-

Most banks and credit unions outsource their investment programs to third-party broker-dealers. Here's how they stack up.

June 28 -

Enforcement actions at the SEC and FINRA highlight emphasis regulators are placing on fees and reverse churning, anti-money laundering programs and variable annuities.

June 23 -

BIC took a fresh look at its top program managers and re-ranked them based solely on team assets under management.

June 21 -

Also, J.P. Morgan saw a team managing $300 million in client assets go independent.

June 20 -

Three industry veterans – one with more than four decades of experience – oversaw more than $205 million in client assets, according to Raymond James.

June 20 -

The adviser, who has more than 30 years of industry experience, left to join Noyes.

June 6 -

The recruit had $1.8 million in annual production before making the move, the regional BD said.

June 2 -

The New Jersey bank moved its investment services program to Raymond James after a 14-year relationship with Essex Securities.

June 1 -

The firm is facing a lawsuit on behalf of investors who lost money in a $350 million Ponzi scheme.

June 1 -

Close scrutiny of data from the nation’s largest IBDs reveals some surprising shifts, with more to come.

June 1 -

The independent broker-dealer industry could lose a third of its brokers and many of its smallest firms, experts predict. What does that mean for survivors?

June 1 -

See which TPM tops the list for both highest production-per-adviser and highest fee income.

June 1 -

The industrywide gain in fee income is a welcome development given the new fiduciary rule--see how firms are preparing for new regulations as well as new competition.

June 1 -

The firm's newest recruit is a veteran broker from Morgan Stanley.

May 31 -

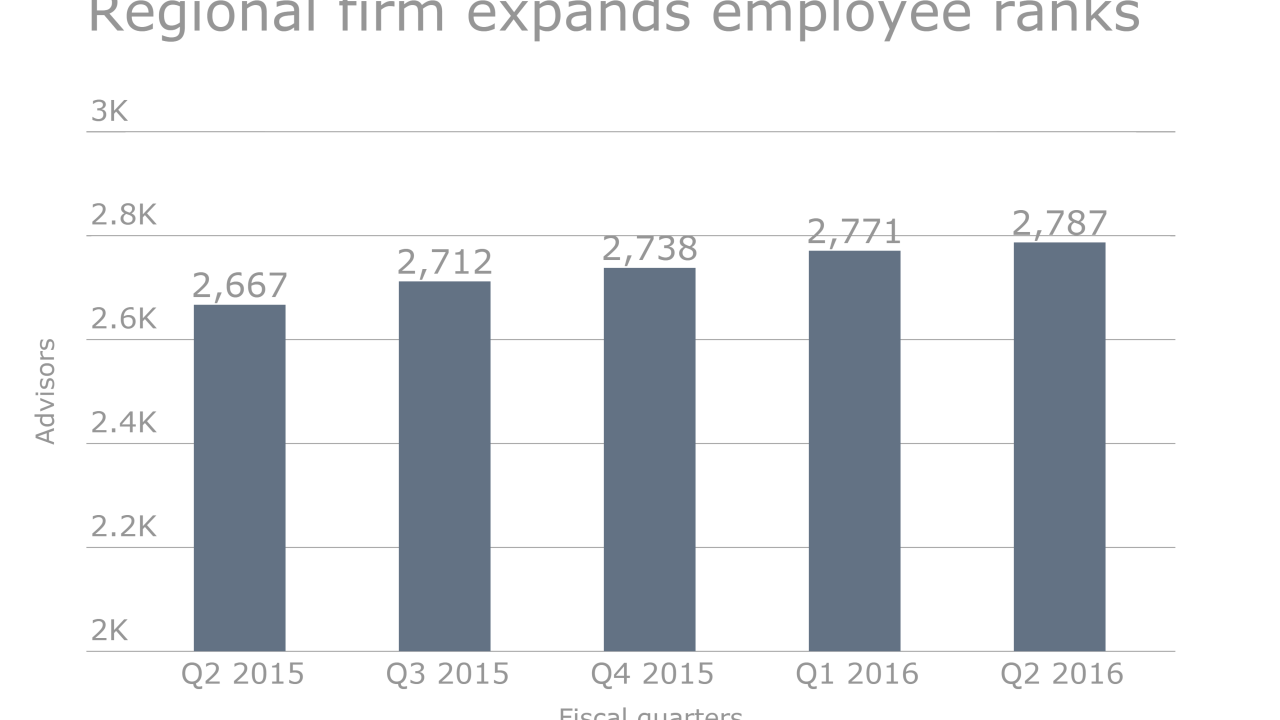

Wealth management leaders are weathering current markets while aiming to jumpstart AUM growth with expanded client services and new tech tools.

May 31 -

Two veteran advisers joined the independent firm, which is affiliated with Raymond James.

May 31 -

Yet that wasn't Merrill's only recruiting success, as the wirehouse also picked up a team overseeing more than $500 million in client assets.

May 26 -

The firm's latest acquisition is MacDougall MacDougall & MacTier, known as 3Macs, and which was founded in 1849.

May 26 -

The recruit generated $1.7 million in annual production before making the move.

May 23 -

Three weeks after the broker killed himself, the firm agreed to a confidential settlement with his wife for an undisclosed amount.

May 19