The consumer and wealth management arm of Goldman Sachs topped $2 billion in quarterly net revenue for the first time as the global financial giant seeks to expand further into the world of RIAs, custody and planning technology.

Goldman Sachs CEO David Solomon sees “wealth management opportunities for us in the U.S.” as well as China and Europe, he said in an earnings call with analysts after one of them asked “about where you think you’re punching below your weight” in terms of “market share and market share opportunities,”

In his response, Solomon cited the firm’s $1.87-billion

“There are opportunities for us around the wealth management business, in particular in Europe, and we’ve been focused on that,” Solomon said. “I think there are wealth management opportunities for us in the U.S. as we move from simply managing money with ultrahigh net worth clientele that have been our traditional PWM business to a more mass affluent structure and using digital technology and expanding the use of Ayco.”

Unknown wealth figures: While its deals in the past two years acquiring

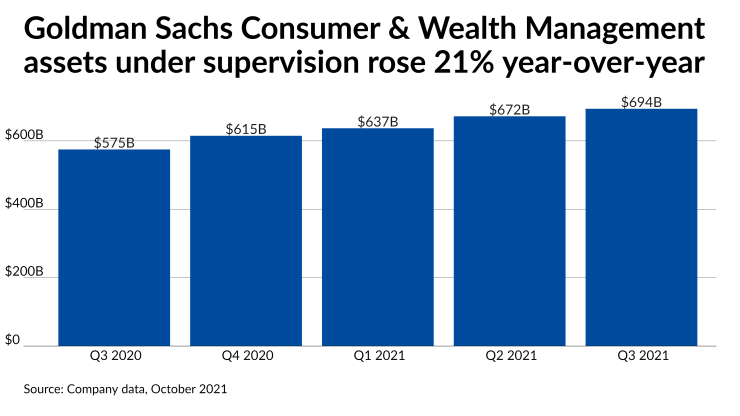

Burgeoning available wealth metrics: In the third quarter, strong inflows into fee-based advisory accounts under the wealth arm drove record management fees of $1.22 billion, up 28% from the year-ago period, CFO Stephen Scherr noted on the call. Net revenue for the full Consumer & Wealth Management unit jumped 35% year-over-year to $2.02 billion. The segment, which Goldman created at the beginning of last year following the United deal, represents 15% of the firm’s quarterly revenue, the smallest share of any of its four divisions. Across that unit and Goldman’s asset management arm, client assets under supervision rose 17% to a record $2.37 trillion. Consumer and wealth client assets specifically increased by 21% to $694 billion.

Possible areas of expansion: Later in the earnings call, Solomon reiterated comments from executives at the firm’s investor day about possible expansion in wealth management and three other areas “to grow and expand our competitive position while also increasing the mix of durable fee-based revenues into the business:” the firm’s digital consumer bank Marcus, asset management and transaction banking. “We can continue to grow them organically but, when there are opportunities to make an acquisition that can accelerate our competitive position and our growth in one of those areas, we’re going to take a hard look at it,” Solomon said. “The bar for us to do something very significant is extraordinarily high. I think there are still opportunities. There may be opportunities in the coming years for us to do things that can accelerate those areas, but we are focused on those four areas because those four areas diversify the durability of our revenues and allow us to continue to grow a more durable and consistent earnings stream.”