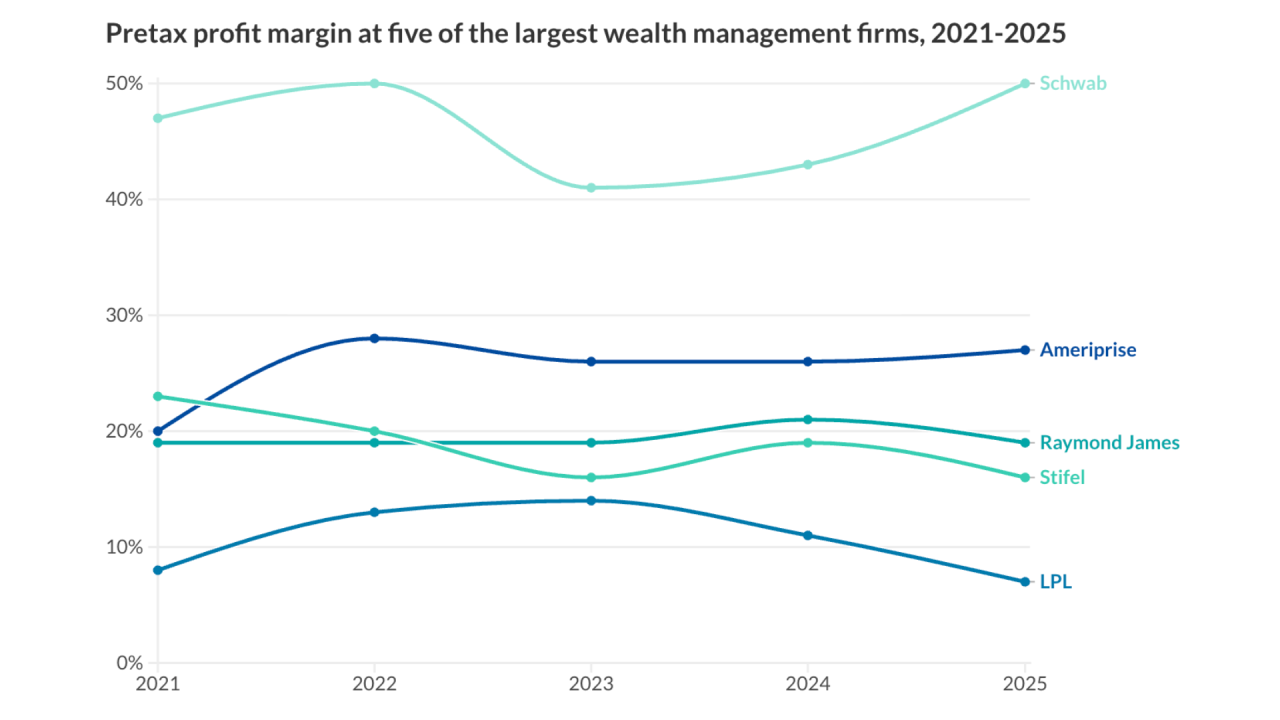

With AI concerns crimping wealth management firms' stock values, an analysis by Fitch Ratings reveals the companies' underlying dynamics after a strong 2025.

8h ago -

Advisors are only human, and mistakes are bound to happen. But missteps, for all the pain they can cause, can also help an advisor — and their practice — grow stronger.

9h ago -

Paul Reid Galietto's lawyer says he was let go by Credit Suisse in 2021 after the firm tried to unfairly blame him for losses from the collapse of the giant family office Archegos Capital Management.

9h ago -

The nation's largest bank said Monday that it will continue to invest in artificial intelligence, despite fears that the technology may harm lenders, and in private credit, despite concerns of cracks in asset quality.

February 23