For clients seeking dividend growth, advisers have a number of ETF options based on indexes that require a minimum number of annual dividend increases. The most stringent annual increase conditions are found in products that track so-called dividend aristocrats.

For decades before the first ETF was introduced, Standard & Poor’s published an annual list of dividend aristocrats, or stocks in the S&P 500 that had increased dividends for at least 25 consecutive years. That simple list has morphed into a suite of indexes encompassing domestic, global and country-specific stocks.

The first ETF based on the aristocrats idea was State Street’s SDY in November 2005. But it was not based on the original aristocrats list. Instead, State Street opted for a modified version embodied in the S&P High Yield Dividend Aristocrats Index. It drew stocks from the larger pool of the S&P 1500, which includes small- and mid-cap U.S. equities. And to draw more fish into the net, the minimum number of consecutive dividend increase years was lowered to 20.

When SDY was launched in November 2005, there were already competing dividend growth ETFs available from iShares and PowerShares. Using the standards adopted for SDY allowed for a more diverse selection of stocks that, perhaps, would prove more attractive.

Almost eight years later, an ETF based on the original aristocrats idea appeared. In October 2013, ProShares introduced its S&P 500 Dividend Aristocrats ETF (NOBL). In 2015, ProShares extended the line with a midcap version (REGL). It’s a bit soon to evaluate REGL, but we can make limited head-to-head comparisons between SDY and NOBL.

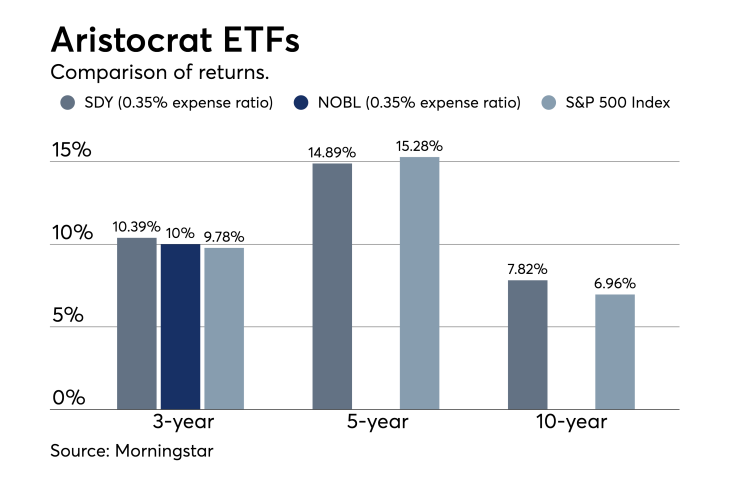

SPDR S&P Dividend ETF (SDY, expense ratio: 0.35%) is based on the S&P High Yield Dividend Aristocrats Index, which requires stocks to have a minimum of 20 consecutive annual dividend increases. The index is weighted by yield and the ETF currently holds 109 positions. Largest sectors are financials, industrials and consumer staples. Morningstar rates SDY five stars and projects its yield this year will be 2.73%. On a risk-adjusted basis, the ETF has outperformed the S&P 500 over the three- and 10-year periods ended June 30 and essentially matched it over the five-year term.

ProShares S&P 500 Dividend Aristocrats ETF (NOBL, 0.35%) holds the 51 stocks in the S&P 500 that have increased their dividends for at least 25 consecutive years. The portfolio is equally weighted. Consumer staples, industrials, and health care are the largest sectors. Morningstar rates the portfolio five stars and expects NOBL to yield 2.48% this year. For the three-year period ended June 30, NOBL’s Sharpe ratio was higher than the S&P 500’s.

In comparing the two funds and their underlying indexes, it’s worth noting that the stringent annual increase screens of both methodologies mean that company turnover is likely to be low. That implies that sector concentration should also be stable. Adviser choices may come down to financials vs. health care.