Federal Reserve

Federal Reserve

-

The sector has seen an inflow surge in recent months as Treasury yields continue to fall.

March 15 -

The Fed’s pause on interest rate hikes has been a “net positive” for the category, an expert says.

February 20 -

Maryland and New Jersey are among the least-appealing places for employees to spend their post-work years, due in part to affordability, health costs and overall quality of life.

February 12 -

Virginia and Colorado are among the most-appealing locations for retirees to spend their golden years, due in part to top scores in affordability, health-related factors and overall quality of life.

February 11 -

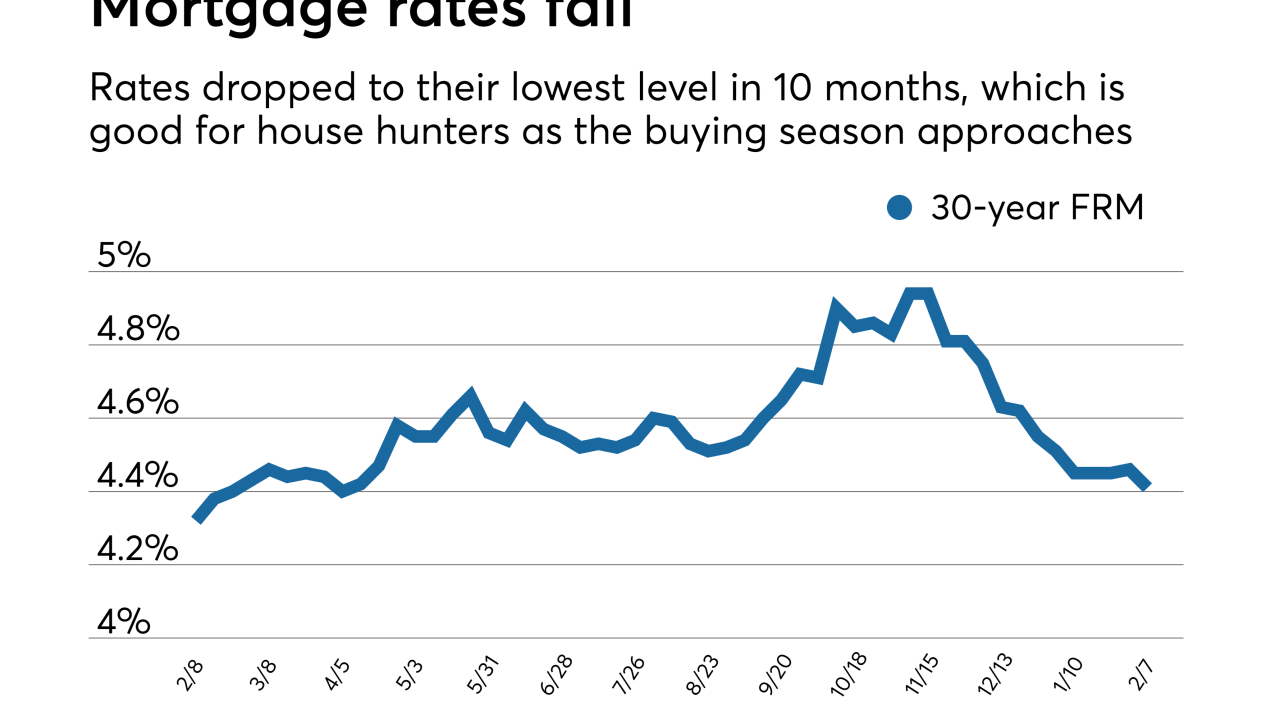

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 8 -

“The board's record of summarily approving mergers raises doubts about whether it will serve as a meaningful check on this consolidation that creates a new too big to fail bank,” Sen. Elizabeth Warren said in a letter to the Fed.

February 8 -

U.S. and European ETFs were stung by redemptions in January even as developed markets added trillions in value.

February 8 -

“The reality is, in Washington, you have this massive amount of unpredictability,” a portfolio manager says.

December 24 -

Incentives to buy the products have eroded amid signs of slowed interest rate hikes from the Fed and the heightened fear of a trade-war.

December 21 -

The fund company has added more than $50 billion this year, mostly from inflows.

December 10 -

Things haven’t been this bad since Richard Nixon’s presidency.

December 6 -

The $7.5 billion fund’s comeback comes as the spread between 3- and 5-year yields slid below zero for the first time since 2007.

December 5 -

In the Treasury market, all eyes remain on the yield curve after three-year yields climbed above those of the five-year bonds.

December 4 -

Fed Chairman Jerome Powell's dovish comments revived global demand for riskier assets.

November 29 -

Clients can save an average of $2,500 off the sales price by striking at the right time.

November 27 -

Some have piled into utilities and long-duration Treasury hedges, while others bulked up exposure to rate-sensitive banks and a chunk did a bit of both.

October 17 -

Investors flocked to ultra-short bond funds as few are willing to bet against persistent rising rates.

October 5 -

The "Rule of 100" follows the rule-of-thumb of growing more conservative as investors grow older, but it also may be obsolete since it was developed when interest rates were higher.

October 3 -

The iShares 20+ Year Treasury Bond ETF took in close to $2 billion in September, putting it on track for its second most monthly inflows ever.

September 27 -

The bond market’s demise has been predicted so many times in recent years that it's hard to keep track. And while returns have been subdued, it's been nothing remotely close to the apocalypse scenario outlined by the bears.

September 18