The parent of two independent broker-dealers poached an executive from SunTrust Bank with an eye toward a growth push that will include a major recruiting pickup and up to three more acquisitions this year.

Wentworth Management Services, which acquired Cabot Lodge Securities and

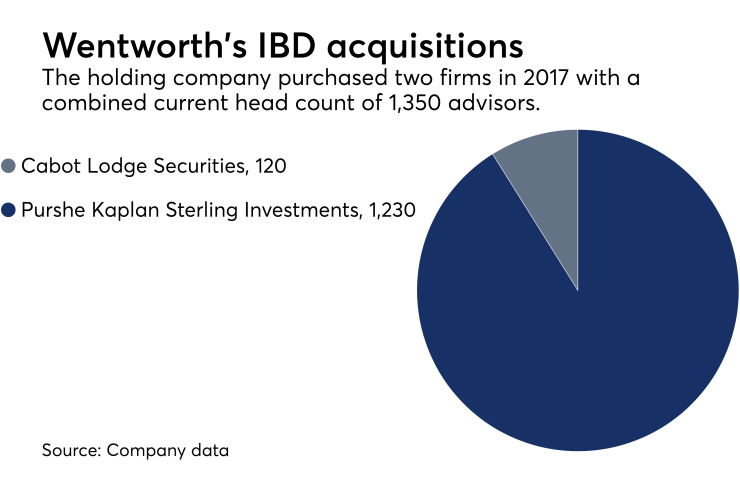

The firm’s broker-dealers span some 1,350 advisors operating about 535 offices in all 50 states, but Wentworth CEO Ryan Morfin says the firm has two more acquisitions awaiting FINRA approval and one other deal in the works. PKS will also soon announce a 150-advisor practice joining the firm, he says.

Morfin met Breath, the CFO of SunTrust’s consumer segment and former CFO for retail banking and private wealth management, through an executive search firm. While private equity capital

“We think it’s interesting that private equity is coming into the space looking for a return for their capital, but this is a service industry and really it’s the financial advisor creating the value,” he says. “We were looking for a very specific type of executive leader that had a lot of experience in integrating businesses and growing companies.”

Representatives for SunTrust declined to comment on Breath’s departure.

He had managed control and risk functions for a business with $6.2 billion in annual revenue at the bank, following his tenure in the wealth management unit. He redesigned SunTrust’s asset management platform for more reporting transparency in brokerage and trust accounts, according to Wentworth.

-

The buyer of the broker-dealer to some 1,200 hybrid advisors is not a private equity firm.

December 5 -

The firm left Kestra for PKS as part of the move as increasingly large breakaways fuel the independent movement.

May 16 -

Larry Roth, who was also head of AIG Advisor Group, is offering up his expertise after helping both firms navigate difficult years as their chief executive.

September 12

At his new firm, Breath will report directly to Morfin. In addition to his primary role in finance and accounting, he will also help lead strategic initiatives around M&A deals and ramping up the scale of the IBD firms.

“The Wentworth team is committed to principled investing activities and building long-term relationships with clients,” Breath said in a statement. “I am inspired by Wentworth’s enthusiasm for growth within the wealth management industry and am excited to be part of this talented team.”

The holding company consists of two members: a New Jersey-based family office named Oak Spring Holdings and a special purpose vehicle called Wentworth Funding allowing for management to co-invest in the acquisition deals.

Wentworth doesn’t buy IBDs just to flip them, Morfin says.

“We’re looking for long-term value creation with our financial advisors and their practices,” he says.