A former Morgan Stanley broker was sentenced to 18 months in prison for his role in a multi-million dollar insider trading scheme, according to federal prosecutors.

Michael Siva, who had

Siva, 57, of Morristown, New Jersey, had been registered with Morgan Stanley from 1996 until his termination in August 2017 from the firm for allegedly engaging in insider trading, according to a note from the wirehouse on

From August 2013 through May 2017, Siva and his alleged co-conspirators made $5 million in illicit profits off misappropriated information originally provided by an investment banker, Daniel Rivas, according to federal prosecutors.

Financial advisor Drew Boyer turned an accidental acceptance from a fire chief into a successful niche serving firefighters and police officers.

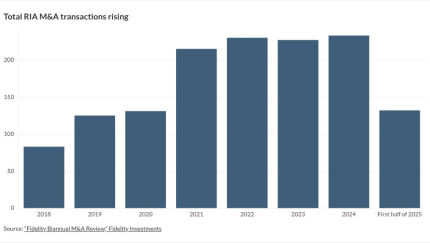

Private equity-backed M&A activity has steadily risen. Owners may do great in a sale, but what about advisors lower in the organization?

With unfounded rumors spreading that Osaic was about to buy its rival Cetera, a Texas-based headhunting firm started calling advisors to see if they wanted to move. Other industry recruiters say that crossed an ethical line.

Rivas was a technology consultant at an investment bank where he used the bank’s internal proprietary system to gain access to material, nonpublic information about potential and unannounced M&A deals, according to prosecutors. Rivas and another individual, James Moodhe, pleaded guilty and cooperated with investigators, prosecutors say. Authorities did not name the investment bank where Rivas worked.

Rivas passed on tips to Moodhe, the father of a woman he was dating at the time, and other individuals, prosecutors say. Moodhe, in turn, passed these on to Siva who used the tips to place trades in his clients’ brokerage accounts, as well as on his own behalf, according to prosecutors.

“Siva committed insider trading to make himself look like a talented stock selector,” U.S. Attorney Geoffrey Berman said in a statement.

To avoid detection, Siva and Moodhe used code phrases on the telephone or met in person at diners outside of New York, according to authorities. Siva also told Moodhe to mark trades “solicited” in his firm’s online trading system “so that it would appear that Siva had directed the trades as opposed to the suggestion coming from Moodhe,” prosecutors say.

In addition to illicit profits he earned off his own trades, Siva also earned commissions off trades he placed in client’s brokerage accounts, according to authorities.

The U.S. Attorney’s office credited the FBI and the SEC for their assistance in investigating the case.

The SEC, which is pursuing a separate civil case against Siva,

In addition to prison time, Siva was also sentenced to two years of supervised release and ordered to forfeit $35,000.

Attorneys representing Siva and Rivas could not be reached for comment. An attorney representing Moodhe declined to comment on the case.