WASHINGTON — Multi-billion dollar advisory firms and industry consolidation may grab the headlines, but small RIAs are still very much in the game.

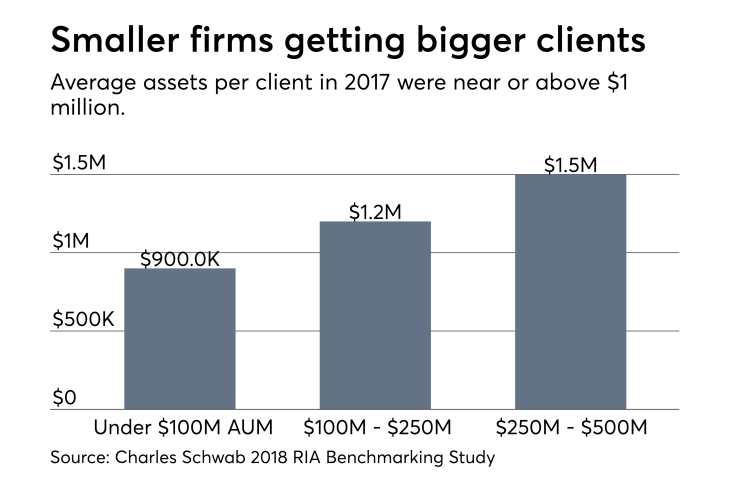

The average assets per client for firms with under $100 million is nearing $1 million, according to a just released Charles Schwab benchmarking study. Smaller firms are also growing slightly faster than their larger counterparts, and thanks to strong organic growth, these firms recorded stronger asset growth than their peers.

From 2012 to 2017, smaller firms posted a five-year compound annual growth rate of 12% — compared to an industry-wide growth rate of 11% for the same period for firms with over $250 million in AUM.

“With the types of relationships they have in their communities, they can go deeper and have stickier relationships,” said Jalina Kerr, the senior vice president overseeing Schwab’s custodial services for firms with less than $100 million in AUM. “Having these relationships also help with referrals and organic growth.”

Smaller firms are also adopting new technology at a rapid rate, Kerr told Financial Planning in an interview at Schwab’s annual IMPACT conference.

“They’re embracing it out of need,” she explained. “They’re constrained around size, but the small firms have been more receptive to new technology than many of their larger peers.”

However, size also constrains how smaller firms manage their time with only one or two employees A lack of sufficient time to stay abreast of the latest practice management techniques has made some smaller RIAs more vulnerable, Kerr says.

“Time is a major investment because so much is coming at them,” she said. “It’s tough to stay current if you have time for education.”

Consequently, Schwab is starting a pilot program in January to provide smaller firms virtual practice management classes with access to a live consultant.

Portfolio Connect, a program that was tested this year to provide smaller advisors with automated reconciliation and other client billing and account services will also launch in January, Kerr said.

And Schwab’s robo option for advisors, Institutional Intelligent Portfolios, has been a big hit with smaller advisors, according to Kerr.

“The smaller firms haven’t felt threatened by robo advisors,” she explained. “They’ve seen what they can do for clients who otherwise might not have had enough investable assets for them to take on. Now there’s an option they can offer those clients, who can later migrate to a traditional service model.”