A year after its initial public offering, Focus Financial Partners is doubling down on its acquisition growth strategy — and defending its liberal use of debt financing to get the deals done.

Through August 8, Focus closed 30 transactions, 20% more than the RIA aggregator completed in 2018. Six of the deals were direct acquisitions, led by the purchase of New York-based Williams, Jones & Associates, which has nearly $7 billion in AUM. In addition, Focus partner firms transacted 24 mergers, or sub-acquisitions, to expand their asset base.

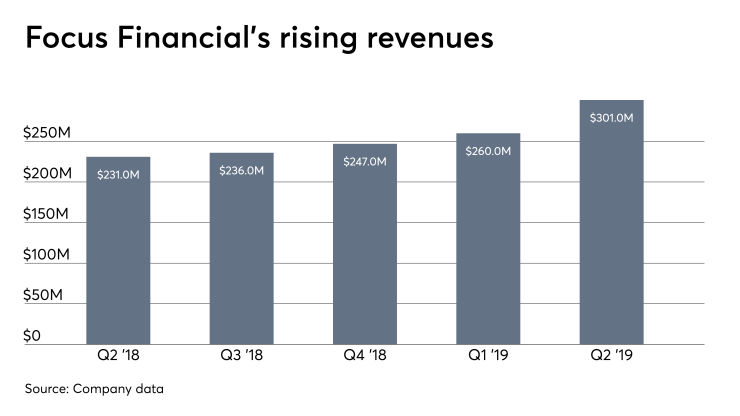

That flurry of activity contributed to total revenues of $301.5 million for the three months ended June 30, a 30% increase from last year’s second quarter results. Net income for the quarter rose to $3.1 million, compared to a $7.6 million loss for the second quarter in 2018.

“Our model continues to resonate with wealth management firms and our momentum is excellent,” Focus CEO Rudy Adolph said in a statement accompanying the second quarter earnings report. “We believe we have established a unique position in this market.”

However, in a conference call with Focus executives following the release of the earnings report, analysts questioned Focus’ debt level, which is more than four times consolidated EBITDA for the first time.

The trade-off of using more debt to spur growth is worthwhile, Adolph argued.

“We believe the benefits of pursuing [unprecedented acquisition opportunities] outweigh the drawbacks of increasing our leverage above four times [EBITDA],” Adolph told analysts.

The number of attractive firms for sale, mostly due to aging founders, is simply too good an opportunity to pass up, according to Adolph.

Taking a shot at his competition, Adolph claimed Focus was “the only game in town” when it came to M&A.

"Analysts seem to be honing in on the challenges faced with running a speciality finance vehicle that is reliant on third party financing," says Fiduciary Network CEO Karl Heckenberg.

“Nobody else can offer our value proposition [allowing sellers to continue to operate independently],” he boasted. “You can get swallowed up by some mega-institution, you can join a monolithic platform where your culture and way of doing business disappears or you get a private equity offer which comes with a significant loss of control and is only temporary capital.”

Focus has challenges of its own, according to some competitors.

“Focus’ analysts and investors seems to be honing in on the challenges faced with running a speciality finance vehicle that is reliant on third party financing going into a lower equity return environment,” says Karl Heckenberg, CEO of Fiduciary Network. “The market won’t be producing the same returns over the next ten years, clients are getting older and that means distributions will outpace inflows. Unless you are investing in net growth firms, which is a super small segment, it’s going to get ugly.”

Focus needs to do a high volume of transactions to feed its growth and demonstrate success to Wall Street, asserts Brent Brodeski, CEO of strategic acquirer Savant Capital Management.

“I am nonplussed that Focus continues to define ‘organic’ growth as including underlying partner firm tuck-ins,” says industry consultant Jamie McLaughlin.

“This introduces the risk of their needing to acquire low-growth businesses versus concentrating their efforts on higher growth, best-in-class firms,” Brodeski says. “The increased competition for RIA’s transactions is causing many acquirers to both pay higher multiples and to pay more cash at closing. This increasingly makes it difficult for financial buyers like Focus, who rely on financial engineering, low cost of capital and the accretion generated from multiple arbitrage, to create real and sustainable growth for their shareholders.”

Brodeski also took issue with Adolph’s put down of acquired advisory firms getting subsumed into a larger corporate structure.

“The important question that remains for Focus is how and if they can pivot from their current M&A focused strategy to creating value in other ways,” he says. “The fact that they are more a confederation of firms, with limited governance and lack of a singular brand, than a single firm that benefits from a single brand, scale and operating leverage will make pivoting difficult for Focus.”

And while Focus reported that its year-over-year organic revenue growth was 18%, skeptical industry observers note that the company continues to include its sub-acquisitions in its definition of organic growth.

Focus has “a significant runway ahead of us for further expanding our business,” says CEO Rudy Adolph.

“I am nonplussed that Focus continues to define ‘organic’ growth as including underlying partner firm tuck-ins,” says consultant Jamie McLaughlin. “No one in the wealth management business uses such a definition. If they can show they can accelerate their partner firms’ organic growth post-acquisition, it would provide proof of concept and give me more confidence that they have a defense against the M&A engine stalling or the market correcting.”

Adolph says growth rates of Focus partner firms has “more than doubled” by using mergers “compared to what they could achieve without mergers.”

Although industry valuation multiples for RIA acquisitions has exceeded double digits for firms with over $750 million in AUM, Adolph says Focus usually pays sellers all cash and an EBITDA multiple of “mid to high single digits” regardless of the size of the firm.

Many RIA M&A deals include cash and equity but Adolph says Focus is reluctant to use equity “unless there’s a very good reason.”

Analysts also questioned the sustainability of Focus’s acquisition pace.

-

The aggregator has filed with the SEC, and the aftermath of an offering will be closely watched.

May 29 -

A public offering will be a landmark for the advisory business. But the aggregator will face unprecedented scrutiny from investors.

June 8 -

The IPO price was lowered, but long-term performance is considered key.

July 26

According to Adolph, Focus has “a significant runway ahead of us for further expanding our business.”

But Focus CFO Jim Shanahan told advisors that the firm doesn’t anticipate “any additional new partner firm closings in Q3.” Focus’s growth “is not solely dependent on acquisitions,” Shanahan said. “The performance of our portfolio is a key driver of long-term growth.”

The CFO also downplayed analysts concern over Focus’ ability to pay down its debt.

“We generate a lot of operating cash flow that helps us support the M&A pipeline,” he told analysts. “If the deals are not accretive, the cash flow helps us to de-leverage.”

But questions remain, says Matt Crow, a certified financial analyst and president of Memphis, Tennessee-based Mercer Capital.

“In the first half of 2019, Focus reported cash flow from operations of $55 million, such that the nearly $300 million in investments made during that period were mostly debt financed” Crow says. “How long can the borrow-and-buy strategy persist?”