Custodial M&A deals made headlines this past year, but the real work — and big changes for advisors — will come in the months ahead.

Financial planners, particularly those with small practices, will be faced with a custodial marketplace very different from the one they've experienced in recent years. And Charles Schwab, already an industry leader, will play an outsized role.

“Now Schwab and TD will wield the greatest scale advantage because of their combined assets,” says Marina Shtyrkov, a senior analyst with Cerulli Associates who specializes in financial advisor trends. “And that will create a certain barrier to entry for new custodians.”

Of course, Schwab isn’t the only player in the custody business even if it is by far the biggest. Hundreds of RIAs with

It’s a host of changes for what has otherwise been a quiet sector of wealth management in recent times.

And it’s prompted advisors to take a second look at their custodial relationships — even if they weren’t directly impacted by consolidation, says Dan Skiles, president of Shareholder Service Group, a custodian with no asset minimums that clears through BNY Mellon Pershing and services approximately 1,600 RIAs.

“Part of it is just simply [advisors] re-checking their research,” says Skiles, who notes that SSG is averaging about two new advisor firm relationships a week. That’s about double what it was in 2019.

'Major challenges'

Yet for many advisors, re-checking their research means taking stock of a beefed-up Charles Schwab.

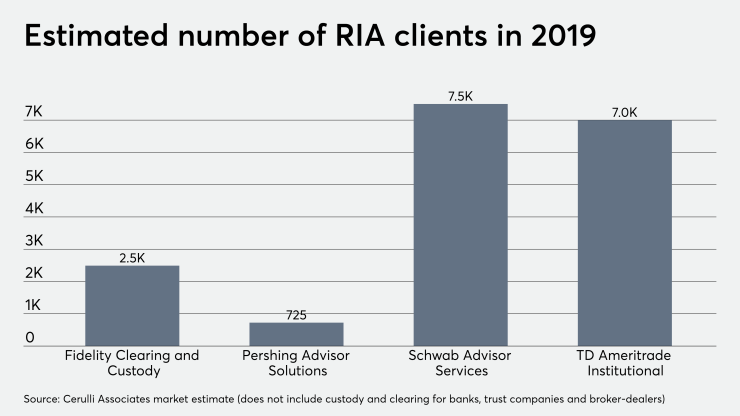

The company bought one of its largest competitors, TD Ameritrade, closing the deal in October. Once Charles Schwab fully onboards approximately 5,500 new RIAs that were formerly with TD Ameritrade, it will custody about $2.6 trillion of the assets managed by independent advisors, according to Senior Vice President Tom Bradley. And Schwab will service approximately 13,000 firms, according to Bradley — an enormous chunk of the independent industry.

There are nearly 18,000 state-registered RIAs across the U.S., according to

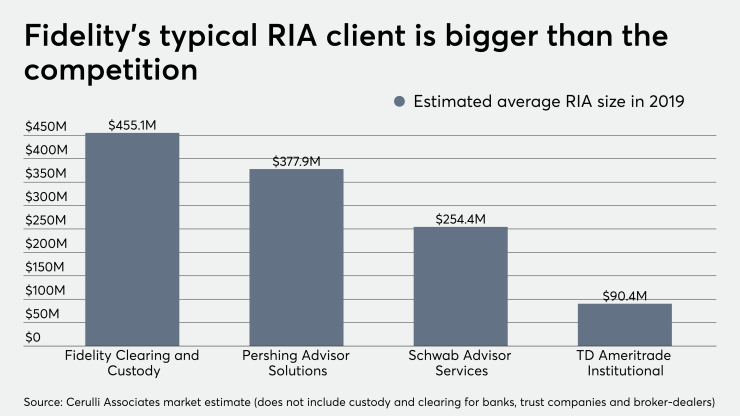

Schwab’s new RIAs skew much smaller in size than its typical pre-existing client. New data from Cerulli Associates estimates that Schwab’s average RIA kept about $254.4 million in assets at Schwab Advisor Services in 2019. At TD Ameritrade, the average firm held about $90.4 million, according to Cerulli.

“I think that’s one of the major challenges of this merger — making sure the combined entity can sufficiently cater to different sizes,” says Shtyrkov.

For its part, Schwab says the average size of its RIAs is larger due to the sheer size of the biggest firms on its platform, according to Bradley.

TD Ameritrade had relationships with many RIAs that were members of fee-only organizations such as XY Planning Network, the Alliance of Comprehensive Planners and Garrett Planning Network. These communities cater to holistic advisors, many of whom charge hourly fees or retainers for their advice and in some cases have limited AUM.

XYPN, which works with about 1,200 RIAs, had its own dedicated service team with TD Ameritrade since

Schwab said they would honor the agreement XYPN had with TD soon after the acquisition was announced, according to Michael Kitces, co-founder of XYPN and a Financial Planning contributing writer. Regarding service, “conversations are active and underway between XYPN and Schwab,” Kitces said in an email.

Bradley declined to comment on any specifics, apart from noting that XYPN is “definitely an important client and you can bet that we're having conversations with them and many other important clients as well.”

TD Ameritrade and Shareholder Service Group are popular choices for advisors with the Alliance of Comprehensive Planners and Garrett Planning Network, according to executives who spoke with Financial Planning.

Alliance of Comprehensive Planners members with TD have expressed concern for what service will look like for them moving forward — “especially with those advisors that have lower asset levels and have a dedicated [service] team,” says Chris Wentzien, an advisor and president of the alliance. Wentzien custodies with SSG.

Approximately half of the advisors with Garrett Planning Network who perform investment management services use TD Ameritrade, says Justin Nichols, director of operations at the Garrett Planning Network and managing principal of advisor services at its turnkey RIA platform, Garrett Investment Advisors, which has more than $273 million in client assets at TD. A “handful” of the firms in the network use Schwab already, Nichols says.

Bradley and other senior leaders at Schwab have been hosting calls with TD Ameritrade advisors via WebEx over recent weeks, starting with the 5,500 firms it hadn’t had an existing relationship with.

“It’s just kind of a welcome-to-Schwab call to give them an opportunity to ask us questions about the integration and what they might expect,” Bradley says.

Nichols, who was on one of those calls earlier this month on behalf of Garrett Investment Advisors, found it to be reassuring.

“I think it’s great they reached out to us,” Nichols says, noting that Bradley made a point to emphasize Schwab is training its service teams and would be very responsive to TD Ameritrade RIAs.

Now that Schwab has full insight into the TD Ameritrade Institutional business — access it didn’t have until the deal’s close

Schwab determined last quarter that it would group together RIAs custodying less than $300 million in assets, according to Bradley.

Firms with fewer than $300 million “don’t call us as often,” Bradley says. They typically go to Schwab Advisor Center for solutions before they get on the phone. When they do call, it’s for different problems, such as gathering documents for an SEC audit.

Bradley, who earlier this year was responsible for firms with less than $100 million in assets, now oversees this whole group, which will comprise 80% of the firms on the Schwab-TD platform post-integration. Schwab is no less committed to sub-$100 million firms, Bradley emphasized.

“Any advisor that is interested in having conversations with us, we either are having conversations with them or we will be,” Bradley says. “They're all important to us.”