Fidelity Clearing & Custody notched a record rise in customer accounts as more clients seek out financial advice.

The custodian’s new RIA customer accounts were up 164% year-over-year by the end of September, according to the Boston-based company. Fidelity spokeswoman Nicole Abbott declined to provide the specific number of accounts.

Business was also good within the custodian’s retail channel, which offers clients robo advice and has a full-service wealth management arm. Approximately 34% more households were using Fidelity’s financial planning services than in the three-month period in 2019, according to

More clients have been seeking out financial advice in 2020 at Fidelity to the benefit of RIAs and their custodian. COVID-related issues such as stalled job growth since

The boost in new client accounts has helped custodians ease the burden of reduced commission revenue and the

Fidelity has been building out its retail advice offerings this year, including Fidelity Spire, a mobile app it launched in

Growth at the custodian also coincides with its new robo advisory pricing model. Fidelity Go is now

On the advisory side, Fidelity added a new wealth management

Fidelity has been adding new accounts throughout the year. At the end of May, the company

At the end of September, Fidelity safehoused $2.5 trillion in broker-dealer and RIA assets, according to the company.

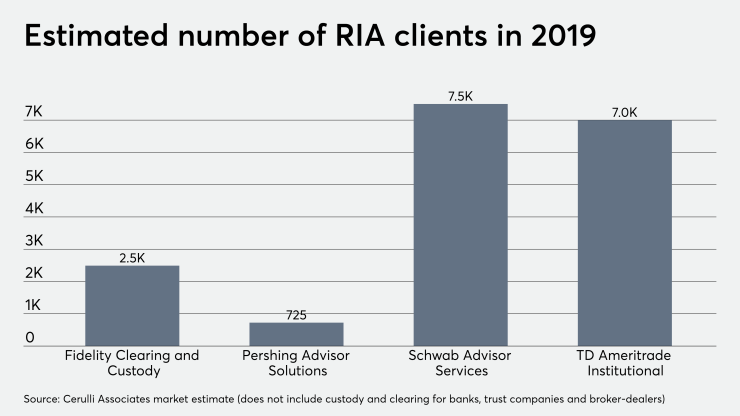

Cerulli Associates estimated the company serviced approximately 2,491 RIAs with $1.1 trillion in assets at the end of 2019. Abbott declined to confirm those figures.

“We’re increasingly seeing broker-dealers convert parts of their business to the RIA model, so it’s more difficult to break out the assets that way,” Abbott says.