Muni bonds will become more enticing because of changes in the tax laws. The new rules limit deductions on state and local taxes to $10,000, so the appeal of any investment that generates income exempt from state and local taxes should increase, says Greg McBride, chief financial analyst at website Bankrate.

Christine Benz, director of personal finance at Morningstar, added that the triple-tax benefit of munis would still apply if the investor lives in the same state and municipality as the bond issuer. And while there are single-state muni funds, other broader funds are spread across multiple municipalities so fund investors might not get that full benefit.

That said, she said “that the benefits of a mutual fund strongly outweigh the disadvantages for smaller investors, in large part because smaller investors transacting in individual munis can confront steep bid/ask spreads; it can also be tricky for them to research and adequately diversify the risk,” she said in an email.

Scroll through to see the 20 top-performing muni bond funds over the past five years. Only funds with at least $100 million in assets were included. We also show year-to-date returns, assets and, as usual, expense ratios for each fund. All data from Morningstar Direct

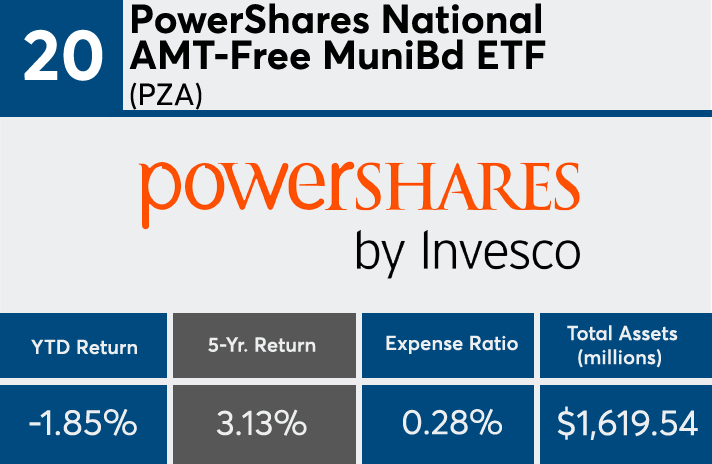

20. PowerShares National AMT-Free MuniBd ETF (PZA)

5-Yr. Returns: 3.13%

Expense Ratio: 0.28%

Total Assets (millions): $1,619.54

19. Oppenheimer Rochester Fund Municipals A (RMUNX)

5-Yr. Returns: 3.13%

Expense Ratio: 0.86%

Total Assets (millions): $5,020.17

Front Load: 4.75%

18. MFS CA Municipal Bond A (MCFTX)

5-Yr. Returns: 3.13%

Expense Ratio: 0.73%

Total Assets (millions): $369.16

Front Load: 4.25%

17. Vanguard NJ Long-Term Tax-Exempt Inv (VNJTX)

5-Yr. Returns: 3.16%

Expense Ratio: 0.19%

Total Assets (millions): $2,101.22

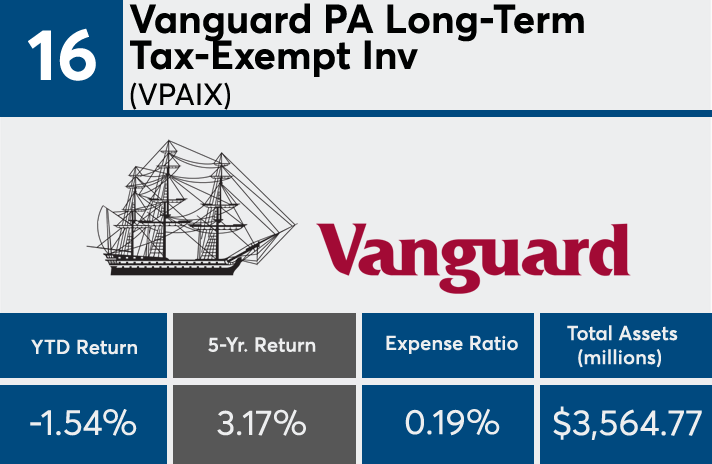

16. Vanguard PA Long-Term Tax-Exempt Inv (VPAIX)

5-Yr. Returns: 3.17%

Expense Ratio: 0.19%

Total Assets (millions): $3,564.77

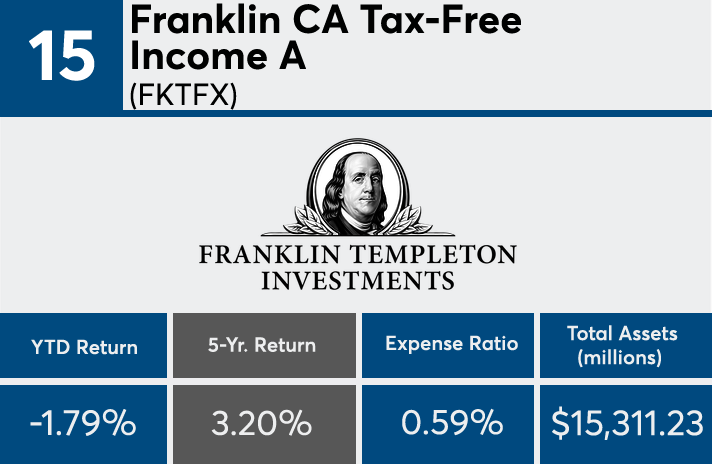

15. Franklin CA Tax-Free Income A (FKTFX)

5-Yr. Returns: 3.20%

Expense Ratio: 0.59%

Total Assets (millions): $15,311.23

Front Load: 4.25%

14. Vanguard OH Long-Term Tax-Exempt (VOHIX)

5-Yr. Returns: 3.20%

Expense Ratio: 0.15%

Total Assets (millions): $1,192.77

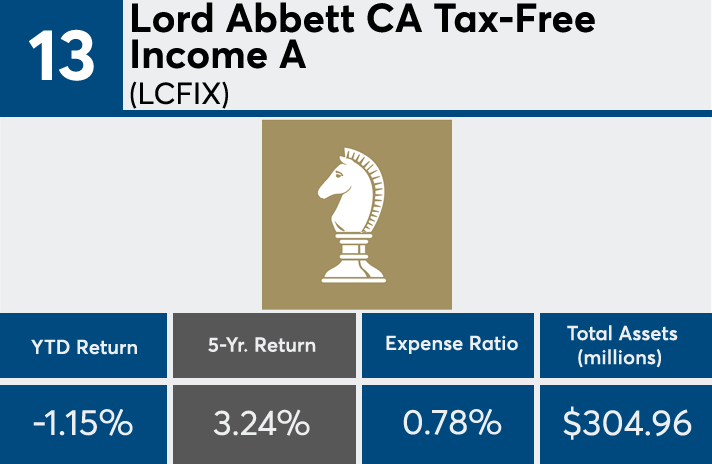

13. Lord Abbett CA Tax-Free Income A (LCFIX)

5-Yr. Returns: 3.24%

Expense Ratio: 0.78%

Total Assets (millions): $304.96

Front Load: 2.25%

12. BNY Mellon Municipal Opportunities M (MOTMX)

5-Yr. Returns: 3.28%

Expense Ratio: 0.73%

Total Assets (millions): $1,231.68

11. Vanguard CA Long-Term Tax-Exempt Inv (VCITX)

5-Yr. Returns: 3.31%

Expense Ratio: 0.19%

Total Assets (millions): $3,962.72

10. Nuveen All-American Municipal Bond A (FLAAX)

5-Yr. Returns: 3.34%

Expense Ratio: 0.70%

Total Assets (millions): $3,698.37

Front Load: 4.20%

9. Principal California Municipal A (SRCMX)

5-Yr. Returns: 3.38%

Expense Ratio: 0.77%

Total Assets (millions): $402.08

Front Load: 3.75%

8. Columbia Strategic Municipal Inc A (INTAX)

5-Yr. Returns: 3.47%

Expense Ratio: 0.82%

Total Assets (millions): $1,284.35

Front Load: 3.00%

7. PowerShares Calif AMT-Free Muni Bd ETF (PWZ)

5-Yr. Returns: 3.48%

Expense Ratio: 0.28%

Total Assets (millions): $251.10

6. Vanguard High-Yield Tax-Exempt (VWAHX)

5-Yr. Returns: 3.56%

Expense Ratio: 0.19%

Total Assets (millions): $12,702.81

5. Sit Tax-Free Income (SNTIX)

5-Yr. Returns: 3.91%

Expense Ratio: 0.90%

Total Assets (millions): $196.73

4. Franklin CA High Yield Municipal A (FCAMX)

5-Yr. Returns: 3.99%

Expense Ratio: 0.63%

Total Assets (millions): $2,470.72

Front Load: 4.25%

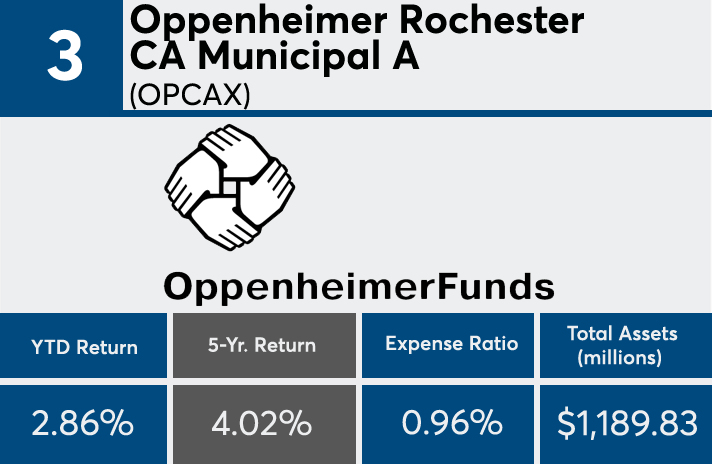

3. Oppenheimer Rochester CA Municipal A (OPCAX)

5-Yr. Returns: 4.02%

Expense Ratio: 0.96%

Total Assets (millions): $1,189.83

Front Load: 4.75%

2. American Century CA High Yield Muni Inv (BCHYX)

5-Yr. Returns: 4.13%

Expense Ratio: 0.50%

Total Assets (millions): $1,125.50

1. Colorado BondShares A Tax-Exempt (HICOX)

5-Yr. Returns: 4.24%

Expense Ratio: 0.61%

Total Assets (millions): $1,203.40

Front Load: 4.75%