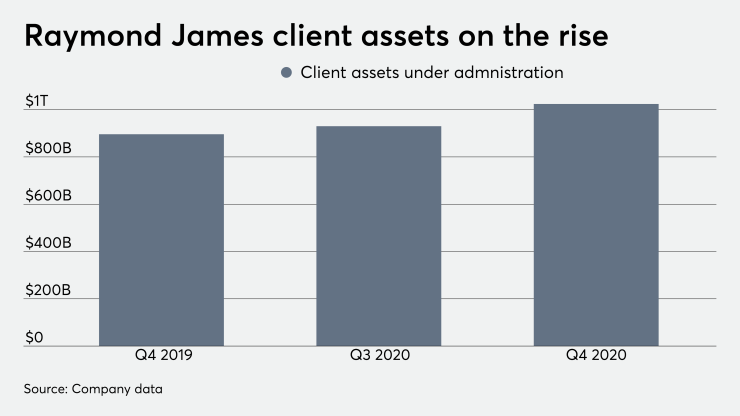

Raymond James topped the trillion-dollar mark for client assets for the first time, a milestone that underscores how the firm has grown over the past decade.

The St. Petersburg, Florida-based firm

“It’s a hard choice for advisors when it comes down to two places and one place will pay 50% more,” CEO Paul Reilly said during a call with analysts Jan. 28.

Without naming specific competitors, Reilly said that rivals had boosted their recruiting deals for financial advisors, prompting Raymond James to up its offer.

“We have also enhanced our recruiting packages to remain competitive,” Reilly said, without going into detail.

A Raymond James spokeswoman declined to comment.

The company, which offers advisors multiple affiliation options, has long been an aggressive recruiter. Total headcount stood at 8,233 advisors as of Dec. 31, a net increase of 173 over December 2019 but a net decrease of six compared to September 2020.

Eaton Vance and E-Trade deals expected to boost the firm’s performance.

Reilly cautioned that while the firm was upping its recruiting deal for new hires, it would not make overly aggressive offers.

“It’s always been competitive. Always. We’ve always had outliers, one or two firms, offering outsized packages. Some of the regional firms have joined the fray. But I think, once we dug into the economics, that … in this interest rate environment, if you structure them right, you get a good return,” the chief executive said.

The firm’s headcount has risen steadily over the past decade, benefiting from recruiting efforts as well as Raymond James’ acquisition of brokerage firm Morgan Keegan in 2012. Raymond James fielded just 5,080 employee and independent advisors at the end of 2010, according to the company’s SEC filings. The firm reported $262 billion in client assets under management at that time.

“Organic recruiting has been the engine. It’s been the engine since 2010,” said Reilly, who

Raymond James reported that overall revenue rose 11% year-over-year to $2.2 billion for the quarter. Net income rose 16% to $312 billion.