Good technology is a must-have in any successful financial advisor’s practice. With so many options available, however, deciding what new tools to use can be overwhelming.

If you are too far ahead of the game, you may waste a lot of time, energy and money investing in products that don’t pan out. Likewise, if you are a laggard, you may pay dearly in lost productivity and client satisfaction. How can you adopt technology sensibly for your practice without driving yourself crazy?

First, find out where you fall on the scale of “innovator” vs. “laggard.”

Most of us can place ourselves into one of five categories. (I’ve adapted the following framework from

“Innovators” try all the latest offerings and actively seek out new opportunities. “Early adopters” are a little slower to adopt but know they will have a leading position in applying the technology in their day-to-day work if the tool is successful. The “early majority” jump on board after seeing evidence it works for others. These three categories make up about 50% of the technology adoption status.

The bottom half consists of the “late majority” — those who belatedly adopt technology, kicking and screaming the whole time — and the “laggards” — those who may never implement certain technology.

I consider myself somewhere between an early adopter and the early majority. My mindset comes from my experience in practicing medicine. One of my professors said, “Never prescribe a newly-released drug for at least six months. Let all the other doctors kill their patients first.” This really came to pass as I saw multiple drugs go on, then off the market when wider use showed their true limitations and side effects.

How does this experience relate to software? In the 15 years of my financial planning practice, I’ve seen many software packages come and go. Very few live up to their promises. The ones that do usually are snapped up by a larger entity that eventually ruins a beautiful product. I’ve been an early adopter and subsequently been totally burned.

Other times, I bought perfectly good software only to be left scrambling when those packages were purchased and killed by bigger competitors. Because of these snafus, I’ve developed a strong filter for buying software. Is the output valuable for us or our clients? If not, we probably don’t need it.

So, what is valuable from a technology perspective?

In a nutshell, must-have software makes us more efficient and/or augments education that provides our clients with financial peace of mind.

My list of “I can’t live without” tools includes relationship management software, electronic document storage, financial planning software, remote meeting applications, accounting and tax planning software. And with me

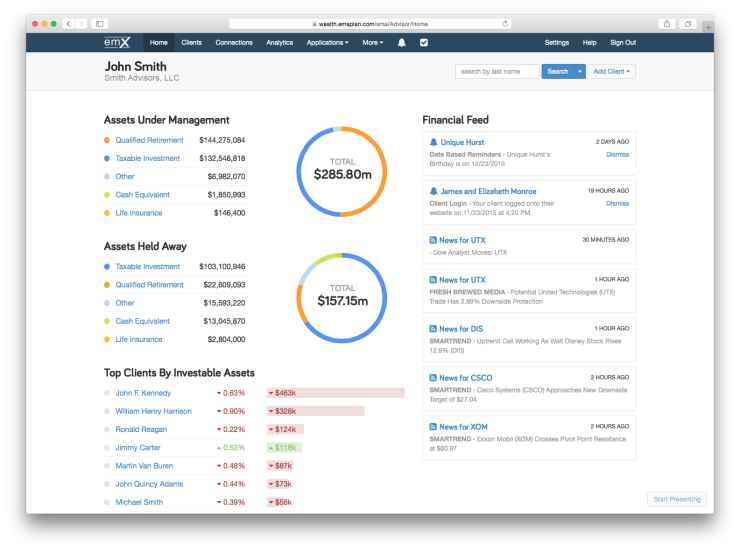

What are tools that help us provide client education? The portal in eMoney is valuable to show clients how they spend money. However, that portal is also the bane of our existence since we spend too much time and money keeping the account connections fresh. This drives us and the clients crazy, but the majority of clients see the utility in keeping it up to date.

We help our clients plan for aging and put processes in place to prevent fraud and abuse of our elderly clients.

Eventually, I teamed up with a group to create my own software application that helps clients plan for transitions in financial care, changes in living situations, decisions about when to quit driving and when to get help with health care decisions. This tool, Whealthcare Planning, has streamlined the planning for an area of life that is generally ignored.

Investment education tools are nice to have and only partly necessary for us. We use passive equities, bond funds and individual bonds for clients with large fixed-income positions, and we only accept clients who agree with our investment philosophy. We don’t pay for any software on the equity side as the fund families we use provide a plethora of educational materials, plus there is a ton of publicly-available information.

Our use of individual bonds creates a higher educational requirement. Most clients do not understand the nuts and bolts of bond ladders and are often perplexed by bond price fluctuations. Our investment manager uses bond analysis software to show clients the behavior and characteristics of their bond portfolio.

What is not valuable to us?

You might notice one big piece of software I have not mentioned — portfolio reporting. When I started our firm in 2004, we did portfolio reporting because it is what everyone does. Since I started out with zero dollars to manage, I chose a very inexpensive but adequate solution at the time, and it worked well for close to a decade. Unfortunately, that software was purchased by a behemoth and slowly strangled to death.

We then decided to go with an upstart that promised great service, and the person who headed it up had a good reputation. They did not deliver, and that was a waste of a year.

Throughout that process, we thought, “Why are we doing portfolio reporting?” We tell clients the past does not predict the future and that short-term numbers do not matter, yet every quarter we send them this report that means nothing to their future financial peace. What clients need is regular information on how much they spend and save and how much they need to accumulate to reach their goals. Of course, a rate of return must be assumed to make those projections, but looking backward doesn’t provide useful information.

Two years ago, we had a small number of client dinners to discuss our conundrum and to get their input. The feedback was pleasantly surprising, and we decided to quit portfolio reporting. Considering that we had graduated to very expensive reporting software that was driving us nuts, it was a relief to break the chains.

We sent out notices on the cessation of reporting and just recently officially stopped providing reports. A number of clients emailed us and said, “Yay!!” Only a couple clients had concerns, and we made the transition knowing full well that we may lose those clients, and that is okay. So far, they haven’t left.

Software can make for a love-hate relationship. By using the filters of efficiency and education, you can winnow down the tools you need and make better choices, plus hopefully stay sane in the process. Our clients want the human touch, and by the judicious use of good software, we can spend more time making that happen.