Welcome to Retirement Scan, our daily roundup of retirement news your clients may be talking about.

Financial support for cash-strapped relatives are among the hidden expenses that many seniors fail to include when preparing for retirement, writes a columnist in The Wall Street Journal. Required minimum distributions can also result in unforeseen costs for retirees who reach the age of 70, the expert adds. "Required minimum distributions can, first, push you into a higher tax bracket and, second, translate into increased Medicare Part B premiums — which are tied to annual income."

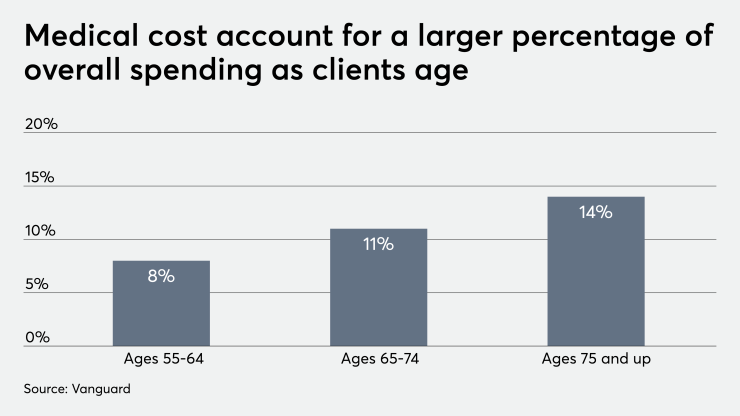

Market volatility is one of the major risk factors that clients are advised to account for when planning and saving for retirement, says an expert in this Morningstar article. To mitigate this risk, retirement investors should ensure they have the proper asset allocation, diversify their portfolio and develop a dynamic spending strategy that will allow them to curb spending during volatile markets, she says. Clients should also consider the appropriate insurance coverage to account for the rising cost of health care..

A backdoor Roth can help clients save more in their Roth IRAs if they cannot increase direct contributions because of income limits, according to this article in TheStreet. This strategy allows them to make after-tax contributions to their traditional IRAs and covert the funds into a Roth account. A portion of the converted amount may still be taxed, depending on the pre-tax and post-tax contributions in their traditional IRAs.

Those leaving the workforce before 65 need more cost-effective places to live.

Clients are advised to consider adjusting their investment portfolio to ensure that they stick to their target asset allocations, according to this CNBC article. Those who are close to retirement should also consider rebalancing their portfolio. “There is certainly a reasonable case to be made that they should take some of their equity risk off the table … to make sure that the downside doesn’t disrupt their retirement plan significantly,” says an expert.