LPL Financial added a massive OSJ and $1.6 billion in client assets to its network, as part of the second phase of transitions following its acquisition of National Planning Holdings’ assets last year.

Life Brokerage Financial, a firm based in Clearwater, Florida, has 80 advisors and 40 full-time staff, according to the firm, and will join LPL from Invest Financial. The firm also has satellite offices in the Seattle and Minneapolis areas.

“We are looking forward to joining LPL to further support our clients and grow our business,” says Life Brokerage Financial CEO Gary Richardson.

The move begins the second wave of asset transfers following the NPH deal, as LPL

LPL estimated that roughly 70% of production will move over in the first half of the transition, but competitors have also swooped in. Two of the firm’s

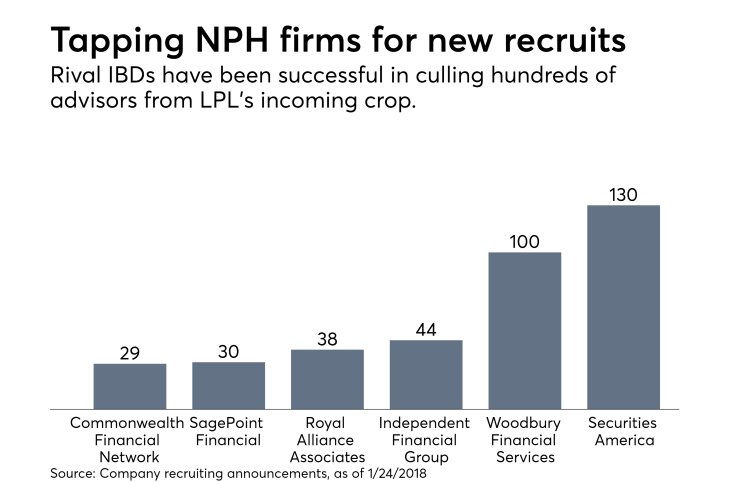

“More financial advisors are taking notice of what we have to offer,” Gregg Johnson, Securities America’s executive vice president for branch office development and acquisitions, says about his firm’s recruiting success at the end of January.

Advisors have gone elsewhere, as well. In all, some 400 advisors with $18.2 billion in client assets have bolted from NPH firms since the acquisition. It remains unclear just how many advisors LPL’s rivals have lost since the deal — many of them do not readily report such data.

LPL has faced significant recruiting headwinds as the firm tries to navigate the possible influx of 3,200 advisors with $120 billion in client assets stemming from the NPH deal. The firm’s

While recruiting has vexed LPL, the looming decision on the fiduciary rule was one of the main motives behind the Life Brokerage move, Richardson says.

“In an ever-changing industry, LPL has its hand on regulatory changes and, therefore, is on the leading edge of developing products and platforms to support the new era of financial services,” Richardson says. “We value LPL’s culture, employees and their ability to make us feel like we are supported as one, even in a large firm.”