A will, power of attorney, health care directive and an information document are some of the important papers clients should prepare as part of their retirement and estate planning, a CFP writes at Forbes. “Creating a well thought out financial plan as well as creating legal documents to ensure your personal, financial and health wishes are carried out the way you want,” the advisor writes. “Managing your estate, regardless of the size, begins with working with an expert to help give you greater control, privacy and security of your legacy — the one you worked so hard to build.”

The costs of housing, transportation and health care are among the major expenses in retirement that clients should prepare for, according to this article from Yahoo Finance. They should also save extra for food, entertainment, savings and pensions. “Retirement spending typically declines for housing, food and clothing costs. However, average spending in retirement often increases for health care expenses,” the article says.

Although clients in the workforce can start collecting Social Security benefits at age 62, this move could permanently reduce their monthly benefit payouts, according to this article from Motley Fool. They are advised to wait until their full retirement age to get the primary insurance amount or delay their claim until the age of 70 to get bigger benefit payouts. Those who are ill or don’t expect to live longer will be better off filing early, rather than delaying the benefits.

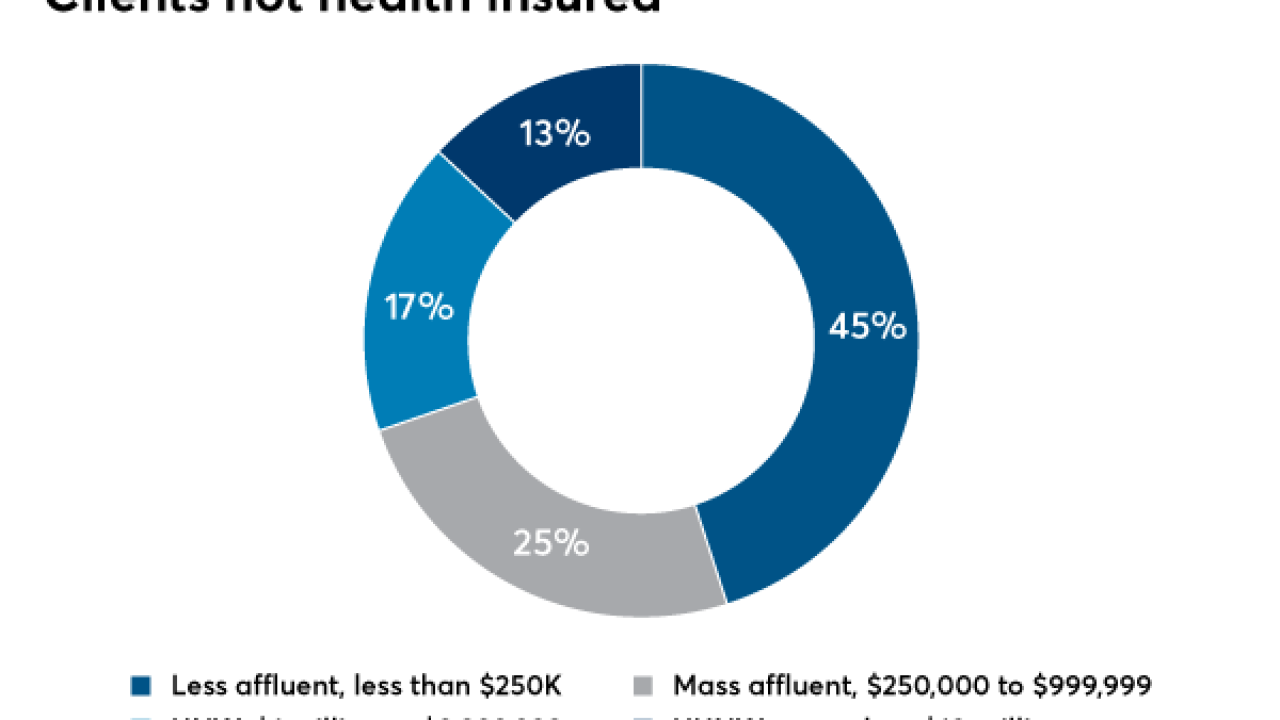

Financial literacy is a problem for a wide range of clients, plus other findings unearthed in Financial Planning’s new survey.

Clients should consider their 401(k)s in the context of their overall retirement portfolio, using a big-picture strategy that focuses on diversification to maximize returns and save on taxes, according to this Money article. “Ideally, you want your 401(k) investments to complement your taxable holdings,” an expert says. “For example, if you own growth-oriented securities in your taxable account, it may make sense to diversify your portfolio by adding dividend and other income-producing securities in your 401(k).”