Despite all the challenges facing the planning industry, from rising competition to fee compression, the advisor profession remains quite appealing. Not only can we have meaningful, life-changing impact on our clients’ lives, but with experienced advisors making two to three times or more than the median household income in the U.S., we are on a potentially lucrative career path.

The caveat is that it still takes significant time to succeed and grow your income as an advisor, which presents a major roadblock for those who want to change careers — or go part-time — but who lack the flexibility to take a near-term pay cut to get their proverbial foot in the door.

The median annual income for an associate advisor with eight years of experience

Yet a shortage of next-generation advisor talent

This can be especially challenging for career changers who often come to the table with existing commitments — be it family, mortgages, looming college expenses, etc. If you’re walking away from a career and whatever salary level you’d achieved there to become an advisor, those factors are not insignificant.

Advising people about their life savings is a sacred duty, and it requires education and experience to do well.

This naturally invites the question, “Can I transition to being an advisor on a part-time basis?” The answer is largely no. You may find some opportunities, although they’re not necessarily what you’re hoping for. And I actually worry more about career changers who try to transition to being part-time advisors rather than the ones who go all in on the change.

SALES VS. ADVICE

The fundamental reason why part-time advisory work is problematic is that in the end, we’re advising clients on their life savings and potentially life-altering career and financial decisions. It’s weighty stuff.

Yet historically, there was never much of an experience requirement for becoming an advisor. Rather it was about being a salesperson compensated for the insurance or investment products that you sold. Any advice you gave was technically and legally incidental and ancillary to your selling a product. Companies would consequently train new advisors in the details of products and how to sell those products, but not necessarily in advice.

In that era, companies actually might have preferred otherwise inexperienced career changers because they tended to have what we call an existing natural market — i.e., people they already knew in their prior careers, who could then become prospects. So companies would often ask for a list of 50 people with whom you might do business, or would focus on the ZIP code you live in and whether you might have affluent neighbors. Everything about you was a potential pathway to selling the firm’s products.

Unfortunately some companies still dangle advisor job opportunities — including on a part-time basis — that are actually sales positions.

In fact, when I survey the

PART-TIME RIA?

The alternative that I know some career changers explore is simply hanging out their shingle and launching their own independent RIA.

To legally get paid advice fees you just

Some advisors out there have completely started, launched and

-

Some of the biggest changes come when industries collide.

January 16 -

It’s time to broaden our understanding — and assessment — of risk composure.

February 2 -

Existing clients and contacts can activate a fire hose of new revenue, so why do advisors shy away from the practice?

December 18

The problem is again, advising people about their life savings is a sacred duty, and it requires education and experience to do well. You wouldn’t see a doctor because they were really up on their WebMD reading, would you? If you want to be a recognized professional, you go and learn from other professionals. That’s been the pathway from apprentice to journeyman to master in skilled trades and professions for literally hundreds of years, and the same is true in our profession.

We’re advising clients on their life savings and what are potentially life-altering career and financial decisions. It’s weighty stuff.

THE IDEAL PATH

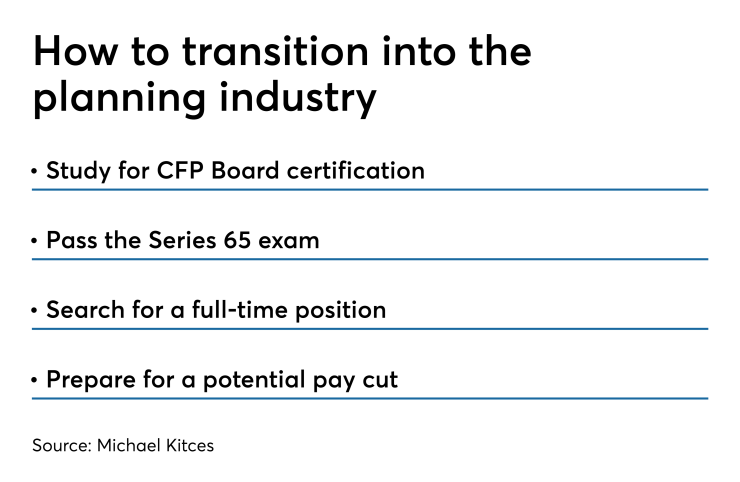

With all that said, what is the best way to transition to the advisory profession?

The first thing I recommend is to start studying for CFP certification. There are

Then again, if you’re studying part-time while getting paid from your current job, that’s not a bad way to ease the transition. From better starting salaries to just the ability to secure a starting job in a true advisory firm, the benefits of CFP certification are self-evident.

There is of course a non-trivial cost associated with getting your CFP certification, but in the end it’s not nearly as costly as the earnings you’d forfeit by trying to be a part-time advisor with no experience, no credibility and little ability to convince prospective clients of your advice’s value.

Second, take and pass your Series 65 exam. Most states

Bottom line, educational exam requirements are a much better way to lay the groundwork than trying to hang your shingle from scratch.

Third, recognize that eventually, you’re going to be searching for a full-time advisor job. Join your local

Educational exam requirements are a much better way to lay the groundwork than trying to hang your shingle from scratch.

Fourth and final, understand that transitioning to your new profession may come with a big pay cut, but understand too that you’ll likely build your income back up. If you want to switch careers and become a doctor, you’d be going back to school for four years and then working four years as a resident. If you wanted to become a lawyer, it would mean three years of school and then probably a couple more years in a big law firm trying to get some real experience before you saw a big check.

So by comparison, the requirements for becoming an advisor are a lot more reasonable. The starting salaries for full-time associate advisors may be lower than entry-level doctor or entry-level lawyer, but as an advisor you can satisfy all these educational licensing exam requirements part-time. No need to step out of the workforce for three to four years of graduate school, and lose out on income and rack up potentially sizeable student loan debt.

But it does mean that you need a plan for

The greatest determinants of income for advisors is years of relevant experience learning your trade, improving your skills and accumulating clients. There’s no shortcut for that. And frankly, attempting a part-time transition probably stretches out how long it takes for you to really see a return on your investment. That’s also saying nothing of the risk you’d otherwise expose your clients to if you lacked the requisite training and expertise.

So if you’re really desperate to, yes, hang out your shingle as an independent RIA and start getting clients on the side — but please, keep the scope of your advice limited to the area(s) where you truly know how to help clients and stay there.

But ideally you’ll instead put that time and energy toward getting your CFP certification, finishing your Series 65 licensing exams and — if you have a little time flexibility — start networking, finding an internship or some part-time work in an advisory firm you admire, etc. Do what you can to get a foot in the door and start learning more about the industry, and more practically, start the clock on that three-year experience requirement. Follow these steps and you might not find a shortcut, but you likely will find the job — and career — you hoped for.

Disclosure: Michael Kitces is a co-founder of