Military members, veterans and their families holding brokerage accounts at USAA have a decision to make in 2020: What should they do with their cash when their account moves to Charles Schwab?

In a purchase expected to close within the next calendar year, San Francisco-based Schwab

Some USAA members are evaluating their options as Schwab plans to move that cash over to its balance sheet.

“It's definitely been a point of concern,” says Sean Scaturro, personal finance director at USAA, although he specified that members aren’t necessarily "angry" about Schwab’s sweep program.

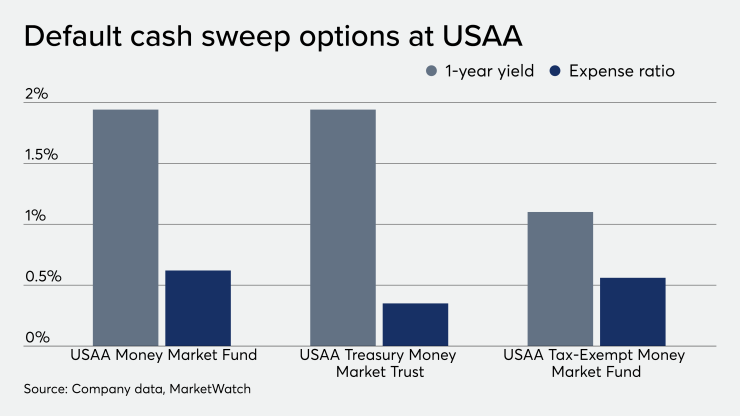

At USAA, client cash

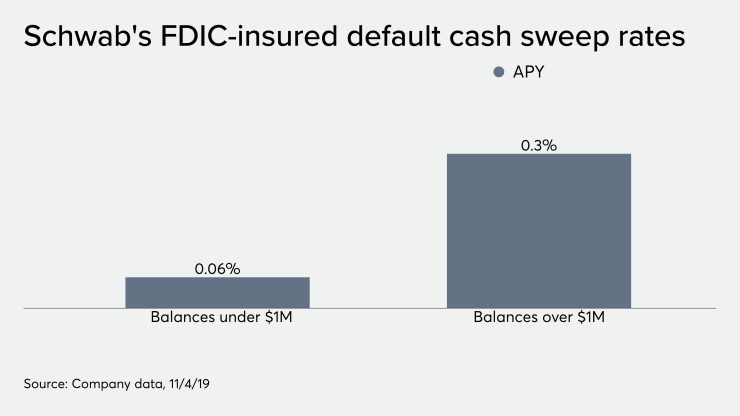

Schwab’s default sweep has an annual percentage yield of 0.06% for balances under $1 million, and 0.30% of balances over that threshold, according to the company. As of June 1, 2016, Schwab's new brokerage clients can no longer elect a money fund for the sweep feature, according to its 32-page

While this money fund option does exist, it is only available for international clients and certain benefit plan and retirement accounts. Brokerage clients may decide to invest cash in money market funds on their own.

USAA is trying to educate members about upcoming changes in their cash positions before they move over to Schwab, Scaturro says.

Wealth managers at USAA — who will all become Schwab employees when the deal is finalized — are proactively discussing the changes as part of their quarterly client conversations, according to Scaturro.

“The biggest thing is going to be around the sweep account, because that's the biggest change,” Scaturro says, noting USAA is managing client expectations during the transition to help avoid massive disruptions in service.

However, the majority of USAA brokerage clients are self-directed and don’t work with a wealth manager. There are 1 million self-directed accounts representing $67 billion in client assets moving over to Schwab. An additional 145,000 accounts representing $23 billion are managed by financial reps, according to the Schwab presentation deck.

The average USAA self-directed client keeps a sizable portion of their portfolio in cash — about

While self-directed brokerage members are receiving information about the transition, Scaturro says, clients need to be proactive about discussing their options. The communication materials are more about the general conversion itself, rather than comparing interest rates, Scaturro says.

“There could be changes on the sweep account on the Schwab side that actually don't create any issues. We don't want to scare people away from something that isn't an issue if it's not,” Scaturro says.

The Schwab sweep may also be a good option for some members, Scaturro says. “I don't want to say Schwab doesn't offer a good plan for that when they do — it's just a different business model,” he says.

In response to a series of questions regarding how it would prepare USAA clients and wealth managers for this transition, a Schwab spokeswoman offered the following statement:

“We hope to be able to share more in the coming months, after the close of the transaction, expected next year.”

Barbara Roper, director of investor protection at the Consumer Federation of America, says that Schwab has a responsibility to provide much more than a disclosure document to the clients moving over to their platform.

“Where customers already had that existing account, Schwab has the responsibility to put them in an account that's comparable,” Roper says. “Unless they have something that's better still.”

Wealth managers at Schwab will need to recommend the best vehicle for their cash to clients, she says, and assure that large amounts of cash don’t pile up in the lower-return sweep account.

“If the words ‘best interest’ mean anything ... It means that when you have two choices like this that serve the same purpose, you recommend the one that's best for the customer and not the one that's best for you,” Roper says.

Clients will ultimately vote with their wallets, Scaturro says.

“If it doesn't make sense for them to maintain such a large cash position, [they] can look at alternatives or [they] can look at competitive firms,” Scaturro says.

Apart from cash sweep changes, Scaturro says that day-to-day operations won’t change much for brokerage clients. Right now, those assets are held on Fidelity’s National Financial Services platform. Transitioning to Schwab will be a “net no-change” as Fidelity’s trading platform is also robust, he says.

The deal is a good one for USAA members — as Schwab is a better dedicated investment company, he says.

“No one likes having their cheese moved up front, but it will be a benefit in the longrun,” Scaturro says.