It’s the moment every advisor fears: getting a call from a regulator investigating your firm.

While it may be chilling, don’t assume defeat or begin mourning the loss of your livelihood. Whatever you do, don’t assume that your behavior from this point on will have no bearing on your disposition — it does.

The good news is that there are concrete steps to take to minimize the severity of any punishment meted out by FINRA, the SEC or state securities administrators. As you may have noticed regulators don’t have a standard protocol for informing advisors of a formal investigation. Frankly, regulators are not obligated to disclose the nature or subject of their investigation and may simply request a sweep of information on a particular matter. In that case, it may even be your compliance department that initially breaks the news.

However you learn of the probe, the first step is to lawyer up. It won’t suffice to contact your childhood friend who is a successful real estate attorney or a well-known litigator who has reaped millions by taking down large corporations. You need a skilled securities attorney who has represented advisors before regulatory bodies.

Procedures to investigate securities violations and enforce securities laws are dramatically different from those governing traditional civil and criminal courts. For example, FINRA relies heavily on an arbitration panel, with specific procedures and practices, whose decisions cannot be repealed. Litigators need specialized knowledge to navigate the labyrinth of rules and regulations that apply to the securities world as you attempt to avert a fine, license suspension or industry ban.

The truth is regulators could be gathering evidence of a serious infraction or just be on a fishing expedition. They could be reviewing a recent incident or a potential violation from years ago at a prior firm. Once you hire an attorney to speak on your behalf, try to determine the nature of the allegation and the exact scope of the inquiry to the extent you can.

Secondly, don’t lie. In the same way politicians embroiled in scandal have been destroyed by an attempt to cover up an indiscretion, advisors can (and do) face consequences far worse for trying to conceal a misdeed. It’s true that the cover-up is often worse than the crime. It’s also a problem for attorneys, who lose considerable leverage to negotiate a deal on your behalf if they are ambushed by a lie, particularly if it surfaces during the course of a hearing.

What’s more, regulators can broaden the scope of their investigation to include actions taken to cover up the original offence. That means stiffer penalties. A slap on the wrist for a minor infraction, such as a letter of caution for violating a firm policy, could become a suspension and a fine, and send up a red flag by your name for authorities to closely monitor your behavior. If you’re fired as a result of the enhanced penalties, it may be difficult to find a firm willing to hire you again.

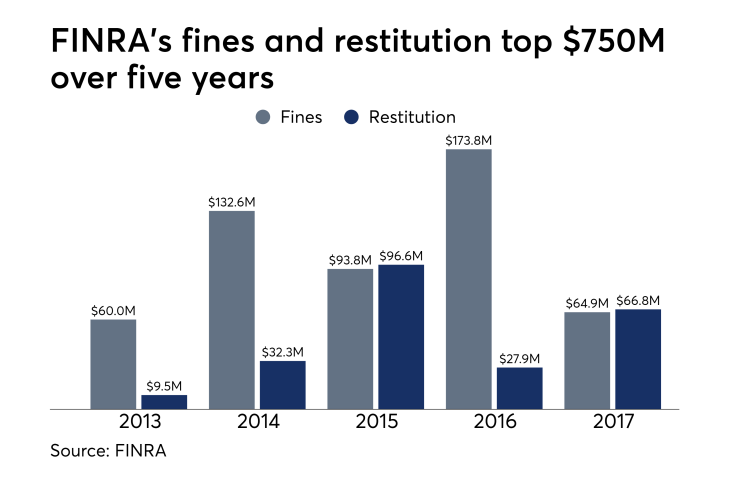

Advisors should expect more regulatory requirements, enforcement actions and uncertainty in 2018, experts say.

Bear in mind that when you initially learn of the probe — either from your compliance team or from a regulator — that is only when you became aware of the investigation. Regulators could have been looking into your conduct many months prior to that moment, gathering evidence that may be far more extensive than you realize. Investigators build cases by interviewing witnesses, and by examining brokerage records, trading data, customer complaints, anonymous tips and automated surveillance reports.

Your lie may be more transparent than you think.

In addition to telling the truth, it is paramount to do so humbly. There remains a perplexing number of advisors who are prone to spewing venom at regulators fueled by arrogance and sanctimony. Regulators will not be impressed by your proclamations. They’ve heard it all before. No matter how aggrieved you feel, resist the urge to make them the enemy.

-

Robert Cook detailed his multi-year overhaul aimed at easing compliance, revisiting old rules and rooting out bad actors.

May 17 -

Expenses are rising, but revenue is flat as the regulator holds off on raising member fees.

January 18 -

It's a bigger challenge to keep pace with a fast changing industry, CEO Robert Cook said.

October 13

For advisors accused of serious violations, disciplinary actions may spell the end of their careers, particularly for repeat offenders. But for others, following these rules can potentially reduce the severity of the punishment and allow them to focus on serving clients again. These advisors can still thrive professionally.

There is a big difference, after all, between an advisor who stole customer funds and one who declared bankruptcy due to medical debt. A single indiscretion can be just that — one mistake that doesn’t have to overshadow an exemplary career.