-

Policy changes could deprive some politicians of significant campaign funds.

January 12 -

While many condemned the violence, few firms have cut financial support to elected officials who have backed Trump’s baseless claims of election fraud.

January 11 -

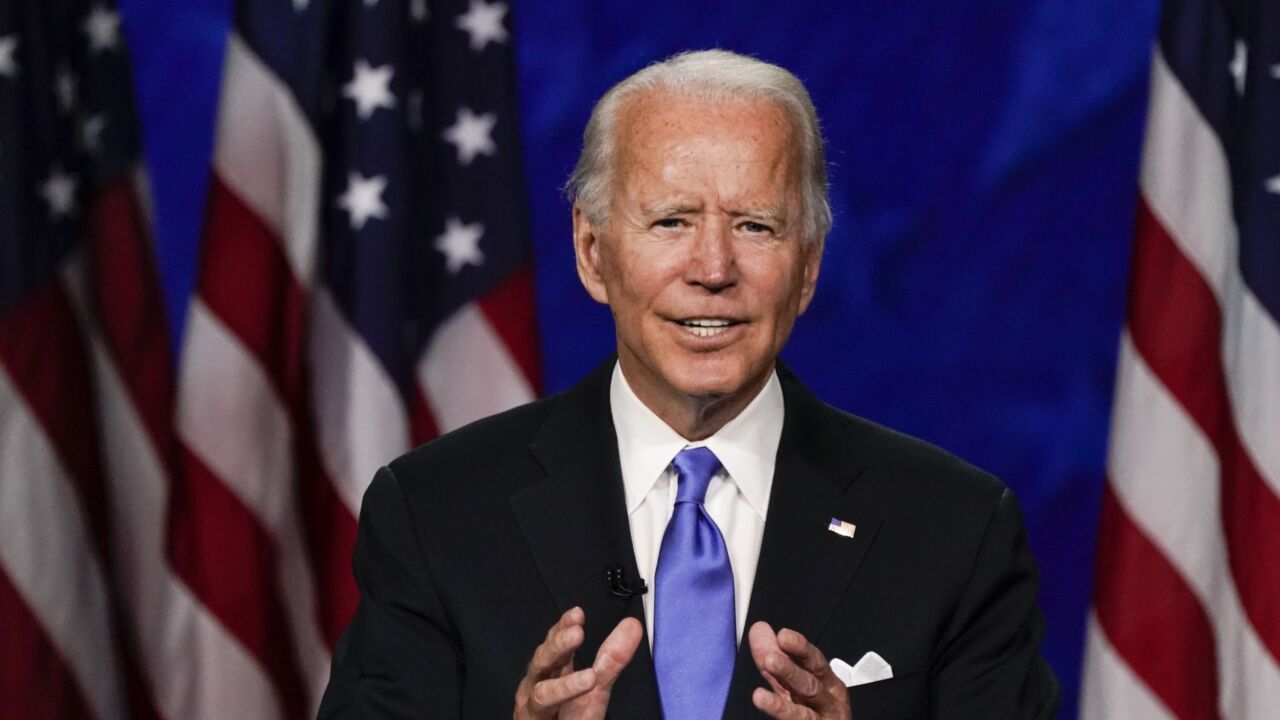

Democrat Joe Biden is expected to name his SEC chairman pick in the coming weeks.

November 16 -

With a divided government, some proposals are bound to change as part of the give-and-take of the legislative process, writes Skip Schweiss.

November 7 Financial Planning Association

Financial Planning Association -

Big changes to regulations and retirement planning could be in the mix following the Democrat’s election victory.

November 7 -

With a Democrat set to take the White House in January, the agenda for agencies like the CFPB could undergo a rapid transformation, housing finance reform could be turned on its head and progressive banking ideas that were unthinkable over the past four years could gain traction.

November 7 -

The uncertainty could lead to market volatility, delayed stimulus negotiations and complicate planning for a potentially new regulatory environment.

November 4 -

What different outcomes could mean for financial planners and their clients.

November 4 -

This election cycle has had more than a few bad surprises, but my advice to clients remains the same.

November 2 Wealth Logic

Wealth Logic -

Many taxpayers want to pay less themselves — but want others to pay more.

October 28 -

At the center is a pledge not to increase rates on those making less than $400,000, and that various changes would only impact earnings above the threshold.

October 14 -

Whatever the outcome in November, taxpayers and their advisors should prepare for changes, an expert says.

October 6 -

The agency issued guidelines scaling back a tax break for client entertainment, following through on an element of President Trump’s 2017 tax overhaul.

October 1 -

Donald Trump has all but promised to dispute the election outcome if he loses. Wall Street’s taking him at his word.

September 29 -

A majority of wealth managers worry about non-business concerns such as the national debt, immigration, civil unrest and media bias, according to a new survey.

September 25 -

Chairman Jerome Powell and other officials have stressed that recovery is highly dependent on the nation’s ability to better control the coronavirus.

September 16 -

Under the proposals, the top 0.1% of earners would be subject to a 43% tax rate on their income.

September 14 -

The executive order provides "temporary relief for employers" to “pay the employee portion of Social Security payroll taxes,” confirms Republican Rep. Kevin Brady.

September 11 -

The new order applies to managing directors and executive directors who oversee subordinates, according to a person briefed on the plans.

September 11 -

Threats to the program are multiplying and the coronavirus pandemic is accelerating a reckoning, according to a new analysis.

September 9