-

At least seven firms with outside RIAs have left the No. 1 IBD since it announced a change in policies last November.

June 5 -

Independent Financial Partners’ CEO predicts the firm will retain about 80% of its business, despite a daunting series of challenges.

May 17 -

An inside look at which firms are attracting assets and advisors.

May 15 -

It’s an essential task both for advisors launching practices and seasoned veterans breaking away. Here’s how to ensure a good fit — and avoid costly mistakes.

May 7 -

Offering specialized planning is now essential to attract and retain HNW clients.

February 28 -

H. Beck’s incoming president brings experience with her new firm’s earlier ownership structure and its custodian's platforms.

December 20 -

Roughly 300 ex-NPH advisors have chosen smaller IBDs over LPL Financial after its massive acquisition.

December 13 -

Survey shows advisors accept fiduciary mindset but do not see major impact on product choices yet.

December 4 -

A collaboration with Lincoln has yielded 30 platform enhancements for advisors, with more to follow.

December 1 -

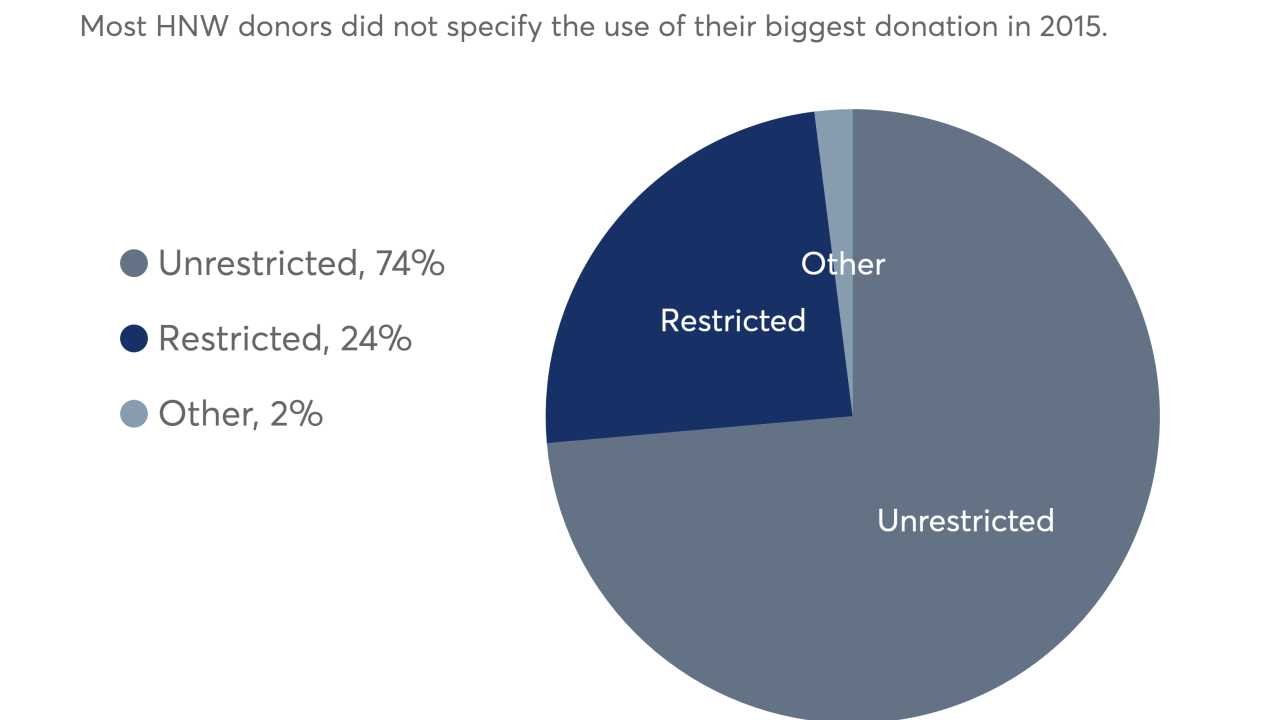

Almost half of wealthy donors don’t have a strategy in place to guide their charitable giving.

November 27 -

The Advisor Group BD has added 140 new advisors this year amid a tough recruiting fight.

November 2 -

Capitol Securities Management says it wanted a partner with more retail brokerage experience.

October 12 -

Bill Morrissey, who is leading the effort, described the firm's rapid, multipronged approach.

September 18 -

The big custodian chose a 35-year company veteran to take over the long-vacant position.

September 5 -

Those recognized for their excellence in innovation and leadership across the asset management industry includes State Street CEO Jay Hooley.

September 1 -

Experts say firms that clear through Pershing have an advantage in the looming recruiting fight.

August 28 -

The new job will focus on middle-office services like hedge funds, software solutions and the firm’s message and connectivity engine.

July 7 -

Assets in products susceptible to the risk of fire sales during a future shock are up 673% since 2000.

June 26 -

The new tool is aimed at lowering costs for investors.

June 26 -

Advisers face fewer choices for clients as both the rule and SEC enforcement roil the market.

June 20