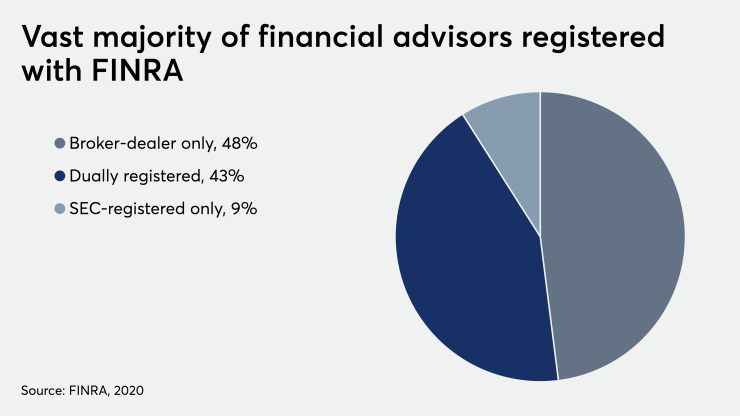

While the vast majority of financial advisors are still registered with FINRA, the organization is losing even more traction with the broker-dealer channel.

Fewer than 40,000 reps joined the brokerage industry last year — the lowest number of FINRA registrations since at least 2005, the earliest year included in FINRA's report. That year there were more than 63,000 new entrants.

Even as fewer reps register, a steady flow of planners is exiting. More than 44,000 advisors dropped their FINRA licenses in 2019. While that number has been falling since 2016, when over 47,000 brokers left the brokerage industry, it’s still outpacing the number of reps entering.

The decline in registrations signals the increasing popularity of the fee-only model, as financial services giants build out — or buy — RIA channels and huge-AUM teams jump to independence.

Over the last

“We've seen the marketplace, not only in the RIA market, but the independent broker-dealer channel growing very quickly,” says Kelly Ryan, head of independent wealth management at State Street.

Ryan’s team, which leads the asset manager’s distribution efforts with IBDs, RIAs and custodians, is now about the same size as the group at State Street that targets the regional BDs and wirehouses, she says.

However, most SEC-registered independent financial advisors still have Series 7 licenses. Only 9% of financial advisors are registered with the SEC alone, slightly up from 8% in 2017, according to FINRA’s

Some advisors, however, are wary of what they perceive as conflicts of interest at dually registered firms. For instance, former advisors from IBD

The impact of 12b-1 fees, revenue sharing and affiliated fund family relationships on advisory services can be problematic in the dually registered model, according to academic

These concerns, in part, are driving advisors’ move to a fee-only model. To meet demand, firms including Commonwealth Financial Network and Cambridge Investment Research are

Goldman Sachs

But the diminished number of broker-dealer registrants may impact FINRA’s annual revenue, as the regulator makes money off of charges including per-rep fees. Earlier this year FINRA