A financial advisor whose practice allegedly sold clients $43.5 million worth of unsuitable and unregistered alternative investments agreed to pay back all of the commissions earned on the products.

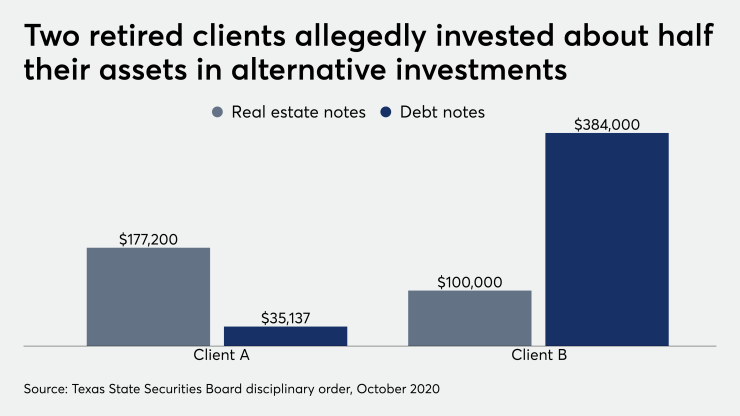

In some instances, Brooklynn Chandler Willy and four other staff members of her practice, San Antonio-based Texas Financial Advisory, recommended that “conservative, unsophisticated investors allocate nearly half of their liquid assets in private, illiquid alternative investments,” the State Securities Board

Under a settlement with Commissioner Travis Iles’ office, Willy must pay back $2,750,500 in commissions for the sales between 2013 and 2019. She has also agreed to a one-year suspension of her investment advisor license, an independent compliance consultant review and five-year bans on discretionary trading authority and alt recommendations.

At least 206 clients invested in privately offered promissory notes in real estate and debt collection, the settlement document states. The clients purchased $8.5 million in notes for a private loan to a real estate firm and $35 million toward a loan for a debt collecting agency, according to investigators. Willy also allegedly failed to inform her RIA she was making alt sales.

In addition, “Willy did not conduct a reasonable level of due diligence to determine whether the alternative investments were suitable to clients prior to recommending they purchase the investments,” the disciplinary order states.

Neither Willy nor her attorney responded to requests for comment.

While not registered with FINRA as a broker, Willy was an investment advisor representative of Global Financial Private Capital and, later, J.W. Cole Advisors, according to the SEC IAPD database. She moved to J.W. Cole in April 2019, after AssetMark

Citing a “violation of firm policies regarding participation in unapproved private securities transactions,” J.W. Cole terminated Willy six months later, her SEC file shows. Willy also disclosed a tax lien of nearly $50,000 in 2018, which she said in her official comment involved an amendment to an earlier return that’s still pending.

Willy hosts a weekly radio show about financial planning, and her firm’s website states that it works primarily with individuals and families with more than $250,000 in investable assets or working professionals with incomes of at least $200,000, according to the order. The Texas Financial Advisory website now lists six staff members and three office locations.

She had listed annuities, life insurance sales and tax preparations as outside business activities but nothing about the private placements, according to the disciplinary order. She also failed to register as a “dealer” with the state, even though her recommendations of real estate and debt notes required her to do so, the order states.

The debt notes — which garnered a majority of the investments — provided a collector with capital to purchase debts, according to the order. After the agency collected on them, the investors were to receive their money back with interest, the order states. The real estate notes paid monthly interest, plus return of principal at the end of a term, investigators say.

Willy must pay back the more than 200 clients for the commissions within 90 days of the order. She sold the promissory notes to 79 clients, while other agents of Texas Financial Advisory sold them to 127 more, the document states. The total commissions over six years adds up to an average rate of 6.3% on the sales of $43.5 million.