A suspended financial advisor accused of tens of millions of dollars in unsuitable sales promoted notes connected to a major nationwide fraud scheme, a new lawsuit alleges.

Despite advertising herself as “The Face of Fiduciary Trust,” Brooklynn Chandler Willy of Texas Financial Advisory sold a client on a $100,000 investment into a limited liability company whose principals were

In October, Willy

“Brooklynn Chandler Willy is an extremely good salesperson and elicits trust in the people she deals with,” says the Andersons’ attorney, Matthew King of King Estate Law. Her claim of being a faithful fiduciary “has had a persuasive effect on several different clients that we are representing in cases against Ms. Willy,” King says.

King has filed one other case against Willy in Bexar County and has discussed potential other claims with former clients as well. Representatives for Texas Financial Advisory denied the allegations of the Andersons’ lawsuit.

“Prior to receiving the petition earlier this month, Brooklynn Chandler Willy was unaware that the Andersons, longstanding clients of Texas Financial Advisory, were not satisfied with the firm’s services,” Texas Financial Advisory spokesman Rich Wilner said in a statement.

“Ms. Willy never actively managed the Andersons’ Sonoqui investment and has no reason to believe that a resolution will not be reached by the June 2021 payment date,” Wilner continued. “To be clear, Ms. Willy is unaware of any breach that would give rise to damages. Ms. Willy is considering all appropriate legal options in response to the petition.”

A web of shell entities linked to Sonoqui principal Daryl G. Bank and three conspirators served as a means of selling hundreds of retirees and pre-retirees on investments that they used to run the scam and make lavish purchases,

The group “defrauded hundreds of unsuspecting investors out of over $25 million, draining their retirement accounts and leaving a trail of financial and emotional devastation for the victims,” Raj Parekh, acting U.S. Attorney for the Eastern District of Virginia, said in a statement. “The jury’s verdicts bring us one step closer to securing justice for the victims of these damaging, manipulative, and life-altering schemes.”

Willy acted as an intermediary to the scam through the Andersons’ investment into Sonoqui, the lawsuit alleges. In 2017, she told Scott Anderson that his loan of $100,000 to Sonoqui would go to a debt collection agency called Collins Asset Group, where the investment would accrue at 10% per year plus interest to earn a $40,000 profit after four years, according to the lawsuit.

Federal agents arrested Bank and Gibson the week after Anderson’s check to Sonoqui cleared, the lawsuit says. Willy called the Andersons around the time of the federal indictment to suggest they direct the money to a different investment if the check hadn’t gone through, the clients say, only to reassure them without mentioning any problems with Sonoqui upon learning it did.

“Despite the indictments, arrests, and subsequent class action lawsuit, Willy has continued to assure the Andersons that both their $100,000 ‘investment’ and the associated $40,000 in promised interest were safe,” the lawsuit states. “Willy never informed the Andersons that the investment she directed them into was a fraud.”

Sonoqui, Collins and seven other defendants in an investor class action lawsuit in Atlanta federal court have agreed to pay more than $15.7 million to settle the case. U.S. District Judge Eleanor Ross issued a preliminary approval of the settlement to “bring about the conclusion of two separate lawsuits involving more than 100 parties with competing legal theories” in January, ahead of a fairness hearing next month for final approval, court records show.

In addition to selling the Sonoqui investment, Willy falsely told Erin Anderson that “a stop-loss provision” in her inherited IRA would limit any depletion in value to 10% or less, the lawsuit states. The IRA declined by 30% at one point, according to the filing.

The Andersons had sought out Willy, who had a radio show about financial planning on a local station, in May 2016 in response to one of her ads. She marketed herself as a fiduciary, as in a January 2017 local magazine ad that explained the difference between the fiduciary and suitability standards, according to an excerpt included in the lawsuit.

“Here at Texas Financial Advisory, we are always saying the F-word,” the ad said. “No, not that word! The one that applies to the world of investments and investment advice. The word that I'm referring to is FIDUCIARY.”

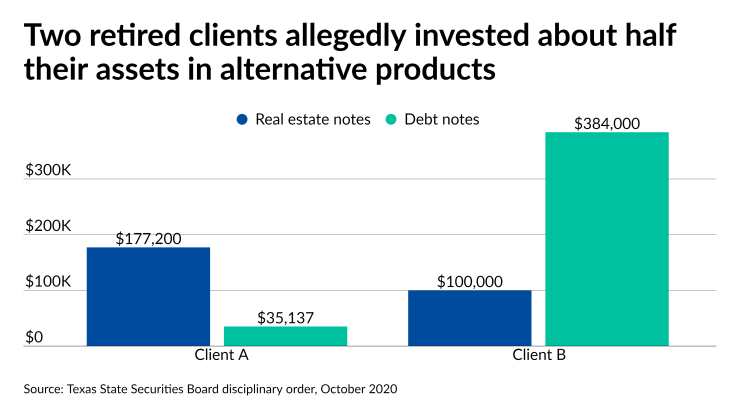

More than 200 clients of the RIA invested in unsuitable and unregistered promissory notes in products tied to real estate and debt collection, the Texas State Securities Board Oct. 16 order

Besides agreeing to the suspension and paying the commissions back to the clients under the settlement, Willy agreed to hire an independent compliance consultant, give up discretionary trading authority over client accounts for five years and refrain from recommending any alternative investments over the same span.