The recruiting game has shifted.

The deal, although still strong, isn't as robust as it has been in previous years. The fiduciary rule and it's uncertain fate have played a role here, scrambling the recruiting landscape for advisers and firms.To some, it doesn’t necessarily feel like the right time to make a move. But there are still things you can do to position yourself to take advantage of the right opportunity, should it come along.

THE LONG GAME

In all my years of recruiting, I’ve seen few people sit down with a manager, say they wanted to move, gotten a deal, and left promptly. During the financial crisis this did happen with more regularity and I even had a team that jumped ship in about 10 days, a colossal effort.

The advisers oversaw nearly $900 million in combined AUM, and moved to Morgan Stanley, Raymond James and HighTower.

Today, there is very much a “wait and see” attitude. This means it’s a low-pressure environment to get out and have a dialogue. The best move might be to stay where you are depending on your level of production and asset base. However, any recruiter or manager worth their salt will tell you, establishing high quality relationships always pays off either by getting you into a better situation, realizing what you have to offer, or the knowledge of a safety net should you find you need one. It’s just smart business to evaluate if your business might be improved elsewhere or if you’re at the optimum place.

THE NEW NORMAL

Even with the fiduciary rule in limbo, one things is certain: deals have changed.

It’s no use pining for what once was or hope for what could be. The P&L’s of firms have been hit hard by robust recruiting deals over the past several years and it’s no surprise to anyone that there’s been a shift. Many of us have been anticipating this change for years, and now it’s finally here. I’ve always believed that a deal needs to be the icing on the cake to what’s being offered at a particular firm. If you’re only moving for the biggest deal possible, then it’s probably best to stay where you are because you’re not going to be happy at your new firm.

Interestingly, some firms that have been landing big recruits don’t have the biggest deals. What they offer is an attractive culture, like Raymond James and Stifel . Culture, in addition to being able to do your business at a firm, is a very good reason to move and one that clients understand and relate to. If you are approaching the twilight of your career and aren’t happy where you are, why not move to an environment that makes you happy and will probably make your clients happy too. Capabilities are important, but culture is what is going to get someone to see that you are not just changing the name on the door. If you’re at a firm that values only the highest level producers and you’re not one of them, it’s time to look at your options.

REPUTATION

Reputation is more important than ever because with a high-level of competition it will be the one thing that sets you apart. Have you developed a niche strategy of client service or acquisition? Have you delved into what social media strategy is allowed by your firm’s compliance? Have you taken a deep dive either with your manager or an outside consultant to determine if your business is growing appropriately?

If you’ve answered in the negative, then it might be time for a closer look. Changing environments demand that people change too. Use as an opportunity to audit your practice. A trusted client or colleague also may be able to provide some perspective.

Additionally, with an aging adviser population, there will be more assets up for grabs. Think about how you’ve developed your reputation to capitalize on this. Is an acquisition or partnership something that makes sense for your business? If so, have you worked to develop these types of options and relationships? Alternatively, have you started developing a junior partner or contingency plan if retirement is on your horizon? You’re missing an opportunity of you haven’t considered this type of opportunity at your own firm or somewhere else.

WORKING WITH RECRUITERS

Naturally, I need to mention that if you’re going to take a look at other firms, the best way to work with recruiters is to find one that understands your business and what might be attractive to you in another firm or opportunity. Once I had someone tell me that they would only move for a producing branch manager position in a very off-the-beat location. A year after she told me this the opportunity popped up. Even though the timing wasn’t ideal, the opportunity was one she couldn’t ignore. She’s gone on to have a very successful and prosperous career at the new firm.

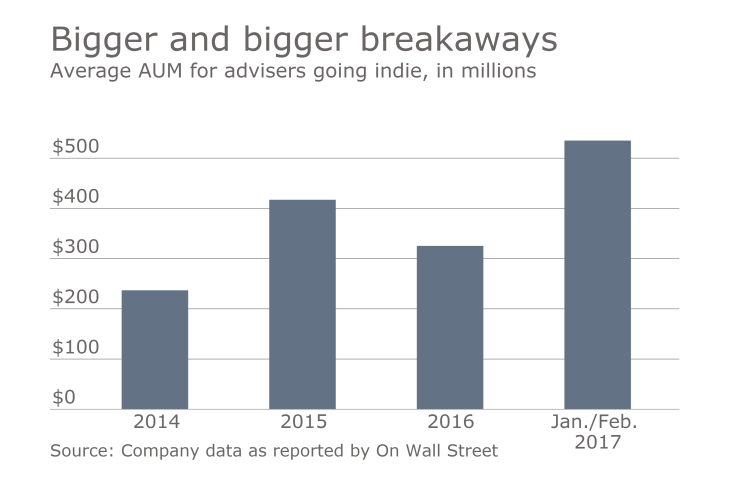

If you can stop for a moment and envision how you want your business to look in the future and articulate that, then a recruiter has a better chance of finding that option for you. There’s also nothing wrong with looking into paths you may not have previously considered, such as independence.

Although your inclination might be to stay put in the current environment, the best advisers are looking forward and strategizing, developing their brand and continuing to develop relationships that might serve them in the future. A proactive approach always puts one in a stronger position even if the use isn’t immediate.

This story is part of a 30-30 series on strategies to boost your practice.