CEO James Gorman has a message about rivals’ moves to zero commission trading: Morgan Stanley’s 15,553 financial advisors don’t work for free.

"An advisor who is working hard and is being paid by commission rather than by a management fee wants to get paid. I mean that’s the deal. They're not a not-for-profit," Gorman said.

That, in part, was the chief executive’s response to analysts questioning whether Morgan Stanley felt pressure to match discount brokerages’ policy changes

Schwab

Gorman, however, was unfazed.

“When you put together the research, the financial planning, tying people into their trusts and estate planning, working with the accountants — it is complicated stuff. And being wrong on this stuff can overwhelm a few basis points on the fees,” Gorman said. “The real question is, on what level of assets is it relevant?”

Morgan Stanley, which fields one of the largest brokerage forces in the country, caters to wealthy clients. The firm’s sweet spots are those with $1 million to $10 million, and above $10 million, Gorman said. That’s where the value proposition of the client-advisor relationship is strongest.

“Someone with $39,000 does not need a financial advisor and will not get the attention of a financial advisor,” Gorman said.

In other words, Charles Schwab and Morgan Stanley aren’t comparable.

“Our clients are looking for something different. They are not looking for zero commission trades,” CFO Jonathan Pruzan told analysts.

His comments echo similar sentiments among other bank and wirehouse executives.

Bank of America CEO Brian Moynihan brushed off analyst questions as to whether his firm’s Merrill Lynch business felt pressure to address commission cuts at other firms.

“We are driving a whole relationship,”

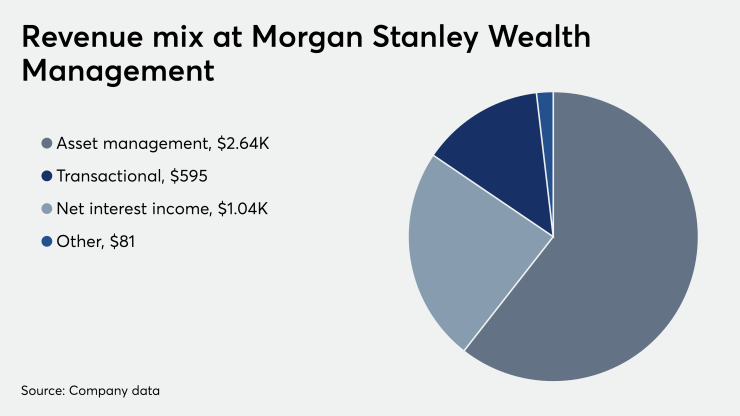

At Morgan Stanley Wealth Management, transactional revenues were down for the third quarter and have counted for less as a piece of the wirehouse’s revenue mix. Clients have increasingly moved toward fee-based relationships, executives said. And the firm has placed greater emphasis on its deposit and lending capabilities, which in turn have boosted net interest income.

Transactional income dropped 15% to $595 million for the quarter, according to the company. Net interest income slid 3% to $1.04 billion. Overall, wealth management’s net revenue slipped 1% to $4.3 brillion.

The wirehouse reported fee-based asset flows of $15.5 billion for the third quarter, up 58% from the year-ago period.

Net income for the wealth management business rose 5% to $962 million thanks to lower costs, the firm said.

Morgan Stanley also reported a net year-over-year decline in advisor headcount, dropped to 15,553 from 15,655, representing a 102 decrease.