-

The unit could fetch more than $3 billion, according to people familiar with the matter.

December 15 -

Even with those challenges, rep productivity and client cash balances expanded in the third quarter.

October 30 -

Ameriprise, for example, has hosted more six times as many advisors virtually than it did in person last year.

September 16 -

The father-son practice with two other advisors switched their affiliations after its founder had spent 18 years with New York Life.

August 18 -

Earlier this year, FINRA arbitrators granted the former advisor’s expungement request, but still sided with the firm on its demands for repayment of two promissory notes.

July 14 -

The father-son team praised Ameriprise’s assistance in the face of the coronavirus pandemic after making the move.

April 14 -

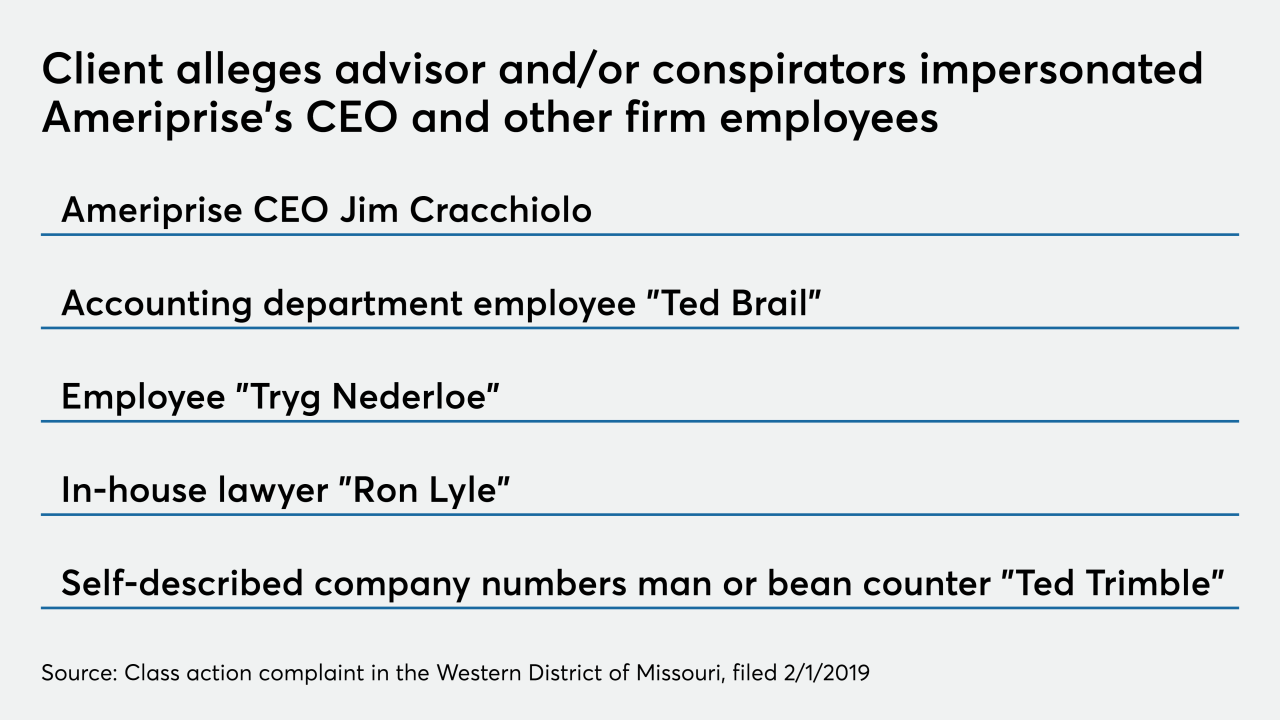

Five years of alleged promises, checks that never arrived, and a mysterious employee named “Tryg Nederloe” add up to a bizarre saga with wide ramifications.

March 2 -

-

Jim Cracchiolo predicts the number of advisors will go back up, but he says the firm places more importance on boosting the size of their businesses.

January 31 -

-

-

-

-

On the losing side of this exchange: Wells Fargo, UBS and Merrill Lynch.

December 3 -

The firm's top recruiter explained its approach to helping advisors keep up with a rapidly changing profession.

December 2 -

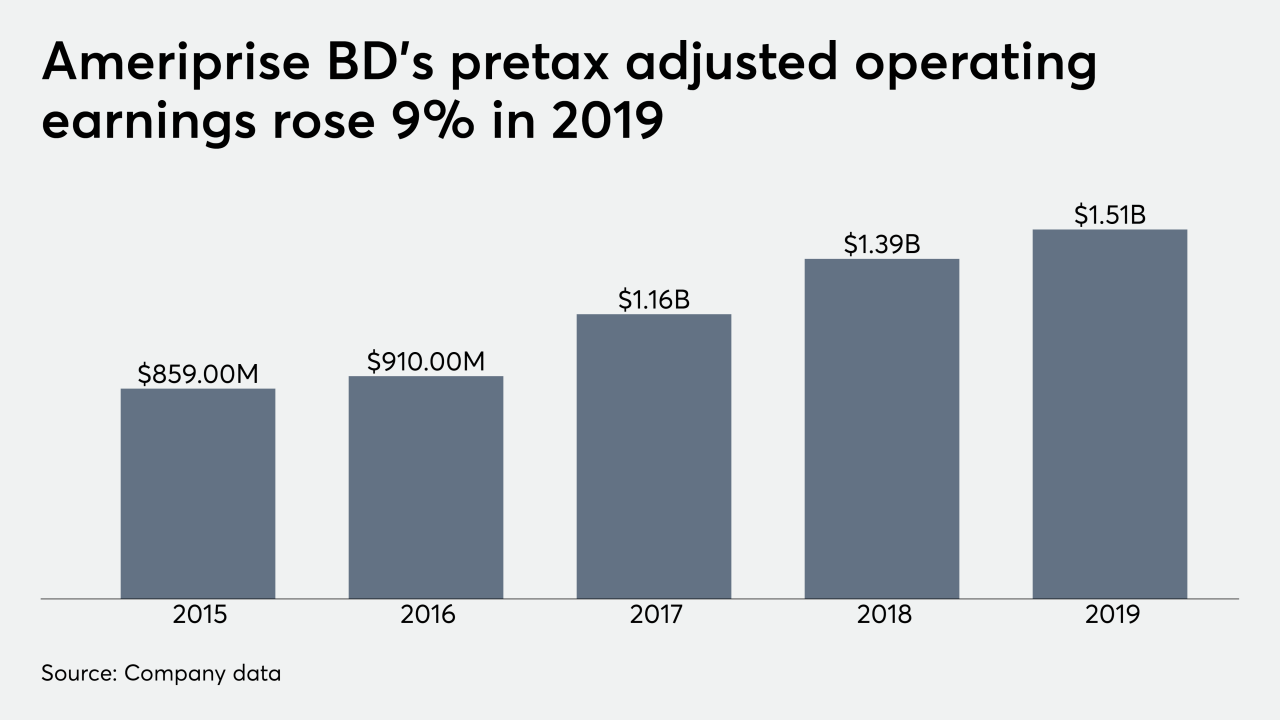

CEO Jim Cracchiolo says the firm is focused on “holistic advice rather than a free trade” after wealth management client assets reached a new high.

October 24 -

New recruits hailed from firms including Wells Fargo, Merrill Lynch and Raymond James.

October 17 -

Buyers and sellers both can benefit from a formula based on the future performance of the business, rather than a metric of current performance.

September 30 -

The breakaways join 72 others who moved their practices to the firm in the second quarter.

September 20 -

The new recruits include a father-and-son duo in Orlando.

September 12