Regulation and compliance

Regulation and compliance

-

A Department of Labor rule adopted under the Biden administration had many brokers worried about their ability to work as independent contractors. A new proposal would roll it back.

1h ago -

The financial advisory firm initially sought an industrial loan charter back in 2020. It's the third company to receive the necessary approvals this year, joining General Motors and Ford.

1h ago -

Paul Reid Galietto's lawyer says he was let go by Credit Suisse in 2021 after the firm tried to unfairly blame him for losses from the collapse of the giant family office Archegos Capital Management.

February 24 -

Impact investing experts admit that the first year under President Trump has brought changes to the rhetoric around ESG. The realities look far more murky, though.

February 23 -

A pair of putative class-action lawsuits this month accuse Edward Jones of allowing information clients enter online to be harvested for use in targeted marketing campaigns.

February 20 -

If you have business clients who are considering changing their LLCs or C corporations into S corporations, now is a great time to discuss the pitfalls.

February 19 -

A federal judge rejected Stifel's bid to dismiss a FINRA penalty. The firm has paid millions to former clients, with 20 more cases still in the works.

February 10 -

A federal judge rejects arguments that U.S. Bank has a fiduciary duty toward uninvested cash sitting in clients' brokerage accounts.

February 5 -

The SEC's decision marks a startling reversal from the full-court press it had mounted against Commonwealth Financial Network in 2019 over alleged failures to disclose conflicts of interest in its brokers' mutual fund recommendations.

February 3 -

Linda Friedman, who has made a career with Wall Street discrimination and harassment cases, is representing an ex-Citi executive in a bombshell lawsuit this week. Things didn't have to take this turn, she contends.

January 30 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

Brokers were worried a new rule intended to lighten their responsibility to monitor advisors' side hustles would ironically mean greater supervision duties with RIAs.

January 22 -

A Ninth Circuit appellate panel ruled that10 advisors recruited to LPL from Ameriprise have the right to resist turning over their personal devices to a forensic examiner to be searched for evidence of misappropriated client data.

January 21 -

The former CEO of Orion Advisor Solutions has since become involved in several artificial intelligence startups, which he hopes will be integrated into advisor technology stacks.

January 16 -

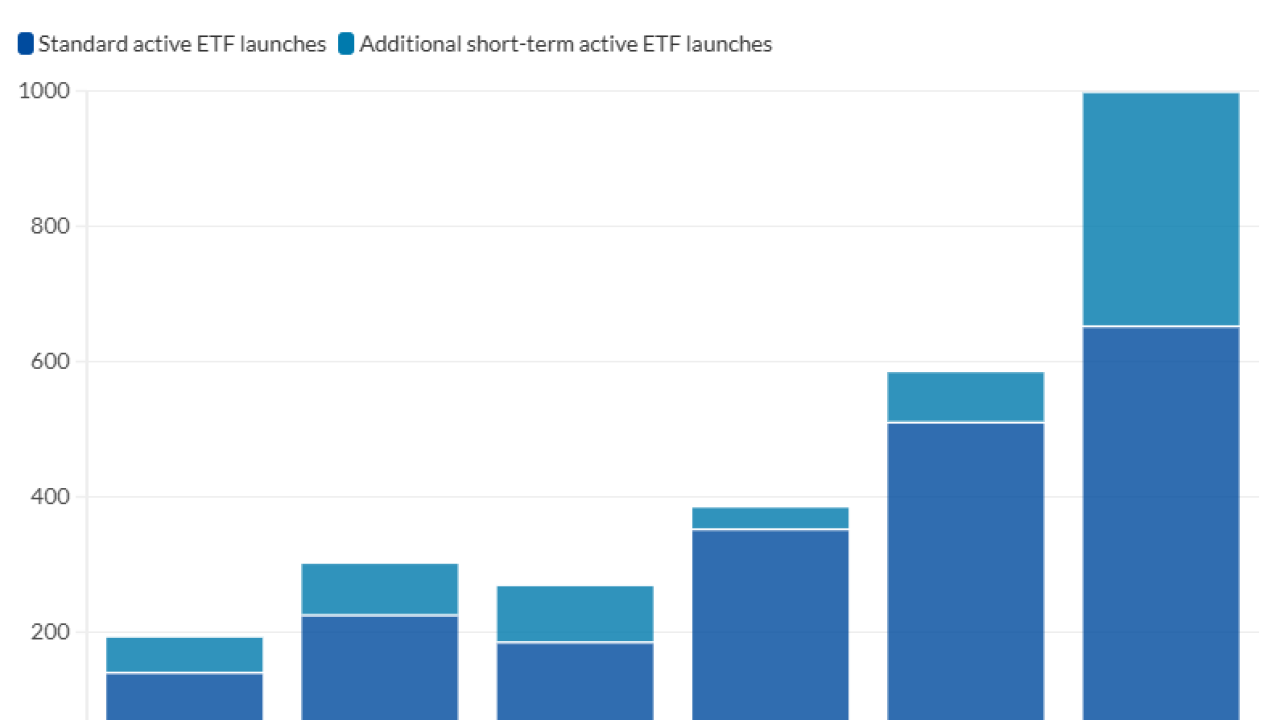

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

The justices are scheduled to resolve disagreement among lower courts over whether market regulators can order fraudsters to repay ill-gotten gains to victims.

January 12 -

Kyle Busch's lawsuit against Pacific Life and his former insurance agent provides a window into potential issues around complexity, suitability and more in indexed universal life policies.

January 12 -

Systems still don't talk to each other as well as they should in 2026, so advisors are finding their own solutions.

January 12 -

A new proposal would allow firms to tack three additional months onto the amount of time they can place holds on the accounts of clients 65 and older in cases of suspected financial exploitation.

January 9 -

The regulator considers raising the AUM threshold it uses when considering how newly proposed rules are likely to affect small RIAs.

January 8