-

The IBD network added a community bank’s investment program after exceeding the goals it set at the beginning of 2020, its head recruiter says.

March 11 -

The rep reeled in at least a dozen victims to the complex scam even though he was suspended from the industry for a different case, according to investigators.

March 9 -

Ascensus sold the practice with four reps and $490 million in client assets after acquiring it two years ago.

March 9 -

The private equity-backed firm’s deal could tack on some 900 advisors to its ranks.

February 8 -

New hires come at a moment of heightened competition for talent industrywide.

February 5 -

Despite the credit-positive reading by one agency, the IBDs are competing against less leveraged rivals.

February 1 -

The founding partners of the 300-advisor OSJ will remain in their current roles for three years under the same structure as before the deal.

January 13 -

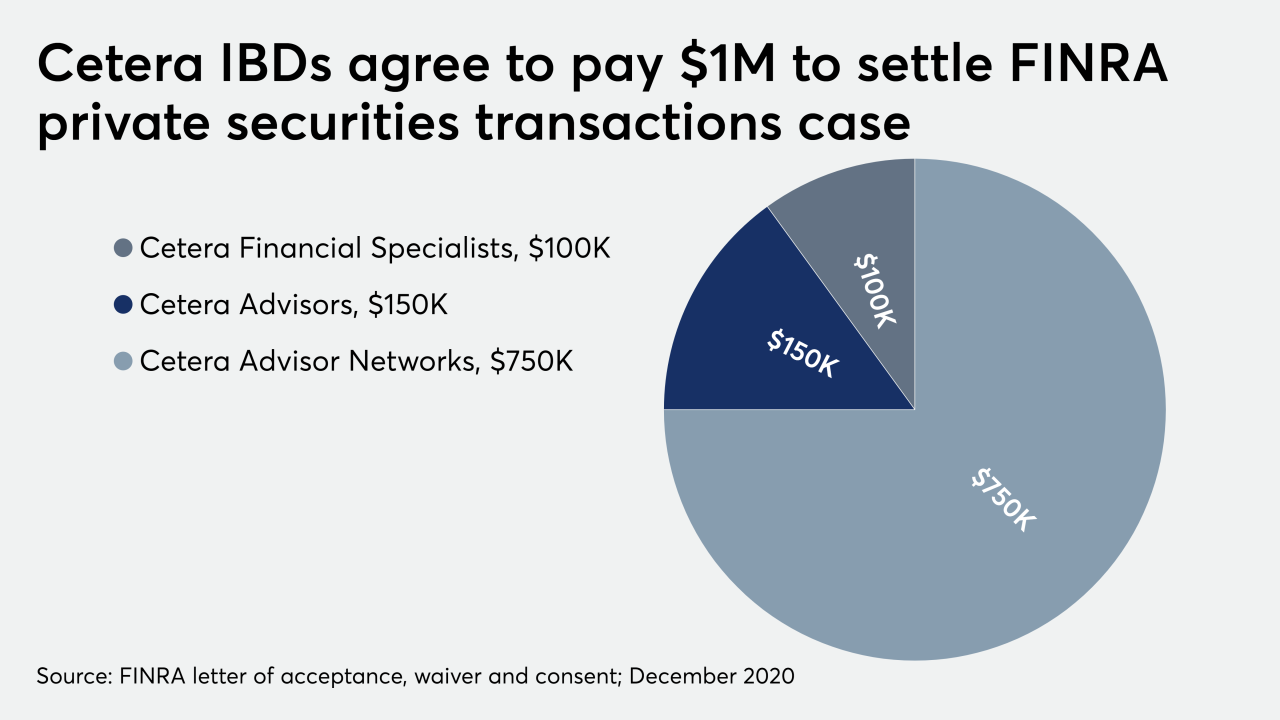

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

In a surprise announcement, Private Advisor Group tapped Moore as CEO nearly two years after he left Cetera for undisclosed medical reasons.

November 18 -

Five firms agreed to pay $3 million to settle an SEC investigation into unsuitable sales of complex exchange-traded products.

November 16