Ladenburg Thalmann’s independent broker-dealers are paying more commissions to a rising head count of financial advisors. But the five IBDs and their parent received roughly $6.7 million from clearing partners last quarter through a forgiven loan, lower expenses, as well as higher revenue and credits.

These were just two of the nuggets of information in the Miami-based firm’s second quarter

Ladenburg disclosed a six-year

The firm also revealed settlements of five arbitration cases amounting more than $5.4 million in claimed damages for clients of a former registered representative, as well as $2.3 million in reserves for three IBDs self-reporting

On the other hand, the firm spent $40 million in 2017 and the first quarter of 2018 in transitional loans to newly recruited advisors. And it’s reaping the benefits: Ladenburg reached a record of $168 billion in client assets in the second quarter, including a new high of $75.2 billion in advisory assets.

The IBD network’s growth “reflects our successful recruiting efforts of talented advisors over the past two years,” Ladenburg CEO Richard Lampen said in a statement. “We will continue to focus on increasing shared services, growing recurring revenues and managing our operations more efficiently to further drive margin and profitability improvements across the enterprise.”

-

Securities America and Atria Wealth Solutions hired recruiting and operational heads from Ameriprise and Cetera.

June 20 -

At least six RIAs have left since the No. 1 IBD announced a change in policies last November.

May 31 -

The network brought together three dozen advisors with 20 tech vendors as it seeks their input on potential partnerships and acquisitions.

May 29

Thirteen of the top 25 companies generated double-digit growth in 2017 as rivals close in on the perennial No. 1 firm.

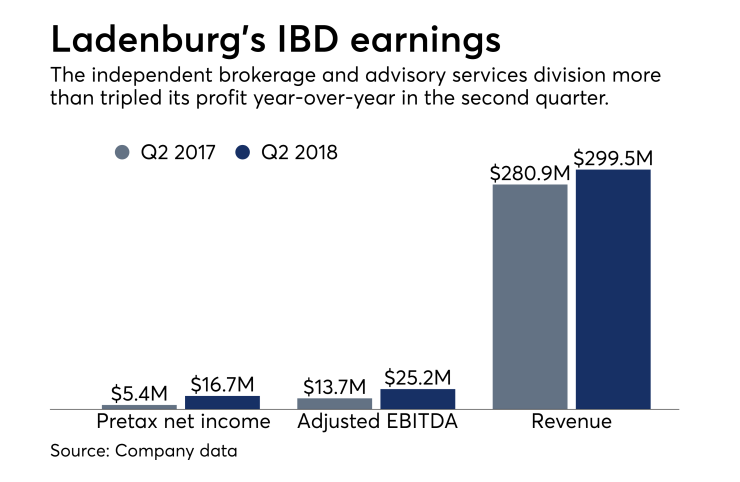

The IBD unit generated $299.5 million in revenue for the quarter, a 7% increase over the year-ago period and 84% of the parent’s revenue. The overall firm, which also includes an investment bank, asset manager and an insurance brokerage, generated $357.8 million in revenue.

The parent’s expenses for commissions and fees, as well as compensation and benefits, rose by double digits with $35 million in additional charges, driven by the IBDs. Both revenue and expenses go up for Ladenburg when advisors expand their businesses, Ladenburg noted in

At the same time, the IBDs cut nearly $1.8 million in brokerage, communication and clearance fees because of higher credits in 2018 and future years resulting from the renewal with Fidelity in May. Fidelity forgave the remaining $2.2 million of interest and principal on a $15 million forgiveable loan it provided to Ladenburg in 2011.

One of the IBDs also received almost $2.3 million in credits from its clearing firm in July through an amendment to an earlier agreement, although the firms’ identities weren’t clear. In addition, the five IBDs also received $472,000 in growth incentive payments from one of their clearing firms.

A spokesman for Ladenburg declined to discuss it, noting a company policy against commenting beyond what’s already included in its public filings. A spokeswoman for Pershing declined to comment, as well.

Fidelity spokeswoman Rachel Shaffer also had no comment, although she noted in an email that the clearing and custody firm “has a longstanding relationship with Ladenburg, working with the firm and its subsidiaries for many years.”

Ladenburg also didn’t disclose which IBDs self-reported to the SEC in the regulator’s push to disgorge 12b-1 fees to clients, in cases where they could have purchased lower-priced mutual fund shares than the ones sold to them. Securities America settled a similar

Ladenburg’s settlements stemming from the arbitration claims of the former rep were not material, according to the firm. Clients had sought compensatory damages after accusing the rep of unauthorized trading, excessive trading and mishandling of their accounts. Ladenburg settled the last case in July.

The 10-Q filing did not say the rep’s name or former IBD affiliation, though it noted the clients filed their claims between May 2016 and July 2017. Ladenburg also doesn’t break out its results among the subsidiary IBDs, which produced $1.14 billion in combined revenue last year.