Q: I recently saw where a rep won a $2 million award against his broker-dealer employer for defamation on his U5. When I left my previous employer they put some “alternative facts” on my U5 that made it hard for me to find another job. Some of the other reps also called my clients and said some pretty horrible things about me. Thankfully, I found a firm that was willing to take a chance on me but I was out of work for a long time and lost a lot of clients. Can I sue for defamation?

A: First, let’s consider what defamation entails. In a nutshell, it’s a broad category description that covers both liable and slander. And to remember the difference between the two, note that “slander is spoken.” In both cases, however, you have to prove that someone made a statement that: (1) was published, (2) was false, (3) caused you damages, and (4) was not privileged.

The offending statement can be written or spoken. And bear in mind, being published simply means that a third-party heard or read the statement. In other words, someone other than you or the person who made the statement. It doesn't necessarily mean that the statement was printed in a magazine or online, it just needs to have been made public. To paraphrase an old adage, if a tree falls in the woods and there’s no one around to hear it, it’s not defamation. However, including the statement on a rep’s U5 does count as publishing since the U5 is a public document whether in hard copy or online form.

If you already had a lousy reputation, your damages are likely to be pretty low.

Next, keep in mind that the truth is an absolute defense against defamation. There are no “alternative facts," as you say, in the law. There is truth, lies and opinion. If I write in my column that I think a certain movie was the worst thing to come out of Hollywood all year, I may not get invited to any award shows, but I can’t be sued for defamation. Likewise I could state on national TV that someone is a thief and as long as I can show the criminal conviction from a court they would have no case against me. In order to sue for defamation, you must be able to demonstrate objectively that the statement is false.

Also, the statement must have caused you to incur damages. If you didn’t lose work and didn’t have your reputation damaged, then there’s no point in suing in the first place. Toward that end, keep in mind that if you already had a lousy reputation, your damages are likely to be pretty low.

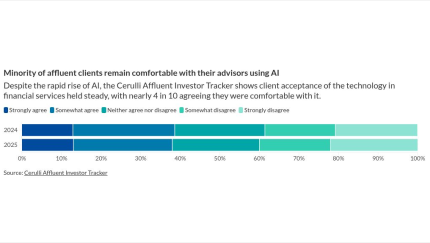

A new report from Cerulli Associates shows older, affluent investors are far more skeptical of AI use than their younger counterparts. Financial advisors who use AI tools in their practices say transparency is key to setting wary clients at ease.

Keep your general knowledge skills sharp while earning an hour of CE credit toward maintaining industry certification by taking Financial Planning's latest continuing education quiz.

As a subscriber to Financial-Planning.com, you can earn up to 12 hours of CE credit from the CFP Board and the Investments & Wealth Institute.

Finally, a statement cannot be considered privileged. Under some circumstances, you can’t sue someone for defamation even if the statement is false. For example, statements contained in a court pleading such as a complaint are privileged. Someone could sue you for theft and, even though they may lose the case, you couldn’t sue them for defamation for calling you a thief in the complaint.

With that understanding, the difficulty in suing your former employer in these circumstances is twofold. First, most brokerage firms are very careful in how they word the U5 information. A statement such as “Rep was terminated for failure to comply with internal policies” is so broad that it’s almost impossible to point to a specific false statement. Likewise, if a regulator was investigating a rep for something, a firm can say so, and claim they were simply reporting the truth. Additionally, firms have significant risk of liability with FINRA if they are not truthful and accurate with their disclosures on U5s and, in order to encourage firms to be open and honest and not “negotiate” a clean U5, they have been given a “qualified privilege” as to what they write on the termination form making it even harder to win a defamation suit.

That’s why awards like the one you saw are so rare.