-

Medicare premiums will increase for high-income retirees because of the change in the income brackets that will serve as basis for determining these premiums for their Part B and Part D coverage.

May 3 -

Financial advisors should immediately contact clients with prenuptial agreements to see if they’re impacted.

May 3 Rackemann, Sawyer & Brewster

Rackemann, Sawyer & Brewster -

If you’re nearing retirement but don’t have a succession plan for your practice, you’re not alone. It’s a common dilemma for advisors who remain busy serving clients and whose businesses have become increasingly complex over time. In fact, most advisors within five years of retirement still haven’t identified a successor or plan.* Creating a strong plan is key to retiring on your own terms – and it’s easier than you might think.

-

Workers with a high-deductible health plan will be better off setting up a health savings account, which offers tax benefits for savings earmarked for future medical expenses.

May 2 -

A retail RIA and robo retirement combination could be a game-changer.

May 2 -

With the rescue attempt's failure, all eyes now turn to the SEC which is considering its own proposal for raising financial advisor standards of conduct.

May 2 -

Clients should determine the benefits they would receive if they file at age 62, at full retirement age, and after their full retirement age.

May 1 -

More than 25 million workers resigned and left at least one retirement account with their former employer between 2004 and 2013, according to the U.S. Government Accountability Office.

April 30 -

The uncertainly of regulation and their own survival is at the root of advisors’ stress, but there are also some positives of the job.

April 30 -

The products are designed to provide some upside potential yet limit investment risk, which has helped boost their popularity.

April 30 -

The influential retiree advocacy group filed for a 17-judge review of the decision.

April 26 -

The products have grown in popularity after undergoing significant changes in recent years.

April 25 -

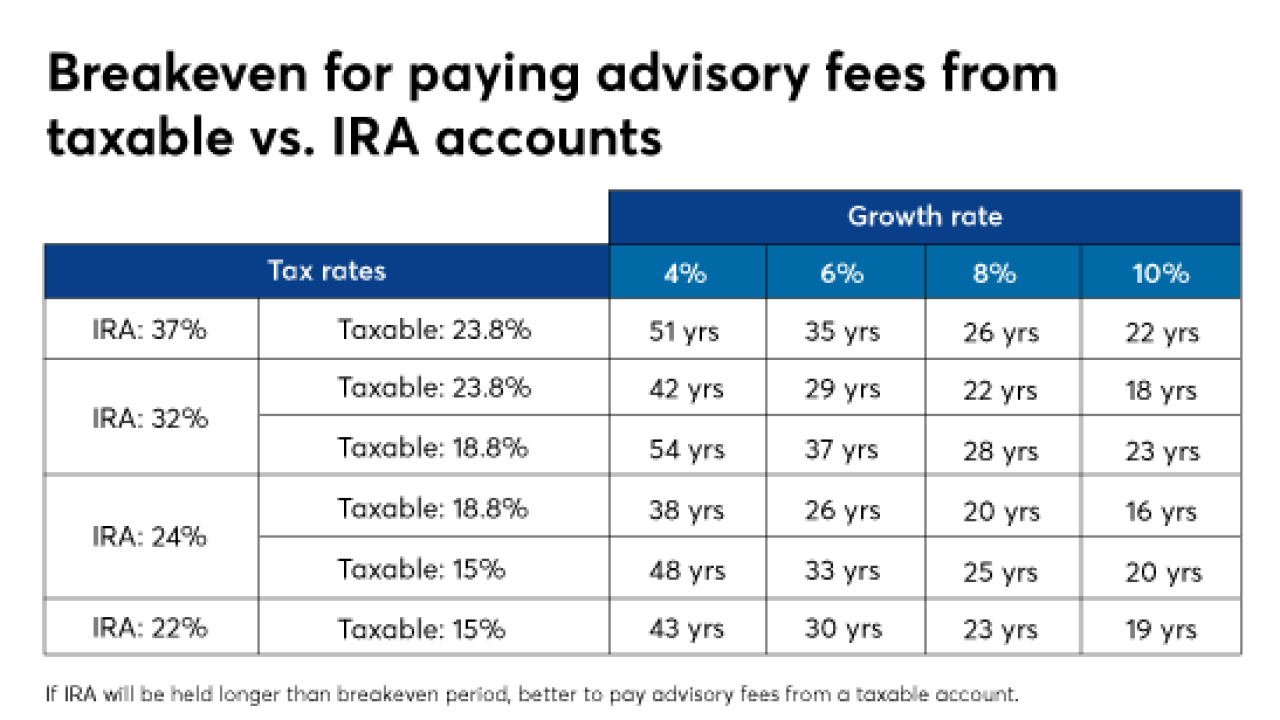

Financial advice sometimes is — and isn’t — deductible.

April 23 -

Instead of amassing $1 million in savings, clients should consider asking themselves if they are prepared financially for several decades of retirement.

April 20 -

Many retirees kept their financial assets for at least 20 years after retiring, according to a study by the Employee Benefit Research Institute.

April 19 -

A majority of affluent Americans are likely to adjust their financial plans under the new law, according to the AICPA. Here's how advisors can help.

April 19 -

A Roth IRA is an excellent savings vehicle for older people as it is for younger clients.

April 18 -

Clients have to change their retirement goals and strategies over the years, starting off heavily in stock allocation while in their 30s.

April 17 -

Clients who think they have lost their retirement assets are advised to seek help from the Labor Department or nonprofit pension counseling centers funded by the Department of Health and Human Services.

April 16 -