Is your client looking for a special type of mutual fund that specializes in producing retirement income? Such funds can be beneficial, but they can also provide a mixed bag for income-seeking clients.

Here we will analyze six different funds that could be options for your retirement-income seeking clients: two from Fidelity, three from Schwab and one from Vanguard. In addition, we’ll consider how three traditional indexes fared when put to use as a retirement income vehicle: 90-day T-bills (aka cash), a traditional 60% stock/40% bond portfolio and the S&P 500.

As shown in “Retirement lineup,” the six retirement income funds are highlighted in green, starting with Fidelity Managed Retirement Income (FIRMX), followed by Schwab Monthly Income Maximum Payout (SWLRX), Schwab Monthly Income Enhanced Payout (SWKRX), Fidelity Simplicity RMD 2020 (FIRWX), Vanguard Managed Payout Investor (VPGDX) and Schwab Monthly Income Moderate Payout (SWJRX). There are other funds in this category, but these six provide a reasonable sample of what’s available.

The common performance history among these funds dates back to June 2008. Thus, the analysis of these funds spans the 11 years from June 1, 2008, through May 31, 2019. As can be seen, the only retirement income fund in this analysis that has amassed a meaningful amount of assets is Vanguard Managed Payout Investor (with $1.7 billion). Based on asset accumulation, the demonstrated interest in retirement payout funds is tepid at best.

The three comparison indexes consist of 90-day Treasury Bills, a 60/40 portfolio consisting of 60% S&P 500 and 40% Barclays Aggregate Bond Index and the S&P 500. The listing of the six funds and three indexes in “Retirement Lineup” is based on allocation to U.S. equity — from low to high.

The six retirement income funds in this analysis had equity allocations ranging from about 18% to 63% (combining U.S. equity and non-U.S. equity). The comparison funds ranged from 0% equity allocation to essentially 100% equity. As you will see, equity allocation is a primary driver of how the various funds fared in the performance analysis.

The six funds and three indexes were subjected to an 11-year withdrawal stress test in which each was assigned a starting balance of $250,000 on June 1, 2008. For the next 11 years, each fund had 0.333% of its balance withdrawn at the end of every month. A monthly withdrawal rate equates to an annual withdrawal rate of 4%. Admittedly, this particular analysis period provided a severe test, because it started in mid-2008, at the height of the global financial crisis.

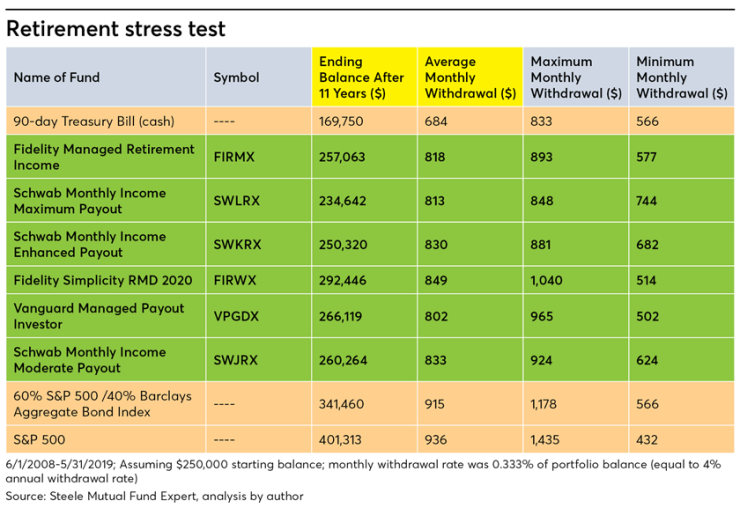

Shown in “Retirement stress test” are the results of the analysis. The average ending balance among the six retirement income funds ranged from $234,642 (SWLRX) to $292,446 (FIRWX). The important takeaway is that all but one of the retirement income funds finished this challenging period with a balance exceeding $250,000. That’s impressive.

By comparison, 90-day T-bills had an ending balance of $169,750. In short, an all-cash retirement portfolio simply won’t get the job done for most retirees. On the other end of the spectrum, the 60/40 portfolio finished with $341,460, and the S&P 500 finished with $401,313. Thus, if judging the six retirement income funds on the basis of ending portfolio balance at the conclusion of the test period, they were dominated by the 60/40 portfolio and the 100% S&P 500. All the retirement income funds performed considerably better than having the $250,000 entirely in cash.

The average monthly withdrawal for the six retirement income funds ranged from $802 to $849. The highest average of $849 was achieved by FIRWX, whereas the lowest average of $802 was experienced by VPGDX.

Perhaps a more important consideration is the range between maximum and minimum monthly withdrawal. Consistency of monthly withdrawal is undoubtedly what many retirees seek. The clear consistency winner was SWLRX. While its average monthly payout of $813 ranked it 5th out of the six funds, the range of monthly payout was $848 to $744, which is very narrow. Both FIRMX and SWLRX had equity allocations of roughly 17%, yet SWLRX had a considerably smaller range in the monthly withdrawal amount. Interestingly, the high to low range of monthly withdrawals for SWLRX was even more narrow than cash.

By comparison, FIRWX had the highest average monthly payout, but the retiree experienced a range of monthly withdrawals from $514 to $1,040. The $1,040 is not problematic, but $514 likely would have been.

What’s the best way to structure a portfolio that needs to produce retirement income? It may be the bucket approach.

The 60/40 portfolio and the S&P 500 produced higher average monthly withdrawals, but at the cost of a large range from maximum to minimum. The S&P 500, for example, averaged a $936 monthly withdrawal. However, the highest monthly withdrawal was $1,435 and the lowest was $432. That type of max-to-min range simply may not be acceptable to a retiree client who is looking for income consistency.

So, what’s the best way to structure a portfolio that needs to produce retirement income? Of course, there is no absolute answer to that question. There are surely a number of wise approaches. One logical course of action is to build a blended retirement portfolio that has a number of different components. One component could be cash, often in the form of a money market fund, or simply a savings account. An allocation of 20% to cash is reasonable. Then, add a retirement income fund to the mix with an allocation of 30% of the total retirement account assets. The remaining 50% could be committed to an all-equity fund, or to a fund that has a majority in equity (such as a 60/40 balanced fund). This approach allows the retiree to withdraw money from the cash fund when the equity-based funds have a decline (such as in 2008). If this looks like the so-called bucket approach, that’s because it is.

There may also be a less visible advantage to utilizing a retirement income fund, which is often a conglomerate of funds within a particular fund family. For example, Vanguard Managed Payout Fund (VPGDX) is made of up 10 Vanguard funds. Of those 10 funds, two have initial investment requirements of $250,000, making them unavailable to typical retirees.

Those two funds are Vanguard Market Neutral (VMNFX) and Vanguard Alternative Strategies (VASFX). Another fund that is embedded into VPGDX is the Vanguard Commodity Strategy Fund (VCMDX), which has a minimum of $50,000 — also a tough hurdle for many retirees. Thus, the pre-packaged retirement income fund gives access — in some cases — to funds that would otherwise be unavailable to a typical retiree client.

In summary, it’s clear from this analysis that retirement income funds offer no magic bullet for clients. However, they likely deserve a place in a client’s overall retirement income portfolio.