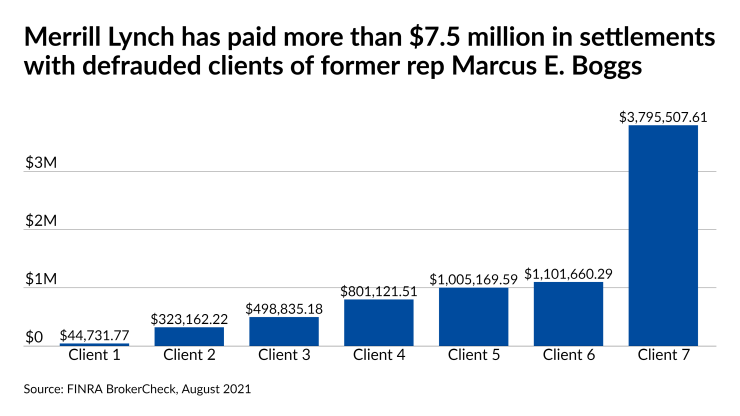

A former Merrill Lynch financial advisor who pleaded guilty to fraud will spend three and a half years in federal prison. The judge also ordered him to pay back the company less than half of the more than $7.5 million in restitution it has paid to victims of his 10-year scheme.

Marcus E. Boggs’ Aug. 12

A heart condition cited by the defense, the seven substantial settlements paid to victims and Boggs’ confession made the fraud case different

BrokerCheck

“During his 10-year scheme, from 2008 through 2018, the defendant wired funds from client accounts to pay for credit card purchases that included international vacations, expensive dinners at restaurants and rent for multiple apartments that he leased in Chicago,” federal prosecutors said in a sentencing memo last month. “Defendant also transferred funds from client accounts to pay the mortgage on his personal residence. Throughout the scheme, the defendant lied to his clients about why their investment accounts were decreasing in value, misrepresenting that the losses were for reasons other than his theft of their funds.”

An attorney representing Boggs in the case, David Weinstein of Jones Walker, declined to add any additional comments to the defense’s filings in the case. Boggs is stable with medication after being “diagnosed with congestive heart failure following contraction of the Chagas virus from a parasite in Brazil” in 2018, the defense’s memo states. Testimony submitted to District Judge Mary Rowland noted he had no other serious criminal history, supported charitable efforts and admitted to the harmful conduct.

“It is clear from the letters submitted by his family and closest friends attached as exhibit one that he is deeply remorseful for his actions and that he is unlikely to run afoul of the law in the future,” the defense said in the memo. “From the time of his arrest in this case, Mr. Boggs has made efforts to make amends for his actions and cooperated in order to bring this matter to a close as quickly as possible. Following his arrest, Mr. Boggs proffered with the government and provided complete and truthful information regarding his actions.”

The firm has made victims whole, to the tune of one former client who received a settlement of $3.8 million after filing a FINRA arbitration case, BrokerCheck shows. Merrill Lynch terminated Boggs, who was subsequently barred by FINRA

“We fired Mr. Boggs in December 2018 after an internal investigation found he stole client funds and made unauthorized transactions,” spokesman Bill Halldin said in a statement. “We notified the appropriate authorities and have cooperated with their investigations. Consistent with our policy, Merrill Lynch notified affected clients and has reimbursed them.”

Last week’s sentencing hearing included testimony from Boggs and three victims, including Shainne Sharp, who lost part of the $5 million payment he received for his wrongful conviction in the Dixmoor 5 case, the Chicago Sun-Times

Boggs “destroyed my life,” Sharp told the judge, calling for Boggs to “get what he deserves” and be “prosecuted to the fullest.”

For his part, Boggs said he had no excuses for the conduct, the local newspaper reported.

“I’ve dishonored myself and my reputation,” he said. “Words can’t express how immensely sorry, remorseful and overcome with shame I am.”

Rowland handed down a 42-month sentence while ordering Boggs to pay restitution of $3.08 million. Under the sentence, Boggs must self-surrender to begin the term by Oct. 18, according to Weinstein, his attorney. Rowland recommended that he serve the time at the defense’s requested location, a medium-security facility in Wisconsin. The federal Bureau of Prisons will ultimately decide the location, though, Weinstein says.