An adviser who generated $1 million in annual revenue won a $417,000 case against her former employer, Southwest Securities, for wrongful termination, an arbitration panel ruled this week.

The dispute began when Illinois' securities regulator audited Kimberly Rose in 2014.

"This was the right result. Kim Rose did not deserve this. Other advisers in her position should seriously consider filing an arbitration to clear their records," says attorney Stephany McLaughlin.

Rose, who had been with Southwest Securities for seven years, quickly reached out to her supervisors for assistance with the audit, but they failed to follow-up, according to Stephany McLaughlin, a Chicago-based attorney at Eccleston Law, who is representing Rose.

"They did not prepare her in anyway. Her supervisors ignored her request for assistance," she says.

About a week later, she was fired for allegedly failing to comply with the audit.

In arbitration, Rose said the firm had defamed her "in an effort to retain her institutional brokerage clients" by placing "false and defamatory language on her form U-5," according to a copy of the arbitration award.

A spokesman for Southwest Securities, now Hilltop Holdings, declined to comment on the case.

Rose, an 18-year industry veteran, lost nearly all of her clients as a result of her termination, McLaughlin says.

She now works at William Blair, a Chicago-based wealth management firm, where she had previously worked from 1999 to 2005, per FINRA BrokerCheck records. Rose now works exclusively with institutional clients, according to her attorney.

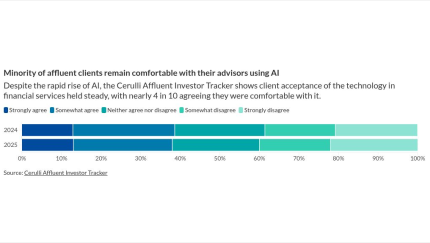

A new report from Cerulli Associates shows older, affluent investors are far more skeptical of AI use than their younger counterparts. Financial advisors who use AI tools in their practices say transparency is key to setting wary clients at ease.

Keep your general knowledge skills sharp while earning an hour of CE credit toward maintaining industry certification by taking Financial Planning's latest continuing education quiz.

As a subscriber to Financial-Planning.com, you can earn up to 12 hours of CE credit from the CFP Board and the Investments & Wealth Institute.

Although Rose won damages, it fell short of the original $2.4 million she sought.

But in addition to the damages she did win, the arbitrators also granted Rose an expungement of her U-5 form.

Firms frequently consult U-5 filings in order to vet new recruits. A negative comment can tank an adviser's career.

McLaughlin says they are in the process of completing the expungement, a process that should be completed within a few days.

"This was the right result. Kim Rose did not deserve this. Other advisers in her position should seriously consider filing an arbitration to clear their records," she says.

The panel ordered that the notation should now read: "Ms. Rose, a productive employee with an unblemished employment record, was terminated after she failed to cooperate with an audit by the Illinois Securities Department, and, after she had requested, but did not receive, meaningful assistance in connection with said audit."

The arbitrators arrived at their decision after four days of hearings, according to a copy of the award. They did not explain their ruling, as is typical for such panels.