SAN DIEGO – Advisers face a future marked by a smaller menu of choices among mutual fund share classes, according to a half dozen experts.

The Department of Labor’s fiduciary rule, SEC enforcement and long-term trends toward lower expense ratios are cutting down on the alphabet soup of offerings, said panelists at last week’s Pershing Insite conference. Such factors pose a huge impact on Class C and Class T shares in particular.

SEC officials vowed to lead change last year in announcing a greater focus on whether advisers’ share-class selections

“As an independent broker-dealer, we model ourselves on being able to give choice to our advisers,” said Carly Maher, a senior vice president for enterprise initiatives at Ladenburg Thalmann, the Miami-based parent of six BDs.

“We’re not going to have a lot of choice anymore. You’re seeing this consolidation happen whether it’s on the broker-dealer side or the asset management side.”

-

In 2016, the SEC brought a record 868 cases, including 173 against broker-dealers and advisers and 159 against investment companies.

May 16 -

Enforcement actions at the SEC and FINRA highlight emphasis regulators are placing on fees and reverse churning, anti-money laundering programs and variable annuities.

June 23 -

The new offerings could boost returns to investors by 50 basis points, according to a study.

April 17

TEETER-TOTTERING

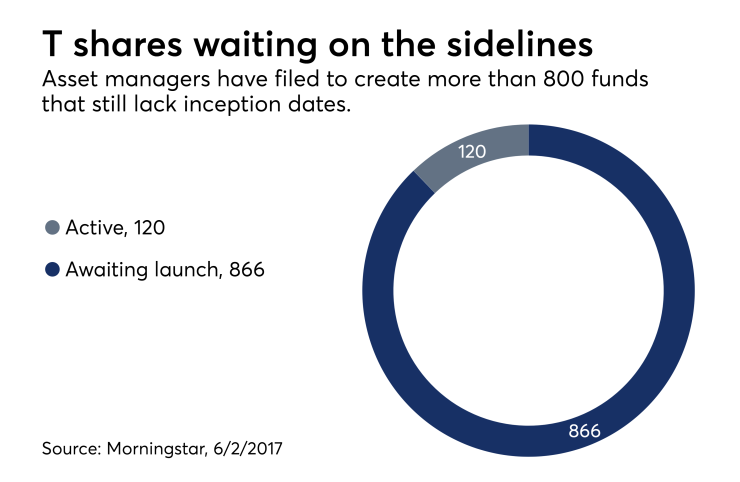

Some 78 different asset managers filed the necessary documents to launch a combined 866 T-shares but had yet to set an inception date June 2, according to Jeff Schwantz, head of client solutions at global research firm Morningstar. Only 120 T-shares have actually hit the market, he said.

Products like T-shares and its no-fee relative, so-called clean shares, present an “operational burden” for firms who sell them to clients, Schwantz said. Firms must address the cost of both the initial advice as well as onboarding charges, according to Schwantz.

“When organizations have really started to peel back that and understand what it looks like, there’s absolutely some reluctance [to get into] in the clean share world,” he said.

“There are so many other down-the-stream applications and things that are necessary to contemplate. It’s always the unintended consequences of that. So I think that’s why you’re seeing this back-and-forth movement and the teeter-tottering of organizations.”

DO THE RIGHT THING

The SEC has not waffled, however, on its crackdown around 12b-1 fees. Credit Suisse and a former adviser with the firm agreed to pay nearly $8 million in

The regulatory focus altered RIAs’ fund-selection processes. Snowden Lane Partners now provides any client not eligible for institutional funds with load-waived funds and rebates for any 12b-1 fees, said Richard West, the New York-based RIA’s general counsel.

Balentine, an Atlanta-based RIA, also changed its protocol around funds. The firm created a specific investment strategy team, separate from business development and relationship management, which ensures clients receive the cheapest available share class, said Erica Farber, its director of operations.

“There is a part of me that feels like we’re losing a little bit of control over the decision, or the ability to make what we think is the best choice for the client,” she said. “I think it’s just par for the course these days, but we’re just going to settle for knowing that we’ve done the right thing from a compliance standpoint.”

FLUIDITY AND FLUX

Asset managers’ actions have displayed their concerns about compliance. Pershing received notice that 18 to 20 fund families would begin offering T shares June 9, according to Rich Calvario, a senior solutions manager for the firm’s FundVest platform.

“That was the number about two weeks ago,” Calvario said. “And then all but a few of them have actually pulled them back. I think the point here is that this has been extremely fluid.”

Calvario and other panelists in a session focusing on mutual funds expressed frustration about the term “clean share.” The SEC’s definition entails only that the fund have no loads and no ongoing fees, such as the 12b-1, Calvario pointed out. Funds used by Pershing’s clients have fit that criteria for a year or two or more, he said.

Calvario and the other panelists agreed that questions around the possible full Jan. 1 implementation of the DoL rule have placed the future of Class T, C and A shares in flux. Ladenburg hopes to use “some type of modified version of an A share” rather than a T share if the rule goes into effect, Maher said.

C shares, which can’t be converted into the lower-expense A shares, don’t have a future under the new regulatory structures, according to Pete Thatch, product manager at American Funds. The current bull market has helped sustain the alphabet soup, Thatch said.

“If you think about a correction, if you think about some of the trends in the marketplace, you can see some consolidation coming both in the asset management business and the broker-dealer business,” he said. “This is a model that is ripe for disruption.”