Advisers who are taking a fresh look at asset allocation and structuring portfolios after the surprising results of the presidential election should take heart, say T. Rowe Price's market experts.

Two likely outcomes of Donald Trump's victory, tax reform and more deficit spending, are "good for growth," said Alan Levenson, T. Rowe's chief U.S. economist, discussing the investment firm's 2017 Global Markets Outlook at a press briefing in New York.

With interest rates set to rise, stock prices can be expected to rise as well, said Larry Puglia, portfolio manager for T. Rowe's U.S. large cap growth equity strategy.

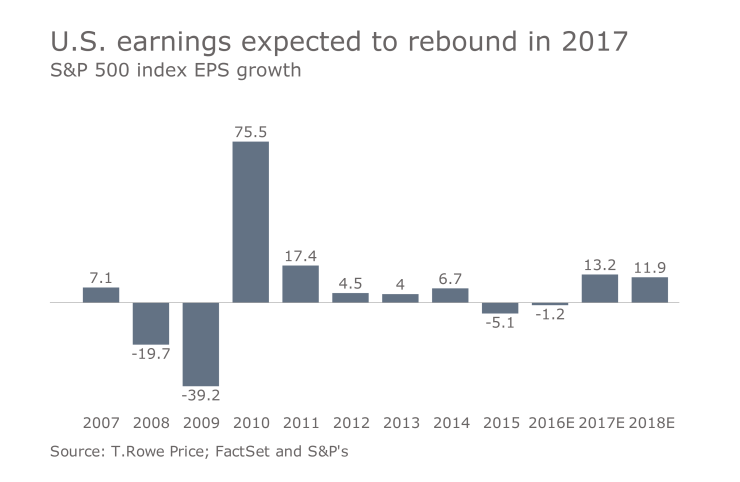

Puglia also anticipates a strong rebound for earnings growth in 2017, and cited information technology and health care as "the industry sectors with the most attractive valuations." Companies selling durable goods should also benefit from Trump's election, he added.

CORRELATON WARNING

The balance between stocks and bonds in a client's portfolio remains the most important allocation decision for advisers, said Sebastien Page, co-head of asset allocation for T. Rowe.

"Long term, a healthy allocation to stocks continues to make sense," Page said.

-

History shows the winning party and their policies will have minimal impact on returns.

November 7 -

Advisers are betting that the president-elect’s promised tax cuts will come as early as next year, and they’re telling wealthy clients to move now to make the most of it.

November 15 - Our 30-30 series helps planners advise clients on everything from alternative assets to risk tolerance.Sponsored by Fidelity Investments

But he warned that as interest rates increase, the correlation between stocks and bonds becomes "unstable," making it "harder to get diversification." As a result, he explained, advisers may be "delivering a higher risk profile than they thought they were."

One buying opportunity may be emerging markets, said Samy Muaddi, the firm's portfolio manager for emerging markets corporate bond strategy.

VALUE IN EMERGING MARKETS

"Emerging markets still offer relative value," Muaddi declared. "After several years of relatively low growth, emerging markets have started to outpace developed markets by a large margin, aided by economic recoveries in Brazil and Russia, rebounds in several smaller countries, and improving sovereign macroeconomic fundamentals."

Exposure to emerging markets corporate bonds is a viable option for investors looking to diversify fixed income allocations and increase portfolio yield in a low interest rate environment, Muaddi said.

And, of course, no portfolio strategy can overlook the importance of China's economy, the experts stressed.

T. Rowe's head of international equity Chris Alderson was bullish on China's prospects to manage its economic slowdown. "The Chinese authorities have the scope and the firepower to keep the economy going," Alderson said.

RISKS: CHINA AND TRUMP

But Muaddi warned that "China’s economic adjustment and significant debt load is a key global risk to monitor. We expect growth to slow toward a more sustainable long-term trend, but volatility will continue as the effectiveness of government stimulus wanes."

The biggest "tail risk" associated with China, he said, was the country's $30 trillion in outstanding credit, which he noted, was nearly twice the size of the U.S. economy.

Other risks to watch for stem from Trump's election, said Levenson.

"There's a lot of uncertainty around Trump's immigration and trade policy," he said. "Everyone was prepared for a post- election environment without much policy change. Instead we have to expect significant policy changes."