Is behavioral finance the new frontier — and revenue source — of the financial advisory business?

It might have to be. With the introduction of the Department of Labor’s fiduciary rule, and the advent of robo advisers, planners are facing an existential crisis, said Sarah Newcomb, a behavioral economist at Morningstar, during Financial Planning's webinar "Behavioral Finance Techniques: Best Practices Beneficial to your Clients.”

Sooner, rather than later, "the only [advisers] left at the table will be those dealing with the emotional side of money," added Newcomb, who also heads behavioral research for Morningstar's HelloWallet unit.

"Robos will do a better job at asset allocation but they can't create a safe space where people can be vulnerable talk to another person about money without shame."

The future of financial advice will be analogous to concierge medicine, where doctors can charge premium prices by carefully monitoring wellness, rather than just seeing patients when they're sick, United Capital CEO Joe Duran said during the webinar, held on Thursday.

ADVICE BEYOND INVESTING?

"That's where the industry is going," Duran maintained. "The big question is: Are advisers going to offer advice beyond investing? If not, their fees will be driven down to 25 basis points and they will be irrelevant."

To be sure, Newcomb and Duran, along with J.D. Bruce, president of Santa Monica, California-based Abacus Wealth Partners, who also spoke on the webinar, have a vested financial interest in promoting behavioral finance.

At the same time, the concept of taking a client's emotions and behavior into account when discussing finances entirely new: holistic financial planning has been a fixture in the industry for nearly a decade.

"Are advisers going to offer advice beyond investing? If not, their fees will be driven down to 25 basis points and they will be irrelevant." - United Capital CEO Joe Duran

Nonetheless, there is no denying both the explosion of interest in behavioral finance, driven by the popularity of such advocates as best-selling authors Daniel Kahneman and Dan Ariely, and the advancement of research and technology in the field.

CHANGING 'BAD BEHAVIOR'

Bruce, whose firm has been a pioneer in incorporating behavioral finance into its practice, says Abacus looks at clients' financial mistakes and "bad behavior," and works with them to change the behavior.

The firm gives clients a quiz to see which archetype category a client falls into. Examples include "The Empire Builder" who "thrives on power and innovation to create something of enduring value" and “The Innocent" who "avoids putting significant attention on money and believes or hopes that life will work out for the better."

While stressing that Abacus advisers aren't therapists, Bruce said the firm strive to help clients understand their unconscious nature "and help them put systems in place that replace weaknesses with strengths."

Many advisers are indeed "afraid to act as therapists," said Morningstar's Newcomb. But that may be an impediment going forward, she warned, as financial planning will increasingly focus on "helping people have a healthier relationship with their money."

INTERSECTION OF MONEY AND LIFE

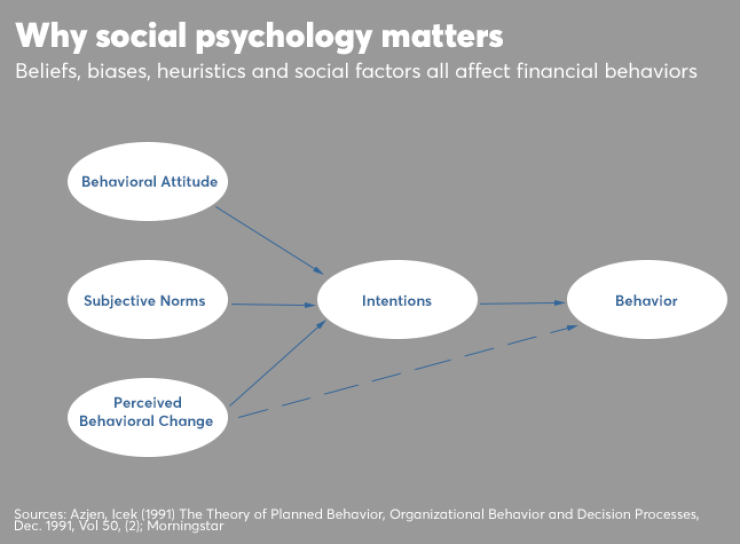

According to Duran, behavioral finance is "anytime we talk about the intersection of money and life. Our job is to not to tell people what to do but help them make better choices and to do that we have to understand their biases."

-

When advisers blend behavioral finance approaches with data insights, it makes them even more valuable.

September 22 -

Like many planners, Shane Larson never received any training in psychology. Now he finds using basic counseling skills can help make relationships with his clients stronger.

August 26 -

Raw performance grabs headlines, but highlighting the benefits of diversification is more beneficial for those who react poorly during periods of market volatility.

August 24

Not coincidentally, United Capital has been heavily promoting and branding its concept of "financial life management" throughout its empire of more than 80 offices around the country.

Underlying the concept is what Duran calls the "gap between the lives people could lead the lives they actually do lead." United, he says, has developed software to help people "measure and track how close people are to leading their ideal lives."

Bruce also stressed the importance of science and technique to implement behavioral finance. "You can't just rely on your instincts," he said. A certificate in behavioral counseling, he argues, will prove to be more valuable to an adviser than going to an investment seminar or getting a CFA certification.

LIMITS

But advisers should realize there also limits to behavioral finance, Newcomb said.

"We're talking about something that requires real thought and commitment," she cautioned. "Be aware that some clients are just not going to go there."

And can advisers increase their bottom line by employing behavioral finance?

The webinar panelists disagreed.

Duran claimed advisers who use the technique can charge an additional 20 basis points and those who have done so have increased their revenue 30% to 40% in 18 months and added wallet share. In fact, he asserts that one-third of United Capital's assets have come from increased wallet share.

Abacus' Bruce said advisers won't necessarily be able to charge clients more money, but using behavioral finance will help them not have to charge less to keep and acquire clients.

Advisers won't be able to charge more, said Morningstar's Newcomb, but demonstrating an expertise in behavioral finance will "be where the value comes from. This is the new frontier."