High-net-worth clients can save millions of dollars by changing their domiciles, but they can’t complete the shift successfully without careful planning, according to one expert.

Advisors helping to move their clients to states with no state income tax or estate taxes should recommend they keep meticulous records at all times, Bachir Karam, a special counsel in Sullivan & Cromwell’s Estates and Personal Group, said in a session at this week’s SourceMedia Disrupt|Advice conference in New York.

The size of clients’ new homes, the location of their boat, art and heirlooms, and the precise breakdown of how many days they spend in their new and former states may all figure in litigation around domiciles, Karam notes. Advisors should even discuss what flights clients take in and out of the old state, he says.

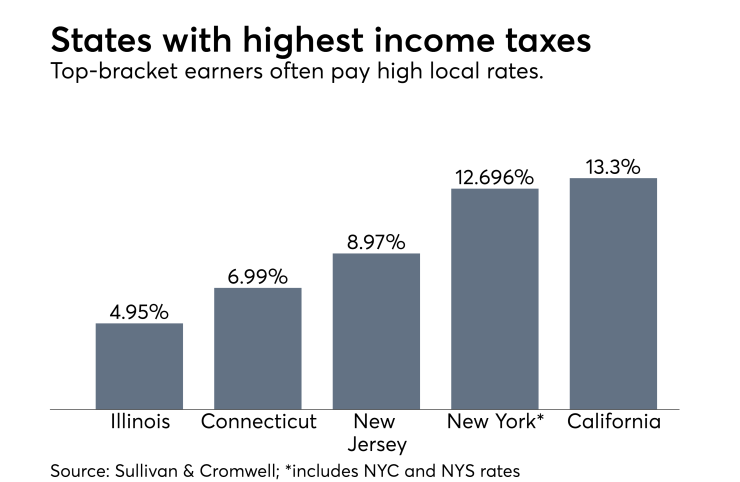

Karam sees technologies allowing for virtual meetings and telework, along with the absence of estate and income taxes in states such as Florida, Nevada, South Dakota, Texas and Alaska, as key motivators for changing domiciles. The rates in places like New York, California and Connecticut also figure into moves, he said.

“These tax rates just keep going up, and each year it feels like they’re up another percentage point or a fraction of a percentage point. And every point is costing our clients, in some cases, millions of dollars,” Karam said.

“And so when we remind them that, if they were a resident of a different state through certain careful planning steps, that they could save that amount,” says Karam, “it’s really starting to push the envelope to get them to think about doing this planning.”

-

Wealthy people in their 80s have the highest average net worth of any age bracket, according to the agency's study.

August 23 -

For ultrawealthy clients who own property, an adviser's starting point should be an irrevocable trust. But you can't stop there.

May 30 -

Most fortunes disappear by the time grandchildren have taken control.

May 22

More than 80% of the richest clients want big asset growth later in life, according to a new UBS survey.

ESCAPE FROM NEW YORK

While New Jersey’s move to end its estate tax on Jan. 1 will make it more attractive to HNW clients, both the Garden State and the neighboring Empire State often lose residents to Florida or New Hampshire, he says. And states may challenge a clients’ residency status every year, according to Karam.

Clients’ success in switching their residency comes down both to whether they spent more or less than 183 days in the state and to other aspects of their domicile — that is, their permanent, fixed home for legal purposes. Days spent and the location of prized possessions, known as “personal items which enhance the quality of life,” loom large, Karam says.

In one case he cites, a client beat a New York tax audit with a boat as a key determining factor. The client moved the boat from a lake in New York to a dock off Florida, outfitting the vessel for deep-sea saltwater fishing. Clients establishing a new domicile should also relocate works of art and get new driver’s licenses and voter registrations, he says.

Another client overcame an audit because he sold his New York home, purchased one three times as large in Florida and rented a small New York City apartment to visit children, according to Karam. A client who wasn’t as lucky had kept her New York home and outfitted her home in Florida exactly the same.

GIRD FOR THE FIGHT

Clients should consider documenting their location through encrypted GPS records using an app called Monaeo, Karam says. And when visiting their former state, he says, they should book flights that arrive in the morning and depart at night, in order to avoid spending an extra day on an early-morning flight.

Regardless of the steps taken by their clients, advisors must warn them that they could face annual legal fights with their former states, Karam says. The proceedings could include audits that take months or even years to resolve. Two states may even claim a client as a resident at once, he adds.

“That sounds like an unfair result, but there’s not really a federal overlay that says, ‘Oh no, that state can’t tax that person,’” Karam says.

“You can only have one domicile, but, when you have clients spending six months in one place and six months in another, it’s starts to be a very murky analysis,” says Karam. “And you can bet that the former state will do its best to try to claw back the revenue.”