Waddell & Reed is laying off hundreds more employees and calling off the relocation of its corporate office in the wake of selling the 84-year-old business.

The mutual fund company and wealth manager is offering severance to 219 employees in unspecified positions who are expected to depart around April 30 — the scheduled date of close of Australian firm Macquarie Asset Management’s

Macquarie’s acquisition of the Kansas City-area firm includes a spinoff of the wealth manager to

“While we can confirm that we will not be occupying the new building, Macquarie and LPL remain committed to the region and supporting the needs of our clients and staff here,” Macquarie spokesman Lee Lubarsky said in an emailed statement.

Lubarsky added that construction of the building will continue. The Kansas City Star

Waddell & Reed’s wealth manager listed 721 full-time employees at the end of 2019,

“Those affected employees are not permitted to displace remaining employees based on seniority or any other factor,” Vice President of Human Resource Ric Rodriguez wrote in a letter to the state Commerce Department in compliance with the Worker Adjustment and Retraining Notification Act. “All affected employees have been or will be notified of their employment terminations at least 60 days before their terminations are scheduled to occur.”

Waddell & Reed’s layoffs won’t affect the firm’s Ivy Funds, spokesman Roger Hoadley said in an email, noting that no further specific information about the departing employees was available.

“Macquarie, Waddell & Reed and LPL are committed to taking a very careful and thoughtful approach in bringing together the capabilities and resources needed to help advisors, intermediary partners, and their clients achieve their investment objectives while delivering exceptional service,” Hoadley said. The affected employees are eligible for benefits including continued health insurance plans and placement services, he added.

Waddell & Reed slashed its footprint by dropping branches for independent locations for advisors

Alongside recruiting fights, shareholder lawsuits and golden parachutes for executives of the selling firm, corporate-office consolidation is an expected part of any major M&A deal. Five executives — including CEO Philip J. Sanders ($14.4 million) and Senior Vice President of Wealth Management Shawn Mihal ($4.2 million) — are slated to receive a combined $41.7 million in cash and equity if they’re terminated upon close,

The parties engaged in nine months of virtual talks that started during the first U.S. outbreak of the coronavirus in March and extended to the Dec. 2

Just six weeks after the announcement, the rate had “more to do with just the timing and where we are in the overall process than anything else,” Arnold told analysts last month. “There's still time left to have that ongoing dialogue and make sure that all advisors can make an informed choice around where that best option is for them.”

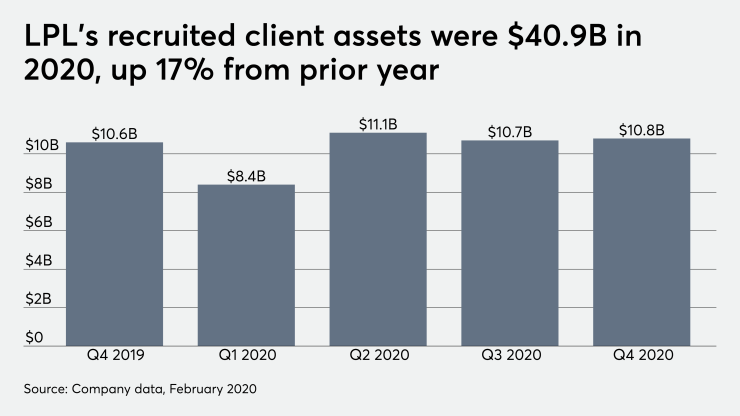

LPL’s modeling assumption had a forecast of only 70% retention of client assets, and the largest independent broker-dealer expects to

Madison, Wisconsin-based Tranquil Lakes Investment Advisors was “at an inflection point” after the deal last year, lead advisor Jason Hatch said in a statement. “We looked at the marketplace and found a firm that had a solid reputation and was a good fit for our business and most importantly, our clients.”

The recruiting pitches aimed at advisors nationwide are playing out as the hometown of one of the country’s oldest mutual fund firms adjusts to Waddell & Reed’s changing plans under the incoming owners. The downtown move drew $62 million in state tax incentives from Missouri and $35 million in local abatements from Kansas City’s government, the Star

Now that the firm won’t be moving downtown, it’s unclear what will happen to its corporate office after Macquarie and LPL complete the deal, according to Beth Johnson, the senior vice president of economic development for the Overland Park Chamber of Commerce. Like any major employer, Waddell & Reed is “extremely important to the local economy,” Johnson says.

“The worst thing is if they would leave the metro completely, which means that those jobs could be relocated,” she says.