Advances in technology are working towards simplifying retirement saving. From digital platforms that open IRA accounts in minutes to micro investing apps that save pocket change, advisors can look to fintech firms to help get clients on track to live comfortably in their golden years.

One problem is legacy 401(k) accounts, experts say. Almost half of all of mass affluent customers have at least one abandoned 401(k) left at a former employer, according to Peter Fishman, director of digital investment solutions at Citizens Bank. These plans can also have hidden fees.

"There is a significant number of assets in abandoned 401(k)s and it is not an easy process to transfer that money into a self-directed account,” Fishman said on a panel about digital disruption at the Finovate Fall 2018 conference in New York. “In fact, the 401(k) administrators make it more complicated.”

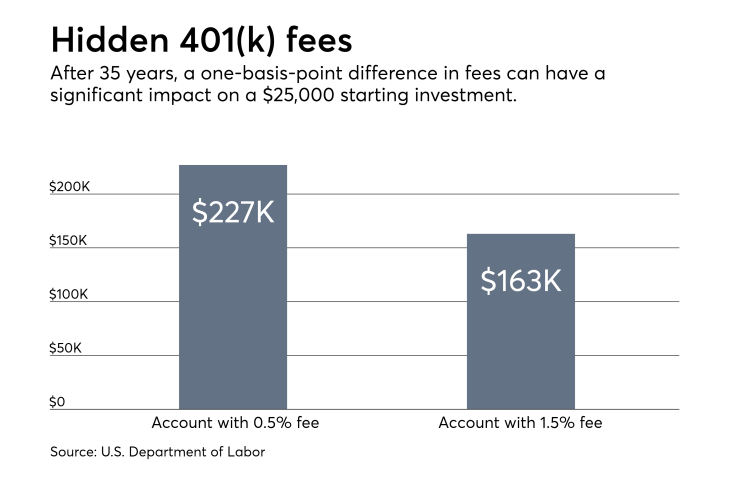

Indeed, a one percentage point difference in plan fees and expenses could reduce an investor’s balance at retirement age by 28% over a 35-year career,

“The accounts could be in many cases as much as 10 years old, and clients don’t know what the account number is or have their statements,” Fishman said. “Taking out that friction is a huge opportunity.”

The biggest hurdles to consumers’ rolling-over these abandoned assets is simply inertia, he said, and a lack of awareness about hidden fees. Not to mention, the accounts may not stay in-line with investors’ goals and risk tolerances, he said.

Citizens’ robo advisor SpeciFi, which was launched as a partnership with SigFig, helps ease the burden of planning for retirement, Fishman said. The platform combines digital on-boarding tools with access to human financial advisors to help with complicated rollovers.

Citizens decided to partner with a third party instead of building an in-house platform or buying another firm, Fishman said. “We wanted to get into the market very quickly and there were solid solutions,” he said. “We looked for a company that not only accompanied good tech with culture, but we were looking for a deal structure that aligned incentives.” The firms were able to launch with retail accounts in under eight months, he added.

Not just taxes, clients care about cost of living, health care quality, crime rates, culture and weather.

Digital solutions aren’t just about simplicity, but anonymity, Fishman said. “Clients may not want to talk to a human about some of these personal situations or admit the mistakes they’ve made,” he said. By using a hybrid robo solution, clients can chose an all-automated process and open an IRA in roughly six minutes, Fishman said. “We need to be wherever our clients want to be.”

Other digital services, like micro investing apps, are also addressing complex rollovers. Acorns launched its Acorns Later retirement service that allows customers to open up an IRA in under a minute. The service helped build up

“It’s not necessarily about working until age 65 and waiting for a Social Security check,” said panelist Randy Fernando, managing director of Acorns Later. “[Clients] want the freedom to do what they want — whether that means continuing to work or starting a business of their own or laying down on a beach and playing golf. They have to make better decisions today.”

Careful planning and frugality can lead to early retirement – but only if clients are truly committed to the goal.

And, some of the incumbents are looking to cash in. BlackRock led a

The partnership is based on a mutual need to serve customers with a limited amount of investable assets, namely those with under $100,000, Fernando said. “BlackRock came to us and said this customer base means something to us and we don’t have something that currently satisfies them,” Fernando said.

As employer matches on 401(k) accounts become less and less commonplace, clients will be looking to advisors for answers, said Henry Yoshida, CEO of the retirement savings website Rocket Dollar.

“Right now in America, there’s a net outflow in 401(k)s,” said Yoshida, adding that employer matches will likely only last another decade. “If I’m an employee, I’m going to fend for myself.”