Fueled by key acquisitions, Morgan Stanley is set to rev its growth engine.

“We’re in the growth phase for this company for the next decade,” CEO James Gorman told analysts Wednesday.

The wirehouse’s fourth-quarter earnings got a significant boost from its acquisition of E-Trade, completed in October. Morgan Stanley Wealth Management’s net revenues jumped 24% year-over-year to reach $5.7 billion for the quarter, according to the company’s earnings report issued Jan. 20. Pretax profit fell 8% to $1 billion due to higher expenses.

The years ahead may see more significant growth, according to Gorman, who said 2021 would be a transition year as the company completes its acquisition and integrates asset manager Eaton Vance and E-Trade, setting up Morgan Stanley to align these businesses with its existing wealth management operation.

“E-Trade serves a younger demographic, on average 10 years younger than we have traditionally served,” Gorman said, adding that Morgan Stanley will now be able to serve a wider range of clients at different life stages and asset levels.

The firm’s advisor-led channel now serves approximately $2.5 million households and generated $77 billion in fee-based asset flows in 2020, according to the company. The firm’s workplace benefits business serves approximately 4.9 million people. Morgan’s self-directed channel serves 6.7 million households.

“With our increased abilities, we can deepen client relationships and provide more services,” the chief executive said.

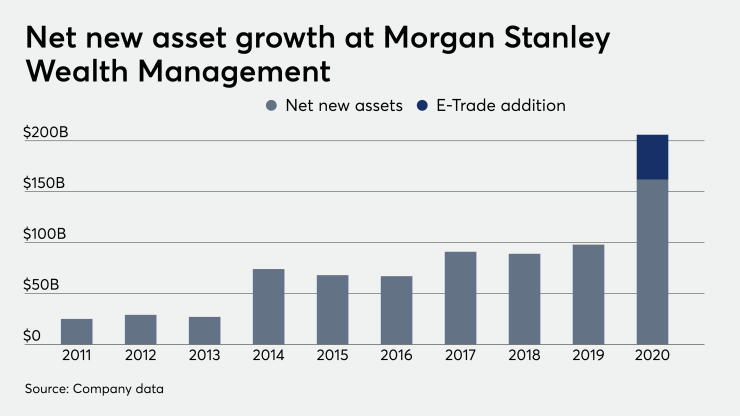

Gorman noted how well E-Trade performed in 2020, observing in particular that trading activity more than tripled. “Net new asset growth was remarkable,” he said, adding further proof that the decision to buy ETrade was the right one.

Net new assets were $66 billion for the fourth quarter and $206 billion for the year. Total client assets at Morgan Stanley’s wealth unit jumped 48% year-over-year to reach almost $4 trillion.

Fee-based assets rose 16% to reach $1.5 trillion in 2020 — only a fraction of which came from retirement accounts. The firm said it expects the shift to fee-based assets to be a long-term trend.

Advisor headcount rose 3% to 15,950.