Fiduciary Trust Company International, the $20 billion financial services giant, has jumped into the RIA buying frenzy.

The global wealth manager and wholly owned subsidiary of Franklin Resources has agreed to buy Athena Capital Advisors, a suburban Boston-based wealth manager with $5.8 billion in assets under management. Terms of the deal were not disclosed.

The merger is a “signature deal for the industry,” according to industry business management consultant Jamie McLaughlin — but not chiefly because of whatever monies may have changed hands.

“Most of the deals that have been done in the industry at large are financial deals — this is a strategic deal,” McLaughlin says. “There have been very few deals for UHNW firms.”

Athena’s impact investment and outsourced CIO businesses were the driving forces behind the merger, according to Fiduciary Trust’s CEO, John Dowd.

“We had nowhere near the infrastructure and track record on impact [investing] that Athena has built out over the years,” he says.

Impact investing has three components for clients, according to Cooper. They align their values with their investments, she says, preferentially choosing companies that they believe do good and are actively making an environmental or social impact.

In November, Athena released the landscape

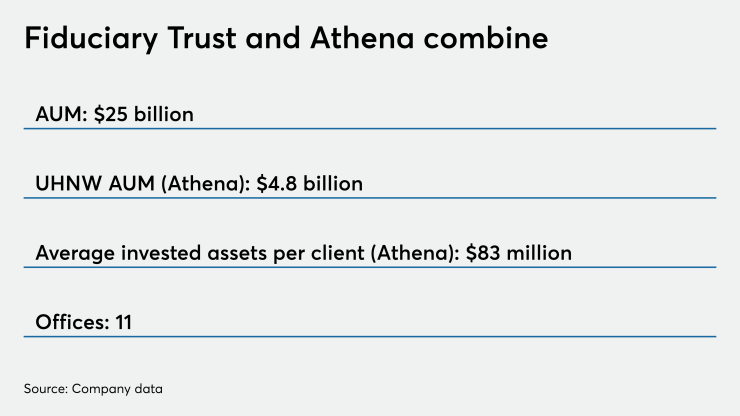

In addition to gaining a seasoned impact investment culture and platform, Fiduciary Trust also gets a bona fide UHNW provider, seeing as an Athena client’s average amount of invested assets is $83 million, according to reports. Athena also provides a world class of alternative investments delivery, according to McLaughlin.

As for Athena, the merger grants the RIA access to capital and trust expertise, offering the firm a larger scale of available resources that it can currently commit to clients on the digital and technology side of things, Cooper says.

Athena is based in Lincoln, Massachusetts, a well-to-do Boston suburb, and has additional offices in San Francisco and Midtown Manhattan. The RIA’s location acquisition was no coincidence, according to Dowd.

“Today we've got almost $2 billion of our assets under management for clients in the Boston area,” he says. “We liked the combination of this type of wealth that's being created — it's very entrepreneurial.”

Fiduciary Trust is headquartered in New York and the company has 11 offices in U.S., including the offices acquired from Athena in the merger. In addition to its new footprint in New England, Athena’s proximity to New York is also significant for the company, McLaughlin says.

Following the acquisition, Fiduciary Trust Company International’s AUM will rise to approximately $25 billion. Athena’s founder, Lisette Cooper, will join Fiduciary Trust as vice chairman and have a seat on the firm’s board. Athena's employees will be integrated into Fiduciary Trust and operate under a single brand.

Although this was Fiduciary Trust’s first deal of the new year, it won’t be its last, according to Dowd. The financial services’ giant hopes to make at least one more acquisition by the end of 2020, he says.