-

The ongoing shift away from commissionable products is driving major changes in the space.

August 17 -

The two LPL rivals show confidence in their current paths, but they both now have important vacancies to fill.

July 10 -

The combined amount across the top 10 firms has jumped 37% to $385.3 million over the past three years.

July 9 -

J.D. Power’s annual survey reveals the importance of leadership and culture, along with differences among male and female representatives.

June 28 -

Author and Commonwealth Financial Chairman Joseph Deitch discusses how to gain a better understanding of yourself and your clients, and how to resolve differences.

June 19 -

Firms of all sizes have helped push fee-based business above commissions as the industry undergoes a transformation.

June 18 -

This interactive tool provides the full collection of data from Financial Planning's 33rd annual study of the largest firms in the space.

June 4 -

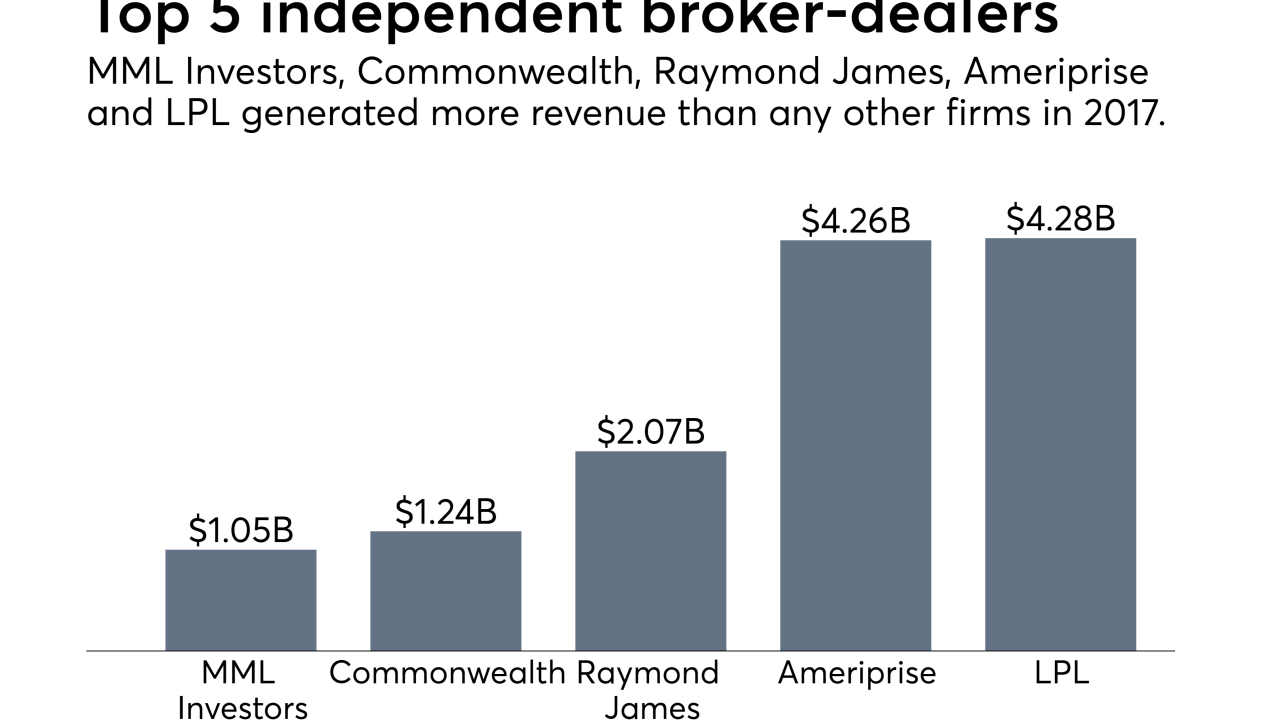

Thirteen of the top 25 companies generated double-digit growth in 2017 as rivals close in on the perennial No. 1 firm.

June 4 -

The No. 4 independent broker-dealer has unveiled two major recruiting grabs from its rivals in two weeks.

May 22 -

Commonwealth Financial Network founder Joe Deitch answers rapid-fire questions on everything from writing his first book, to the person he finds most interesting, in this Lightning Round video.

May 16 -

The firm broke off from its OSJ and followed four others of its type in leaving the No. 1 IBD after a change in its RIA rules.

May 15 -

The $263 million practice’s new IBD reported record recruiting for 2017, helped in part by the movement of advisors following LPL’s massive acquisition.

April 9 -

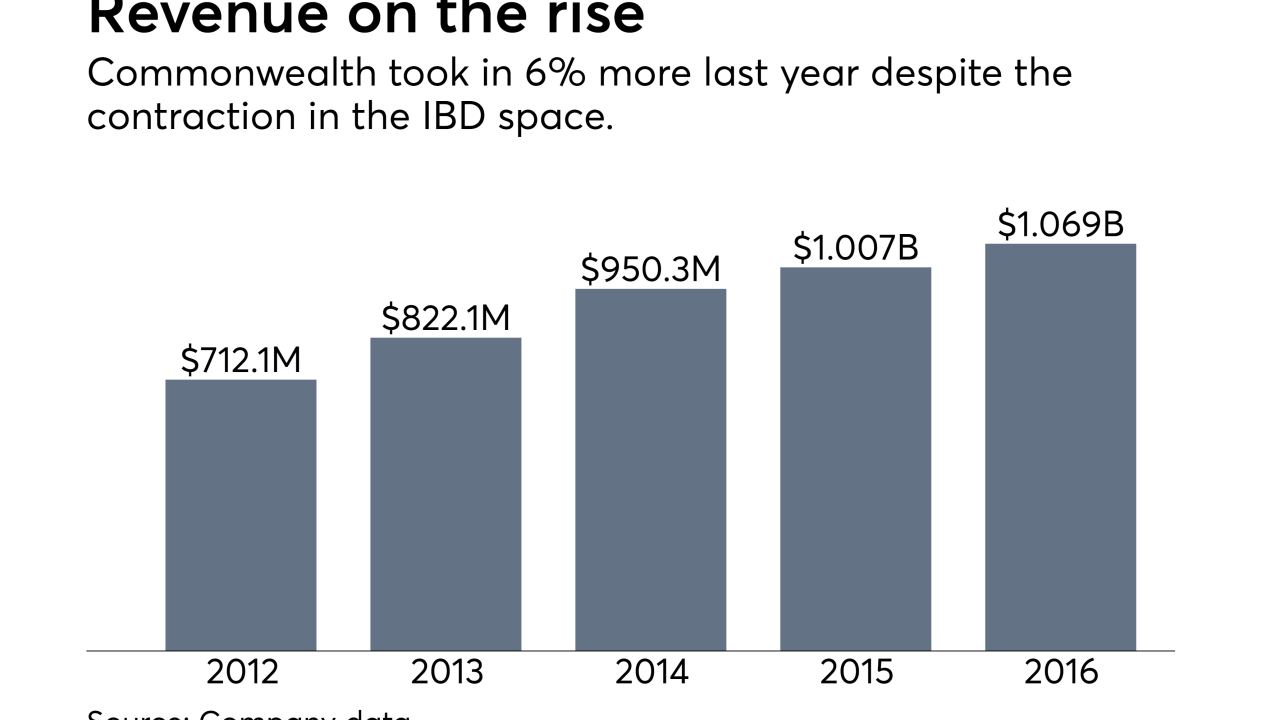

The 1,778-advisor firm constitutes the largest privately held IBD, underscoring the growing appeal of boutique-like models.

March 22 -

Industry leaders see an opportunity to reshape debates that determine wealth management's future.

January 31 -

LPL's acquisition of National Planning Holdings' assets alone resulted in 10 moves of $744 million or more of clients assets.

December 18 -

Exclusive: The No. 4 IBD unveiled a new bank-based team even as its competitor began revealing its retained firms under the acquisition.

December 15 -

In a concession to the advisor, he can still respond to client emails and calls, even though he may not initiate contact.

December 13 -

Both advisors are attracted by Ameriprise’s technology and investment options.

December 4 -

The No. 4 IBD has added 12 advisors with $2.1 billion in client assets since the acquisition.

November 30 -

17 great reads planners recommend to their colleagues and clients.

November 17