-

Warren Buffett said the company has paid the U.S. government more than $101 billion in taxes since he took the helm 60 years ago, more than any other company in history.

February 24 -

Berkshire still holds almost 962 million shares, the filing shows — worth $39.5 billion at Monday's closing price.

August 1 -

Munger, a famed investor who was the vice chairman of Berkshire Hathaway and Buffett's beloved sidekick, died at age 99 on Tuesday.

November 28 -

The Oracle of Omaha and his longtime friend and business partner Charlie Munger chided wealth managers at their annual event, but offered lessons in life and business.

May 8 -

Shareholder advocacy nonprofit As You Sow singled out Berkshire Hathaway as a low performer while giving good marks to CVS, PayPal and Activision Blizzard.

November 14 -

The philanthropist wife of Howard Buffett started at the biggest U.S. bank on Monday, according to a post on her Instagram account.

September 20 -

The Oracle of Omaha's fintech bet is less a testament to his beliefs about the future of banking than a hunt for standout growth potential, driven by consumers, writes Anjali Trivedi.

June 11 -

The market for newly minted stocks has exploded this year, with U.S. initial public offerings raising more than $80 billion so far.

October 1 -

Instead, the billionaire opted for a lucrative credit hedge that earned his firm about $2.6 billion in profits when the market plummeted.

April 7 -

Roughly 45% of Berkshire’s stock portfolio is allocated to the financial sector, and eight of the portfolio’s top 12 holdings are financial stocks — a deeply contrarian bet.

August 27 -

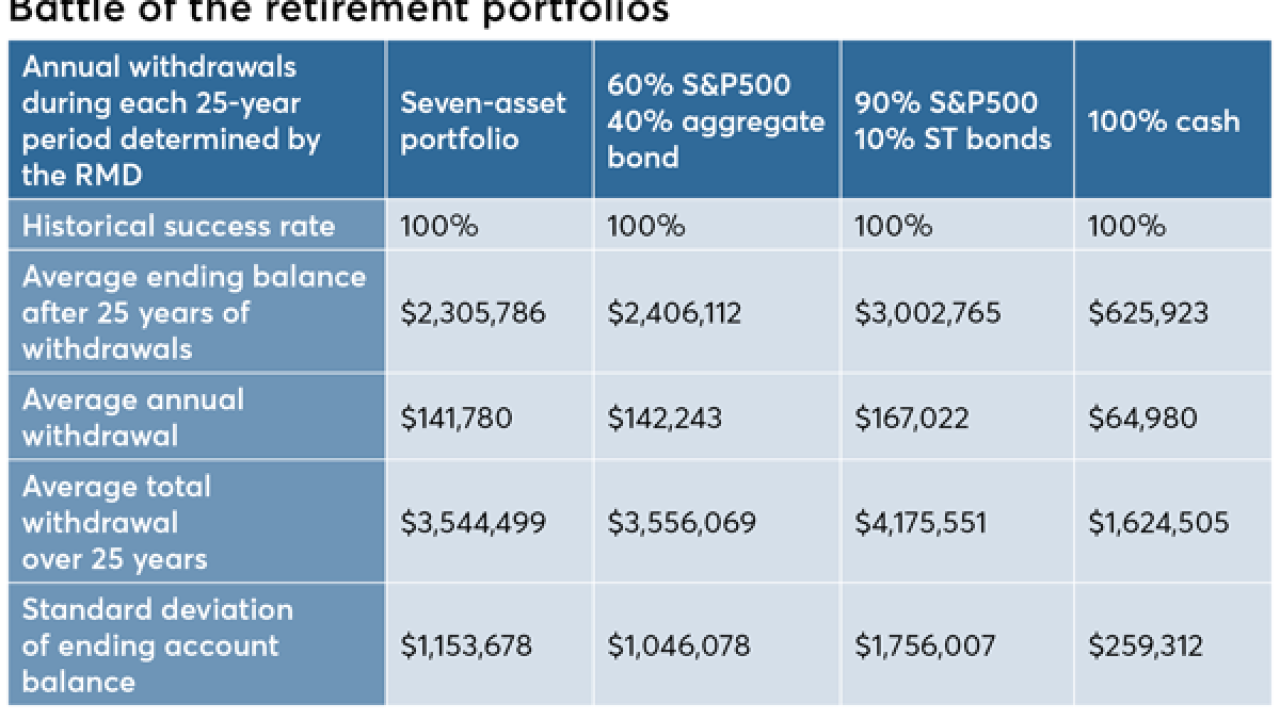

The famed investor recommends 90% large-cap U.S. stock and 10% short-term government bonds. Is it a crazy idea?

April 3 -

Evidence-based portfolios have been a bust over the last decade, and they may become a tough sell for the average investor.

March 19 -

In today’s age of data and algorithms, the underpinnings of human-led investment philosophies are in question.

March 7 -

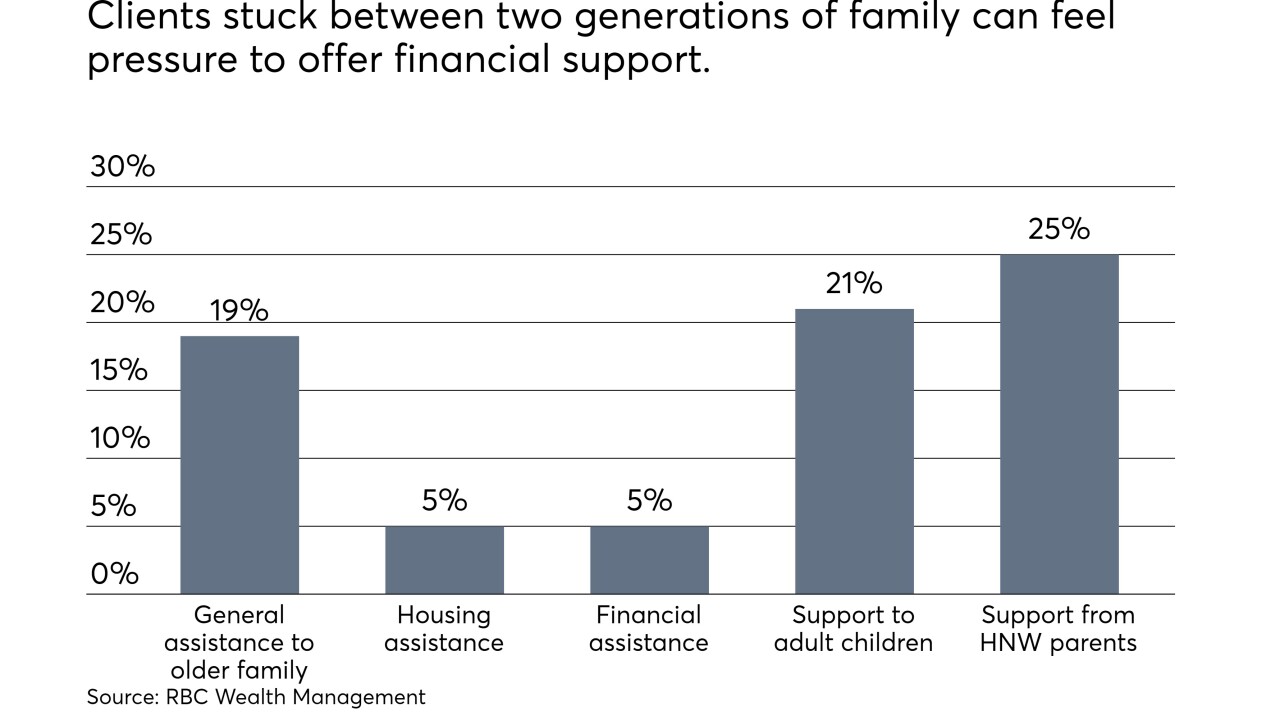

The sandwich generation is struggling to save for its own needs, and when you add in family demands, it paints a "grim picture," an expert says.

February 26 -

Critics say quarterly reporting prompts companies to hold back on hiring and spend capital on share buybacks to meet short-term forecasts.

October 12 -

The funds have the potential to distort stock prices and to inspire a large-scale market sell-off.

June 15 -

The new strategy will focus on long-term ownership of income-producing companies, not unlike Warren Buffett’s buy-and-hold style.

May 18 -

Buffett can put cash to better use than paying dividends. But the majority of CEOs lack his skill so investors and their advisors should be happy when corporate boards pay shareholder dividends.

May 16 -

They will have a lot of questions. Here are ways to put the decline into perspective.

February 8 Mercer Advisors

Mercer Advisors -

A 2014 law lets clients disabled before the age of 26 to save as much as $14,000 annually without facing any tax burden.

May 19