Broker Protocol exits got you worried? Don't panic, and don't feel trapped.

Instead, take a cue from the Boy Scouts: Be prepared. Simply put, if you invest the time and effort now and, on an ongoing basis, in some simple readiness strategies, you can insulate yourself from the effects of protocol fallout. You can ensure you’ll be the one calling the shots when and if the time for a move comes.

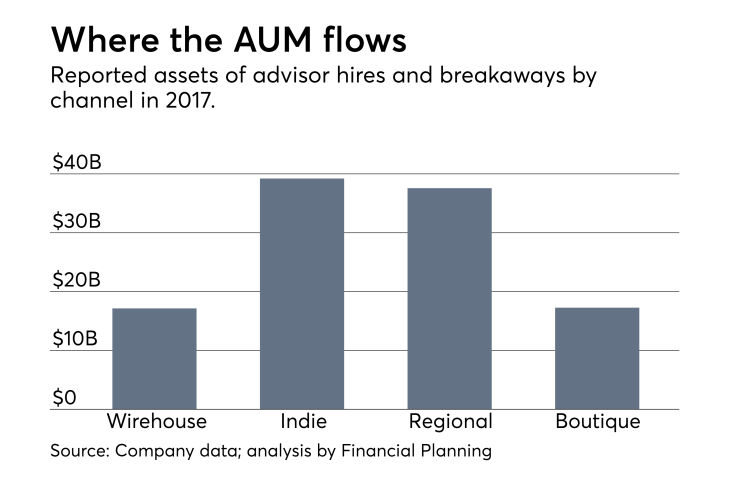

While Raymond James and Stifel are on hiring sprees, Wells Fargo is still losing talent.

Here's how:

• Take an afternoon for client recon. You likely know your most important clients from memory. Take the list of your MVPs and see which ones have information that's publicly accessible, such as via the internet. This will put your mind at ease as to those you'll be able to easily reach post-protocol and also highlight those you may have a harder time getting in touch with. This way, you'll be aware of where your vulnerabilities lie.

• Raise your profile. Most advisors maintain a profile on LinkedIn, Facebook and/or other social media platforms. But if you’re not active online, now is the time. Make sure you are clear with regard to your firm's policies on the use of social media and optimize your use of these media within those policies. For example, publishing compelling content on a regular basis is a great way to ensure that your clients will want to follow you and that they'll be tuned in if you make a move. And remember, follows beget follows.

• Double down on client communications. Look for all the useful ways you can find to make sure that your name is in your clients' hands — provide them with their documentation on a regular basis, publish a newsletter either in print or via email, or send birthday and holiday cards. Staying in touch (within your firm's rules, naturally) is not only good business, it's a great way to mitigate the potential effects of a future move.

• Keep up with your own documentation. Make sure you always have a printout of your current production run so that, should the need arise, you can demonstrate your earning potential and the extent of your book without violating any recruiting agreements.

• Know your employment contract. That's right, figure out which file you shoved it in or where it's archived on your computer and read it over, closely, especially the section on nonsolicitation. Industry provisions generally provide for a one-year period of nonsolicitation. But, if for some reason you cannot locate your contract, do not ask your firm for a copy — this will signal you're looking, whether you mean to or not.

The dissolution of the protocol does a disservice to the industry. Advisors do not want to, and should not have to, fight over clients for whom they have worked for years — sometimes decades — and, in many cases, with whom they are close friends. Firms, meanwhile, are artificially cautious about recruiting given the decline of the protocol. We all know that uncertainty does little to benefit anything in the financial industry.

Perhaps more critically, it is the investing public who really suffers the most from this instability. Most investors have little insight into the machinations of regulations like the broker protocol when it is in effect, much less when it lapses. Thus, they are caught totally unaware when their trusted advisor moves and they are suddenly in receipt of a flurry of phone calls from a stranger at their advisor's former firm.

In the wake of the financial crisis, the client-advisor relationship is much more valuable than what a client has with any given firm. The investing public should have the choice to work with those they trust when it comes to managing their money. Our hardworking friends and neighbors should not be limited by the false constraints of big banking.

All told, in the face of Broker Protocol instability, taking the time to be prepared for a future move today is just smart business. It’s smart for you. And, it’s smart for your clients.