-

Top advisers are using these strategies to create well-balanced portfolios.

August 1 -

Don’t just say you do the right thing, show you do the right thing. Here’s how.

July 29 -

The bank's three advisers and $300M in AUM leave LPL after more than a decade.

July 29 -

Seven recruits made the move to either the firm's employee or independent channels.

July 28 -

These program managers have ranked most consistently among the best of the best.

July 28 -

The recuits joined the wirehouse from Deutsche Bank, which is selling its U.S. Private Client Services unit to Raymond James.

July 26 -

The former wirehouse group, which specializes in retirement plan consulting and planning, worked mostly with institutional clients before making the move.

July 25 -

See which independent broker-dealers have the most high-end reps, plus dive into the average production for the top 10.

July 25 -

The alleged wrongdoers transferred client money to their wives’ accounts, the commission says.

July 22 -

CEO Paul Reilly says the firm has hired new compliance professionals and is also working with outside attorneys in order to prepare for new regulations.

July 21 -

Two wirehouse veterans opened a new office for the regional firm's employee channel.

July 21 -

"We are not going to have a separate robo adviser that would disintermediate our existing advisers," says CEO Paul Reilly.

July 21 -

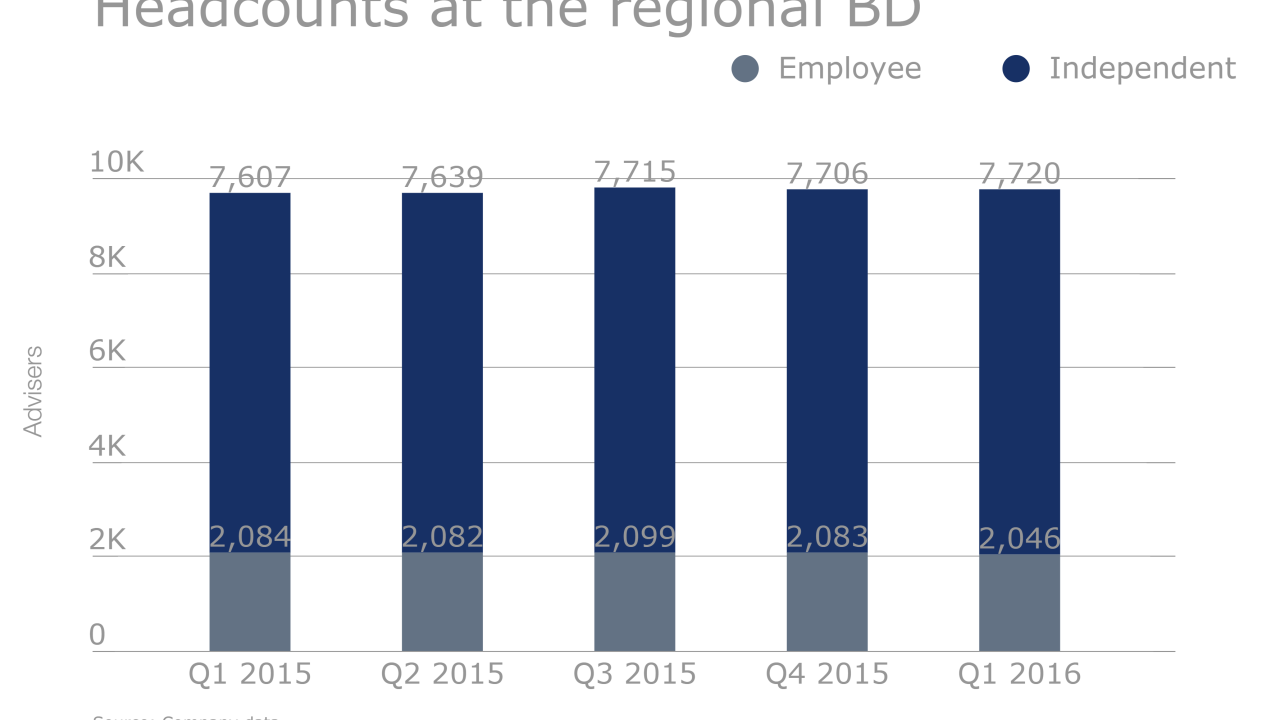

Headcount at the fast-growing firm was up 327 year-over-year.

July 20 -

We reshuffled the deck on our top program managers and ranked them by third-party marketers.

July 20 -

The recruit spent two years researching the move before deciding to leave the wirehouse.

July 20 -

Several of the largest moves this year show top talent is looking beyond traditional choices.

July 20 -

Two advisers joined Confluence Financial Partners, which is affiliated with Raymond James.

July 14 -

The firm's latest hires come from Morgan Stanley and Raymond James.

July 13 -

The two ex-wirehouse advisers each had about 20 years of industry experience.

July 12 -

The largest recruits managed more than $17 billion in client assets.

July 11