It was “heartbreaking” for John Lanzetta to leave his longtime independent broker-dealer after an acquisition deal — but he says he chose another he sees as less likely to change hands in the future.

Lanzetta of Quakertown, Pennsylvania-based LifeSpan Financial Associates and the 10 other advisors of his office of supervisory jurisdiction

Advisor Group’s Woodbury IBD added

Lanzetta had spent 15 years with Questar and USAllianz Securities, he noted in an email, praising it as a “top-notch partner filled with consummate professionals.” While he declined to go into specifics, he says his OSJ’s advisors just didn’t view Woodbury as a long-term fit.

Securities America and its parent’s offerings — like investment banking, trust services, marketing and its advisor platform — will allow LifeSpan and the OSJ to grow with flexibility, he says. Lanzetta also views the IBD as enhancing his recruiting.

The OSJ manages around $175 million in client assets when including insurance-based assets, according to Lanzetta. Securities America’s automated platform will make it easy to expand and hire up staff accordingly, he says.

“It had never occurred to me that I would ever be in a position to have to look for a new ‘home,’” Lanzetta says. “One other important factor was to find a place where it would be less likely to potentially face the possibility of needing to go through another ‘consolidation’ in a few years. In my opinion, I think SAI is positioned to weather and grow as the industry consolidates further.”

-

The deal with the family-run independent insurance firm followed record sales in fixed-index annuities.

September 11 -

The 4,300-advisor network is investing in insurance distribution after benefiting from rising interest rates and record client assets.

November 7 -

The network’s largest subsidiary will support fee-only advisors, and one of its smaller firms is targeting five times its level of recruitment from 2018.

January 29

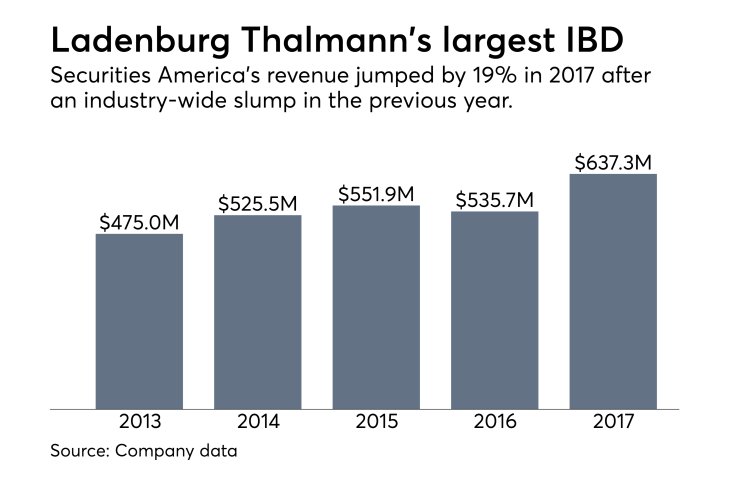

Thirteen of the top 25 companies generated double-digit growth in 2017 as rivals close in on the perennial No. 1 firm.

Representatives for Woodbury and Questar declined to comment on the group’s move. Lightyear Capital-backed Woodbury expanded to 1,600 representatives after the Questar deal and another one last year to acquire

Lanzetta’s OSJ has practice locations in Pennsylvania, Connecticut and Florida, and he officially joined Securities America on Dec. 10, according to FINRA BrokerCheck. His 25-year tenure includes time with LPL, Lincoln Financial Advisors and Baird.

Securities America also

“Our commitment to supporting independent business owners in how they want to run and grow their practices fit first and foremost into this group,” Johnson says. “The transaction caused them to look more seriously at what options were available to them, and we were fortunate to get in front of them and win their business.”